“[T]he larger driver of our everyday activity is the fact that the software industry is completely changing with AI. It feels like the AI era of the past two years just makes the SaaS era feel like sleeping days.”

Ivan Zhao, Notion CEO (11 August 2025, The Verge)

“It's been eight of the most exciting months, I think, of my career.”

Marc Benioff, Salesforce CEO (29 August 2025, The Logan Bartlett Show)

An agentic software future

The current artificial intelligence (AI) revolution has ignited widespread debate about its transformative potential across industries, with software playing a central and pivotal role in these changes. Many observers express concerns that AI could disrupt the very foundations of software as we know it, rendering the current software paradigm obsolete. This fear stems from the belief that AI's generative capabilities could automate code generation to the point where bespoke applications are created with ease, bypassing the need for ongoing subscriptions to SaaS platforms. Additionally, some industry experts foresee a future where traditional software becomes redundant, as instead of interacting with a range of siloed software applications, users will interact with an agentic interface through which they can express their intent and have agents work in the background to obtain the desired outcome.

“I think the notion that business applications exist, that's probably where they'll all collapse, right, in the agent era.”

Satya Nadella, Microsoft CEO (12 December 2024, BG2)

High-profile voices have amplified these fears. In a recent social media post (Figure A), Musk suggested that phones and computers would effectively become edge nodes for AI, directly rendering pixels without the need for a traditional operating system or conventional apps. In that same exchange, he agreed with Replit’s CEO, Amjad Masad, who commented that AI could generate apps on demand, with agents eating traditional apps. Replit itself exemplifies this shift: its vibe coding (i.e., “rapid prototyping”) tool allows users to build and deploy apps in a fraction of the time compared to traditional software development, collapsing traditional coding barriers and enabling anyone to be a software developer.

Figure A: Elon Musk’s post on X

Source: X

We believe the AI revolution will significantly impact existing software, but that does not necessarily mean the demise of established software vendors. Presently, vibe coding tools excel at code generation and prototyping, yet have fallen short in delivering fully polished, production-ready products. We suspect that time will come too, but even then, incumbents possess moats that cannot easily be overcome in the short run. These include network effects, deeply embedded workflows and troves of user data. For instance, CRM is not just a tool but a living ecosystem of customer relationships and integrations that vibe coding cannot simply replicate. However, existing software will have to evolve significantly to meet user expectations if it is to stay relevant in the long run.

In an August 2025 report, Gartner forecasts the future evolution of AI in enterprise software, as shown below (Figure B). Although timelines are highly uncertain, we think this forecast provides a good outline of the many steps (and hurdles) and time taken before we get to a world where agentic software is mainstream.

· Stage 1. By the end of 2025, the majority of enterprise apps will have embedded AI assistants to simplify tasks and enhance user productivity. AI assistants are generally human triggered.

· Stage 2. By 2026, 40% of enterprise apps will incorporate task-specific AI agents capable of handling complex, end-to-end processes independently, such as automating cybersecurity responses or other specialised functions.

· Stage 3. By 2027, one-third of agentic AI implementations will have different agents collaborating within individual applications, combining diverse skills to manage intricate tasks.

· Stage 4. By 2028, there will be AI agent ecosystems that collaborate across multiple apps and business functions. One-third of user interactions will occur through agentic front ends.

· Stage 5. By 2029, at least 50% of knowledge workers will be able to create AI agents on demand.

Figure B: Gartner’s forecast for agentic AI in enterprise apps

Source: Gartner (August 2025)

An example of this agentic evolution is the introduction of Salesforce’s Agentforce, which it launched in September 2024. This AI-powered autonomous agent platform connects to enterprise data and handles tasks across sales, service, marketing and commerce. Agentforce has seen rapid adoption, with over 12,500 deals closed by July 2025, of which 6,000 were paid. Below is an illustration of its enterprise stack (Figure C), composed of a data layer (Data Cloud), a core application layer (Customer 360) and the agentic layer (Agentforce) which orchestrates work on top. We think this is a good illustration of where the enterprise stack is heading, though we acknowledge that there will likely be variations across different companies and industries. A key challenge for incumbent companies like Salesforce however will be adapting these innovations around legacy systems rather than building AI-native solutions from scratch.

