In the age of digital transformation, the influence of software is pervasive and undeniable. As technology continues to advance at an unprecedented pace, software is revolutionising traditional business models and redefining customer experiences. From e-commerce to finance, manufacturing to transportation, industries across the board are being reshaped by the transformative power of software.

The appetite for software is insatiable and enterprise software, cloud software, and Software-as-a-Service (SaaS) markets are each playing their part in the digitalisation of businesses. Together, they represent critical pieces in companies’ efforts to efficiently manage virtually every aspect of their businesses and often provide mission critical functions.

Before we delve deeper into how we think about those opportunities – and for perspective on how they fit together – here is a quick breakdown of each market:

Enterprise Software

Enterprise software is designed to meet the needs of organisations rather than individual users. These applications are complex and scalable, and integrate with other software and network configurations on a large scale. They serve a variety of business functions such as enterprise resource planning (ERP), customer relationship management (CRM), supply chain management (SCM), cybersecurity, observability, and data warehousing. Companies use enterprise software to manage vast amounts of data, streamline their operations, support decision-making and enhance productivity across multiple departments.

Cloud Software

Cloud software refers to applications that are hosted on remote servers and accessed over the internet, which are maintained by external vendors rather than the users themselves. In contrast to old on-premises models, cloud software allows for flexibility, scalability, and cost efficiency as it eliminates the need for organisations to purchase, run, and maintain physical servers and other on-premises infrastructure. Cloud software can be delivered through several models including Infrastructure-as-a-Service (IaaS), which provides virtualised computing resources like servers, storage, and networking; Platform-as-a-Service (PaaS), which offers a complete platform for developing, testing, and deploying applications; and Software-as-a-Service (SaaS).

Software-as-a-Service (SaaS)

SaaS is one of the most significant subsets of the cloud computing market. It is a software distribution model in which applications are hosted by third-party providers and made available to customers over the internet. Unlike traditional software that requires a license purchase and installation on individual machines, SaaS products are typically subscription or usage based and centrally hosted. This means users can access software and its functions remotely from any device with internet connectivity. SaaS offers numerous advantages, including lower upfront costs, reduced time to benefit, high scalability, and automatic updates.

Many enterprise software providers have already transitioned part or all of their offerings to the cloud, capitalising on the cloud's scalability and operational efficiency to better serve large organisations. Similarly, the rise of SaaS over the past two decades has reshaped how businesses think about software expenditure and management, shifting from capital-intensive software ownership to more operational expense models with ongoing subscriptions.

These markets continue to grow as businesses increasingly rely on digital solutions to manage their operations, interact with customers, and compete in today’s global economy. The push toward digital transformation, accelerated by factors like remote work trends and the global scaling of businesses, further drives the demand for sophisticated enterprise software solutions, robust cloud service platforms, and accessible SaaS applications.

Cloud-based software-as-a-service models are not just good for enterprise end users; they have also ushered in an era of superior software businesses characterised by higher recurring revenues, sticky business models, stable cash flows, and lower cyclicality.

Current state of the industry

The software industry is currently experiencing a period of rapid growth and transformation. With the increasing reliance on digital technologies across various sectors, software has become a critical component of modern businesses and everyday life. The industry is driving innovation in areas such as artificial intelligence, cloud computing, blockchain, and cybersecurity.

Open-source software is thriving, fostering collaboration and community-driven development.

The industry is facing challenges such as cybersecurity threats, privacy concerns, and the need to address ethical considerations in emerging technologies. Overall, the dynamic software industry is evolving, shaping the way humans live, work, and play.

Over the past decade, the enterprise software industry has experienced rapid growth driven by increasing demand for integrated solutions across every aspect of a business’ operations.

Gartner research indicates that over the past several years, the global enterprise software market has enjoyed solid mid-double-digit percent growth (ranging between 11% and 16%), buoyed in part by initiatives to increase productivity during the COVID-19 pandemic.

