Portfolio hedging is a risk management strategy employed by investors to protect their investment portfolios from potential adverse market movements. It involves the use of various financial instruments or strategies to offset or mitigate the impact of unfavourable market conditions. The primary objective of portfolio hedging is to reduce the overall risk exposure and minimise potential losses.

The stock market does well over very long-term timeframes (15-20+ years) but it is volatile and secular bear-markets occur which bring about horrendous drawdowns (50%+ at the index level). It is not uncommon for secular bear-markets to last for 10/20/30 years and for the related indices to not make any progress for such extended periods of time! Whilst “buy and hold” works during secular bull-markets, this can be a very challenging and frustrating strategy during secular bear-markets.

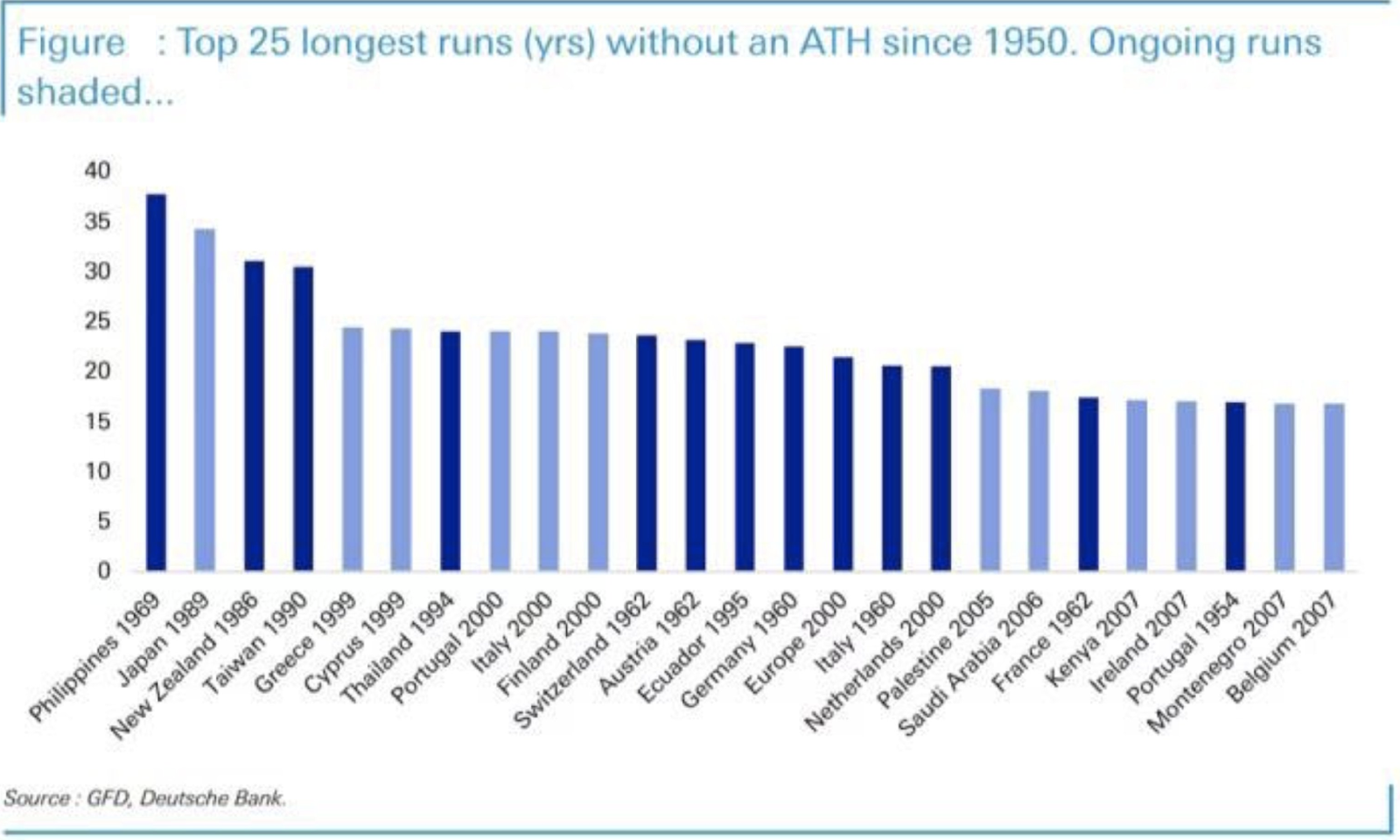

Since 1950, there have been over 25 secular bear-markets in stocks in different countries / regions of the world, each lasting for more than 15 years (Figure 1)! It goes without saying, such secular bear-markets test the nerves and patience of even the most enthusiastic investor.

Figure 1: Secular bear-markets are not uncommon

Source: GFD, Deutsche Bank

One way to avoid getting caught in secular bear-markets is by trend-following and cashing out of stocks at the end of primary uptrends and another way is by hedging one’s investment portfolio to offset some of the drawdowns. For our part, we combine both approaches and until we are fully in cash, use a systematic trend following strategy to hedge our long exposure.

In addition to secular bear-markets, hedging also provides protection to an investor’s portfolio from sudden and large stock market declines caused by exogenous shocks, geo-political conflicts, pandemics and recessions.

Portfolio hedging – common approaches

There are several common approaches to portfolio hedging. One popular method is diversification, where investors allocate their capital across different asset classes, sectors, or geographical regions. By spreading investments across a range of assets, an investor hopes that the impact of a downturn in one area can be offset by positive performance in others. In theory, this helps to reduce the correlation and concentration risk within the portfolio. However, under certain market conditions, major asset-classes become highly correlated, and they all decline in tandem!