Figure C: Salesforce’s Agentforce

Source: Salesforce

The fruits of thy labour

“[T]he overall addressable market went from software to software plus labour, which is 10 times bigger.”

Yamini Rangan, HubSpot CEO (5 May 2025, Grit)

It is important to note that the rise of AI is not just a challenge for software vendors to overcome in order to stay relevant, but also a significant opportunity. Those who innovate early and integrate AI capabilities into their products can offer more advanced services, effectively monetising the additional value they create. In other words, the leaders in this AI-driven evolution can potentially charge for the extra “intelligent” work their software does, creating significant new revenue streams.

At the same time, there is an open question about how much of this value will be captured by the software vendors relative to the infrastructure and model providers e.g. Microsoft and OpenAI, who supply the inference capabilities. Although inference is getting cheaper, with some estimating it is becoming 10x cheaper per year, the amount of inference needed per task is also growing extremely quickly, especially as models become more advanced and do more work. In an article by The Wall Street Journal, they provided an estimate of tokens needed per task below, showing how inference requirements increase drastically with task complexity.

• Basic chatbot Q&A: 50 to 500 tokens

• Short document summary: 200 to 6,000 tokens

• Basic code assistance: 500 to 2,000 tokens

• Writing complex code: 20,000 to 100,000+ tokens

• Legal document analysis: 75,000 to 250,000+ tokens

• Multi-step agent workflow: 100,000 to one million+ tokens

The article also commented on how this is impacting margins: Ivan Zhao, CEO of productivity software company Notion, said his business had a gross margin of 90% two years ago, fairly standard for SaaS companies. However, approximately 10 percentage points of that margin now goes to the AI companies that power its latest offerings.

It is difficult to forecast the long-term margin impact of inference on SaaS companies, as it will depend on several factors. These include the market dominance of hardware and model providers, which determine their pricing power. Another determinant of inference costs will be the extent to which hardware and software efficiencies improve relative to inference demand. However, if the history of traditional cloud computing by big tech is any guide, inference providers are likely to capture a healthy share of the economics.

Still, we think innovative software vendors will see more upside than downside. They will be able to offer significantly more value to their clients by automating work and reducing labour costs, value that can be monetised at a strong premium. Additionally, as agent-driven systems become embedded in everyday workflows, almost like training an employee who learns a company’s specific needs, vendors could become much harder to dislodge, strengthening their moats. This, in turn, should allow them to raise prices and improve margins. ServiceNow, for instance, exemplifies this opportunity, with the company’s NowAssist AI products commanding 20%+ price premiums over standard offerings, while driving significant revenue growth.

Monetisation revamp

As software increasingly performs work through AI inference, software companies will also need to restructure their monetisation models. SaaS companies will need to shift away from their reliance on seat-based revenue towards usage-based revenue to align monetisation with value delivered. However, this transition is fraught with challenges. Seat-based pricing is more straightforward, scaling with user count. Usage-based models, however, introduce unpredictability, as costs fluctuate with consumption, making forecasting difficult for customers and businesses. It requires real-time systems to track potentially unbounded spend, unlike monthly batch processes. Complex discount structures for enterprise contracts add further intricacy, and data must be stored accurately and accessibly to maintain financial integrity and future pricing flexibility.

Operationally, incentive structures will transform. Sales teams must prioritise high-usage clients over seat counts, necessitating new compensation models. Product teams need to focus on unlocking use cases that drive usage, requiring agility to adapt to evolving customer needs. This transformation demands top-down leadership from the CEO to align sales, product, and finance teams. The right pricing model is still being figured out, with no universal solution yet, and we expect this will take time as AI models and hardware continue to rapidly improve. As seen with Salesforce’s Agentforce, it has reportedly changed its pricing model three times in a single year, reflecting rapid experimentation to find the optimal approach.