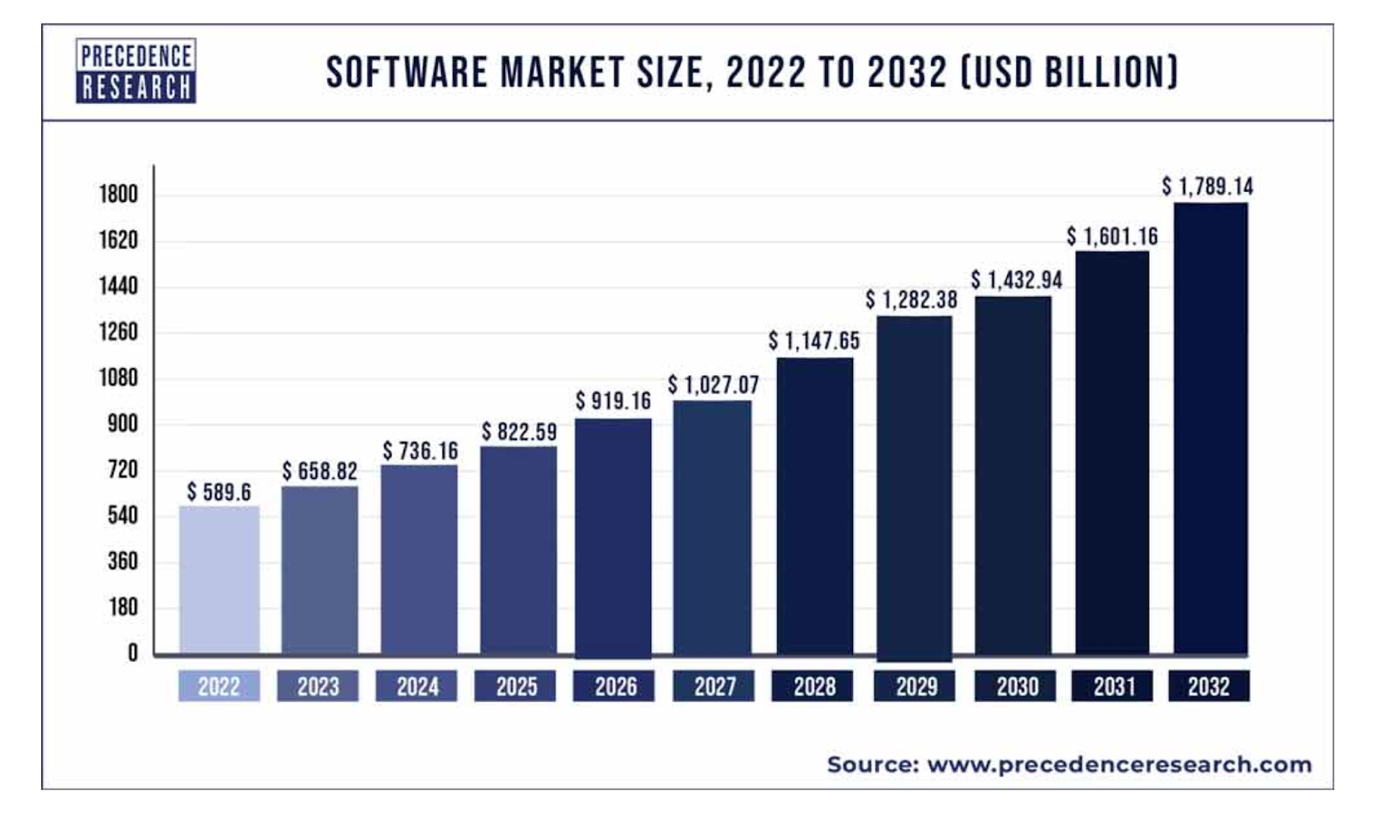

According to Precedence Research, the worldwide software market grew to US$659 billion in 2023 with North America responsible for 44% of the total spend, followed by Europe (27%) and Asia Pacific (24%). It is interesting to note that the software market is expected to continue growing to US$1.789 trillion by 2032, representing a CAGR of 11.74% (Figure 1).

Figure 1: Evolution of the worldwide software market

Source: Precedence Research

In 2022, on-premises software deployments still represented more than half of global enterprise software spending, highlighting the significant opportunity remaining for software companies to capitalise on the industry’s ongoing transition away from on-premises solutions and toward cloud-based offerings.

With more than half the world’s enterprise workloads still on-premises, the SaaS industry is expected to grow at a rapid clip as enterprises continue to migrate to the cloud. Today, the enterprise software and cloud/SaaS markets are dominated by several key players that have played pivotal roles in shaping its direction and technological advancements.

In 2022, the top five vendors — Microsoft, Oracle, Amazon, Salesforce and SAP — captured 34% market share, whereas the next five vendors — IBM, Adobe, Google, VMware and Cisco — held 11% market share.