Another hedging technique is the use of derivatives, such as options or futures contracts. These financial instruments provide investors with the opportunity to protect their portfolio against adverse price movements. For example, investors can purchase put options to establish a predetermined selling price for an asset, thereby limiting potential losses if the asset's value declines. Similarly, futures contracts can be used to lock in prices for commodities or currencies to hedge against price volatility.

Finally, one can also hedge his/her investment portfolio by shorting ETFs which are correlated to the long holdings in their investment portfolio.

Overall, portfolio hedging is a proactive risk management strategy that helps investors protect their investments from adverse market conditions. It allows them to minimise potential portfolio drawdowns and maintain a more stable and predictable investment performance (equity curve). However, it's important to note that portfolio hedging strategies come with their own costs and limitations, so investors should carefully consider their objectives, risk tolerance, and always consult with their registered financial adviser before implementing any hedging strategies.

Shorting index ETFs or stock futures is a common strategy used to hedge long exposure in a stock portfolio. When investors short an index ETF or sell stock futures contracts, they aim to profit from a decline in the value of the underlying index or stock. This allows them to offset potential losses in their long positions and create a more market-neutral portfolio, reducing overall risk.

An investor can hedge any type of investment portfolio, but since we allocate our capital to mid to large cap growing businesses, during stock market downtrends, we hedge our exposure by shorting Russell 2000 Index futures. An investor can achieve the same outcome by shorting the related equity index ETF.

By shorting index ETFs, investors can directly hedge their exposure to a specific market index or sector. For example, if an investor holds a portfolio heavily concentrated in technology stocks and wants to hedge against a potential downturn in the technology sector, they can short a technology-focused index ETF. If the technology sector experiences a decline, the short position in the ETF would generate profits that offset the losses in the long positions.

Alternatively, (like us) investors can utilise stock futures contracts to establish a hedge. By selling stock futures contracts, investors commit to selling a specified number of contracts at a predetermined price in the future. If the stock market declines, the value of the futures contracts decreases, thereby generating profits and offsetting losses in the long portfolio.

When implementing a hedge, investors have the option to hedge on a 1:1 basis, where the value of the hedge matches the value of the long position. This provides a direct offset to the portfolio's risk. Alternatively, investors can choose to beta-hedge, which involves adjusting the size of the hedge based on the beta or correlation of the portfolio to the market index. This approach aims to provide a more effective hedge by considering the portfolio's specific volatility characteristics.

During the duration of the hedge, the portfolio becomes less risky and more market neutral. The short positions in the index ETFs or stock futures help to balance out potential losses in the long positions, reducing the portfolio's overall exposure to market fluctuations.

It's important to note that while shorting index ETFs or stock futures can be an effective hedging strategy, it also carries risks. Instead of declining, if the stock market rallies, the short positions produce losses, but these are offset by the long positions in an investor’s stock portfolio. Additionally, costs such as borrowing fees or margin requirements should be considered.

Systematic trend following hedging

To short index ETFs or stock futures, like us, investors can employ a systematic trend following strategy to determine when to initiate and remove the hedge. By using this approach, the decision-making process becomes rule-based, relying on objective criteria rather than subjective discretion or emotions.

A systematic trend-following strategy involves analysing market trends and using predefined rules to determine whether to implement or remove a hedge. Typically, momentum and/or volatility indicators are utilised to identify stock market downtrends or uptrends.

When the trend following indicators signal the start of a new downtrend, the investor would initiate the hedge by shorting stock index futures or ETFs. This helps protect the portfolio from potential losses during the downward market move.

Conversely, when the trend following indicators indicate the end of the downtrend and the start of an uptrend, the systematic strategy triggers the removal of the hedge. At this point, the investor would close the short positions in the index futures or ETFs, allowing the portfolio to benefit from the subsequent upside in the market.

The use of a systematic trend following strategy adds an objective and disciplined approach to the hedging process. It removes the element of emotion and subjective judgment from the decision-making, relying solely on predetermined rules and technical indicators to determine when to hedge and when to remove the hedge.

By employing this systematic approach, investors can potentially benefit from market trends while reducing the overall risk and volatility of their portfolio. However, it's important to note that no strategy is foolproof, and investors should carefully evaluate the effectiveness of trend following indicators and consider potential risks and costs associated with implementing this strategy.

Our extensive back testing has revealed that since the start of the new millennium, our proprietary systematic trend following hedging strategy would have marginally reduced long-term returns but significantly reduced one’s portfolio drawdowns during all severe stock market downtrends.

Figure 2 shows the signals generated by our proprietary systematic trend following hedging strategy during the COVID-crash in early 2020 as well as during the 2022 stock bear-market.

As you can see, our proprietary systematic hedging strategy gave us the signal to hedge our portfolio just before the COVID-crash and it told us to remove the hedge just after the crash. Conversely, no hedging signal was generated during the strong stock market uptrend between spring 2020 and summer 2021. There was one false signal (whipsaw) in autumn 2021 but our hedging system correctly got us hedged in late 2021 and the signal to remove that hedge only came in August 2022.

Figure 2: Our proprietary systematic hedging strategy on display

Source: Trendspider

As you can see from the above, during the recent two bear-markets, our proprietary systematic hedging strategy generated accurate signals to protect our capital and mitigate our portfolio drawdown.

At AlphaTarget, we invest our capital in some of the most promising disruptive businesses at the forefront of secular trends; and utilise stage analysis and other technical tools to continuously monitor our holdings and manage our investment portfolio. AlphaTarget produces cutting-edge research and those who subscribe to our research service gain exclusive access to information such as the holdings in our investment portfolio, our in-depth fundamental and technical analysis of each company, our portfolio management moves and details of our proprietary systematic trend following hedging strategy to reduce portfolio drawdowns. To learn more about our research service, please visit subscriptions.