Despite challenges, usage-based pricing offers immense opportunity. By aligning monetisation with usage, companies achieve better product-market fit, capturing more value as customers derive greater benefit, fostering a flywheel of growth and innovation.

The agentic organisations

“I am on a mission to make Salesforce an agentic enterprise.”

Marc Benioff, Salesforce CEO (29 August 2025, The Logan Bartlett Show)

In addition to evolving their products and monetisation models, software vendors will also need to rethink their organisational structures. As Marc Benioff from Salesforce highlighted, it’s not just about making the product agent-driven, but about making the entire organisation agent-driven. In a recent podcast, he mentioned reducing Salesforce’s support staff from around 9,000 to 5,000 thanks to AI agents, reducing costs substantially.

Likewise with sales, AI agents are reshaping how leads are managed and converted. Benioff explained that Salesforce had accumulated over 100 million uncontacted leads over 26 years due to insufficient human resources. However, now agents call back every person who calls them, handling more than 10,000 leads weekly, engaging in conversations and funnelling them into their pipeline. This highlights how agents are not just helping cut costs, but also helping grow revenues more efficiently. We imagine there will be many more use cases where agents will enhance efficiencies significantly. We therefore see significant upside potential for companies that can transform themselves to become more agent driven.

Sizing the opportunity

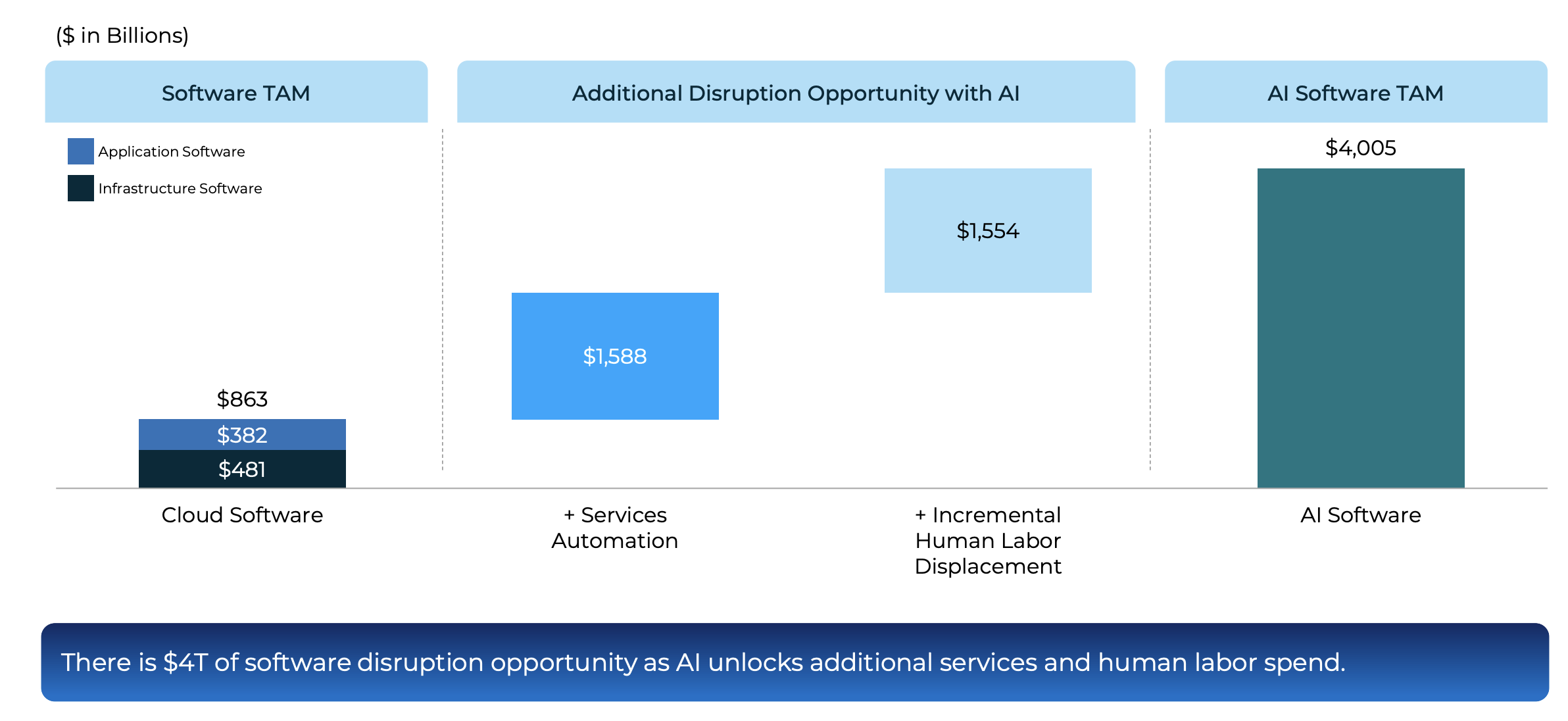

Cutting-edge software firm Palantir estimates it will be able to grow its revenue by 10x over the next 5 years, while simultaneously reducing headcount. This is a testament to the potential efficiency gains of AI. Although most firms will likely not be as operationally efficient as Palantir, we believe the potential for software to automate services and displace human labour will still lead to a substantial TAM expansion. According to Battery Ventures' 2024 State of the OpenCloud report, the AI software TAM is worth approximatley US$4 trillion (Figure D).

Figure D: The AI Software Market Opportunity

Source: Battery Ventures, State of the OpenCloud Nov 2024

Conclusion