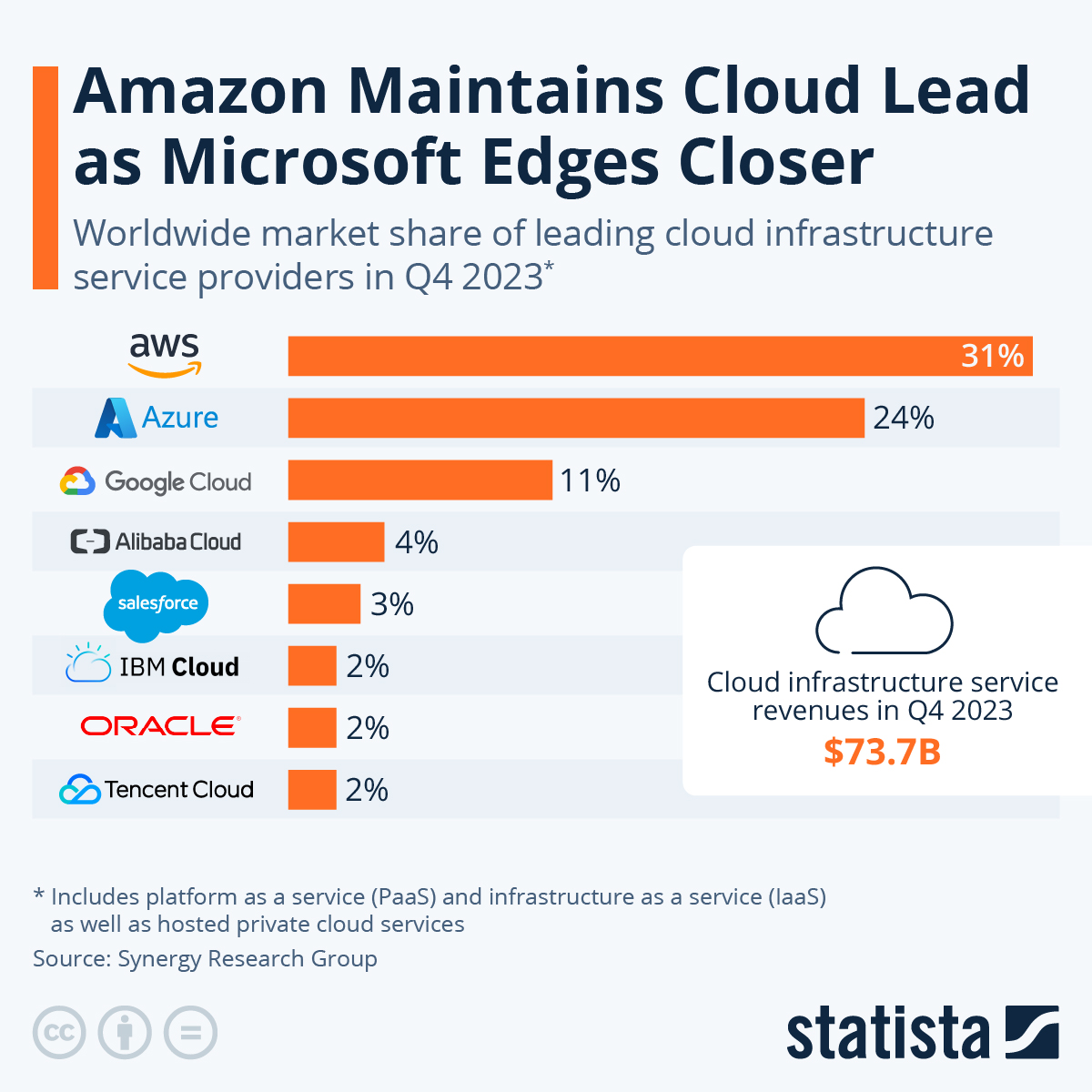

In the Infrastructure-as-a-Service (IaaS) space, Amazon Web Services, Microsoft Azure, and Google Cloud dominate the industry and command decisive leadership positions (Figure 2).

