In 2025, the autonomous vehicle (AV) race accelerated sharply. Waymo’s weekly rides increased more than fivefold in just under a year, putting it neck and neck with China’s Apollo Go in cumulative autonomous miles. Meanwhile, Tesla launched its robotaxi pilot mid-year and is currently gearing up for mass production of its Cybercab, targeting 2 million units annually.

In our previous note, Driving Towards Autonomy (2024), we provided a primer on the autonomous vehicle space. This report builds on that foundation, examining key developments over the past year. We explore the surge in autonomous ride-hailing, expanding partnerships, unit economics and why we believe the AV sector is now at an inflection point.

Autonomous ride-hailing surge

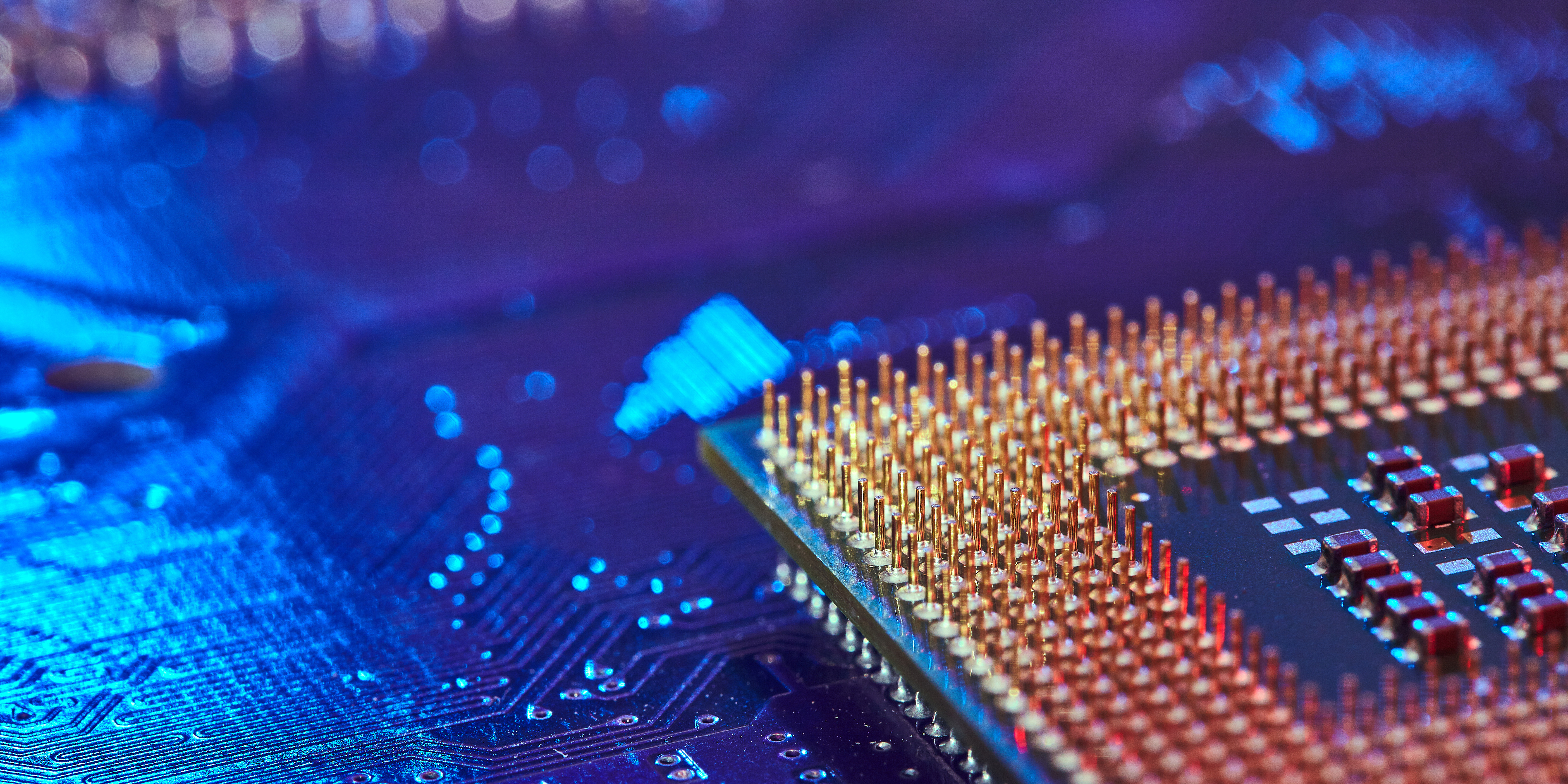

Ride-hailing has seen strong momentum over the last 12 months. Waymo’s cumulative autonomous miles reached 100 million in July 2025 (Figure A), supported by more than 250,000 trips per week across five major US cities and a fleet of over 1,500 vehicles.