The current AI paradigm poses one of the greatest challenges the software industry has faced, forcing vendors to rethink many aspects of their business. Yet it also represents a powerful accelerant. Vendors could see substantial revenue uplifts by monetising the intelligent work their software performs, while also capturing significant operational efficiencies within their own organisations. Existing moats give incumbents valuable time to adapt, and as software evolves from being a critical tool to performing critical workflows, these moats may in fact deepen, making vendors harder to displace. However, Darwinism will take effect. The winners will be those agile enough to adapt quickly and embrace AI holistically, not just at the product level, but across their entire organisations.

In our view, companies that are already geared towards usage-based pricing models, will naturally benefit in this evolving AI landscape. We believe usage will rise as AI performs more tasks and we are already seeing signs of strong growth for software infrastructure companies, where usage based revenue models are native. Seat-based models on the other hand may face headwinds as businesses become more efficient and may as a consequence see less seat growth. We are therefore more cautious on vendors that remain seat-based without a clear path to transition toward usage-based models, particularly where their products have limited potential to perform meaningful work that could be monetised.

Additionally, we have a preference for infrastructure software businesses with deeply embedded workflows. Such companies are less easily disrupted than application software vendors and have more breathing room to evolve without immediate competitive threats. We also see cybersecurity as a particularly promising area. As companies expand their AI capabilities, their attack surfaces and vulnerabilities will grow. This will create more demand for advanced cybersecurity solutions. With adversaries also leveraging AI, cybersecurity firms that can help clients secure these new environments are well-positioned to benefit.

At AlphaTarget, we invest our capital in some of the most promising disruptive businesses at the forefront of secular trends; and utilise stage analysis and other technical tools to continuously monitor our holdings and manage our investment portfolio. AlphaTarget produces cutting-edge research and our subscribers gain exclusive access to information such as the holdings in our investment portfolio, our in-depth fundamental and technical analysis of each company, our portfolio management moves and details of our proprietary systematic trend following hedging strategy to reduce portfolio drawdowns. To learn more about our research service, please visit alphatarget.com/subscriptions/.