Figure 2: Leaders in Infrastructure-as-a-Service

Source: Statista

Amazon Web Services (AWS) has been the clear dominant player in the IaaS industry thanks to its leadership and first-mover advantage. However, Microsoft Azure and Google Cloud are rapidly closing the gap, leveraging their existing enterprise customer relationships and integrating their cloud offerings with popular productivity and collaboration tools. The big three hyperscalers are growing quickly at scale, with AWS growing sales at high teens, with Azure and Google Cloud growing at close to 30% annually. The enormous size of the world’s cloud computing market is intensifying competition with players such as Oracle and IBM now jostling to become key players in the IaaS/PaaS market. This ongoing battle for market share could lead to more competitive pricing, better service levels, and faster innovation, ultimately benefiting customers.

Software is a good industry

The dominant businesses in enterprise software, cloud software, and Software-as-a-Service (SaaS) have business characteristics which make them attractive investments. Some of these attributes are set out below:

High growth potential: The software industry has demonstrated strong growth and the market is enormous! The SaaS market, in particular, is expanding rapidly, with projections indicating significant increases in market size over the coming years due to the shift toward cloud-based solutions and digital-transformation initiatives. Accelerated by the COVID-19 pandemic, this growth is being driven by the increased need for scalable software solutions that can adapt to changing business environments.

Recurring revenue model: SaaS and cloud services typically operate on a subscription-based model, offering predictable and recurring revenue streams and consequently, more stable cash flows and less-cyclical businesses. Unlike the traditional licence-based software business, this new model is attractive to investors because these recurring revenues provide more visibility into future earnings.

Scalability: Cloud and SaaS businesses are highly scalable as they can easily accommodate growing customer demands without the need for significant capital investments. Unlike old economy businesses which usually require significant sums of capital to grow, the marginal cost of distribution for these businesses is minimal or zero. Moreover, the subscription-based model allows for flexible pricing tiers and the ability to add or remove users seamlessly, allowing these businesses to better align their resources with customer needs.

Stickiness (high switching costs): Software businesses often exhibit stickiness due to high switching costs associated with their products or services. Once customers integrate a particular software solution into their workflows, it becomes challenging and costly to switch to an alternative. The switching costs may arise from data migration, retraining employees, or the need to rebuild processes around a new software system. This stickiness creates a competitive advantage as it fosters customer loyalty and reduces the likelihood of churn. The software vendors typically expand their offerings and upsell to their existing customers which results in high net retention rates (i.e., existing customers spending more each year). These high retention rates, combined with the recurring revenue model, lead to attractive customer lifetime values (LTV) and when combined with lower customer acquisition costs (CAC), lead to improving profitability and cash flow visibility.

Network effects: Software businesses can benefit from network effects, whereby the value of their product or service increases as more users or customers join the network. As the network expands, it creates a positive feedback loop, attracting more users and generating additional value. The larger the user base, the more valuable the software becomes, creating a barrier for potential competitors and enhancing the market position of the business.

High margins: Software businesses often enjoy high margins due to the relatively low marginal costs associated with producing and distributing software. Once the initial development costs are covered, the incremental cost of serving additional customers or delivering software updates is typically minimal or zero. This characteristic allows software companies to achieve significant economies of scale, resulting in healthy profit margins.

Innovation and Integration: Software businesses at the forefront of technological innovation, especially when it comes to integrating cutting-edge technologies like artificial intelligence (AI), machine learning (ML), and advanced business analytics. These advancements enhance the functionality and competitiveness of cloud and SaaS offerings, making them more attractive to end users. Software vendors today are sitting on rhetorical gold mines and they are increasingly building value by deploying their own AI agents on top of their respective leading software platforms.

Our team at AlphaTarget has been studying and investing in the software industry for almost two decades. At present, a significant portion of our investment portfolio is allocated to high quality, rapidly growing software businesses.

Sizing the opportunity

Though the enterprise software, cloud computing, and SaaS markets can each be quantified individually, these three closely intertwined markets collectively present an immense opportunity for vendors to drive outsized top-line growth with attractive unit economics.

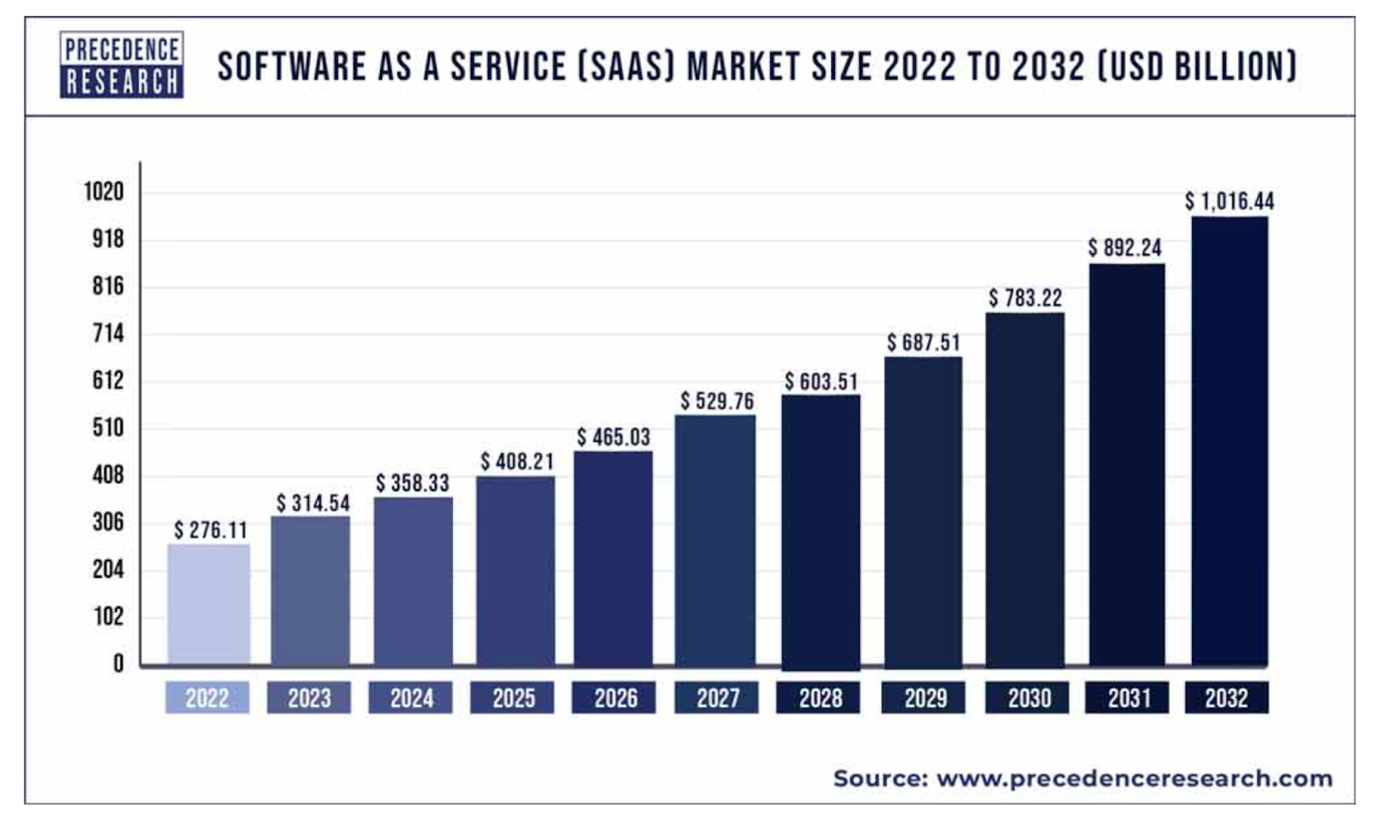

According to Precedence Research, the SaaS market is likely to nearly triple from US$358 billion in 2024 to US$1.016 trillion by 2032 (Figure 3). Whilst this market-wide growth forecast is impressive, it is notable that some mission-critical software vendors are growing their revenues and free cash flows at an even faster clip.

Figure 3: SaaS market size expected to triple by 2032

Source: Precedence Research

While the aforementioned leaders in the IaaS space are undoubtedly dominant businesses, our in-depth research at AlphaTarget has led us to invest our capital in the most promising, rapidly growing enterprise software and cloud-computing businesses with long growth runways. Our preferred businesses are run by strong management teams and we expect them to keep performing well over the foreseeable future.

At AlphaTarget, we invest our capital in some of the most promising disruptive businesses at the forefront of secular trends; and utilise stage analysis and other technical tools to continuously monitor our holdings and manage our investment portfolio. AlphaTarget produces cutting-edge research and those who subscribe to our research service gain exclusive access to information such as the holdings in our investment portfolio, our in-depth fundamental and technical analysis of each company, our portfolio management moves and details of our proprietary systematic trend following hedging strategy to reduce portfolio drawdowns. To learn more about our research service, please visit subscriptions.