Figure A. Waymo’s cumulative autonomous miles

Source: Waymo, X

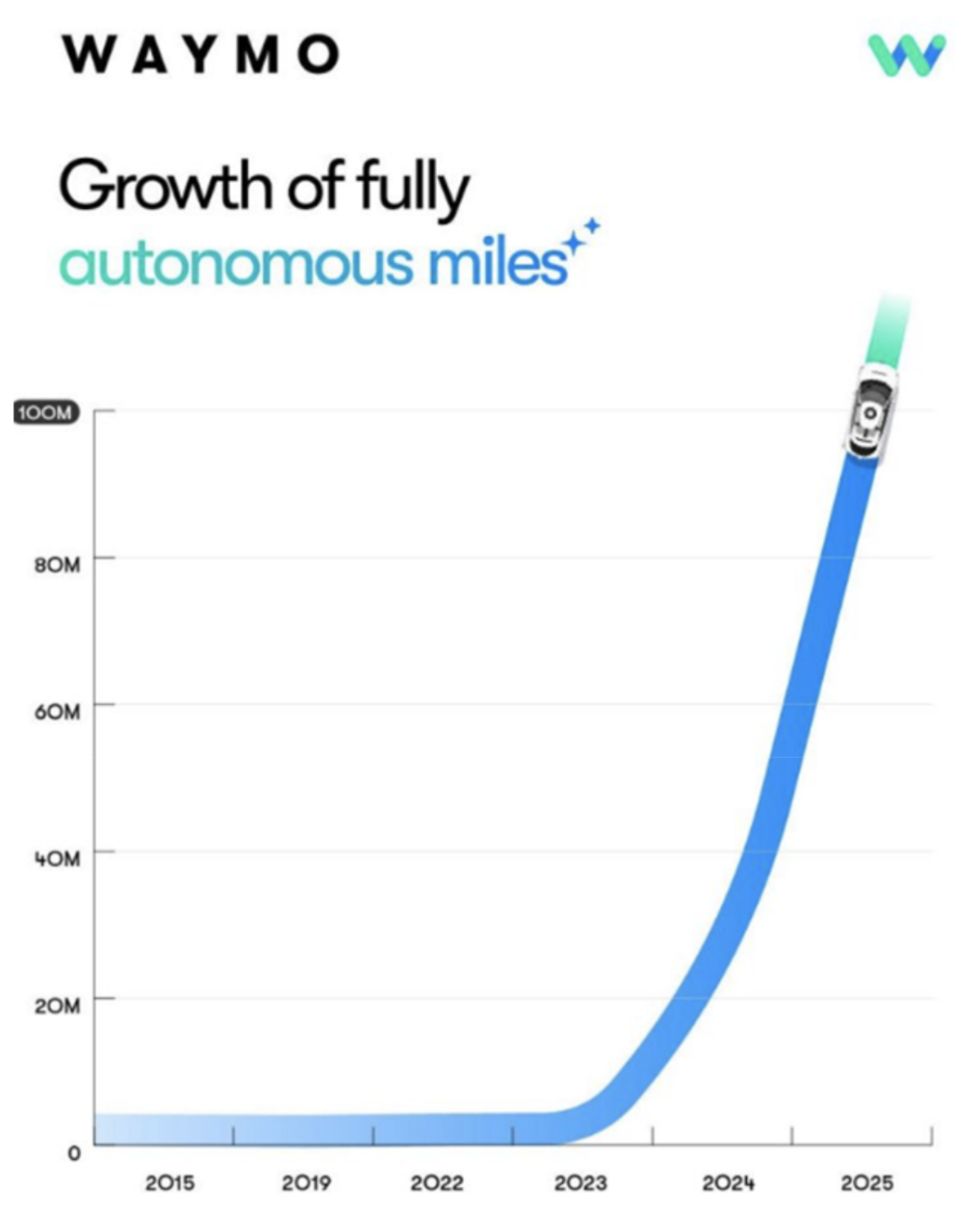

Waymo has also taken market share from other ride hailing services, surpassing Lyft in San Francisco in late 2024 (Figure B). Waymo now plans to add an additional 2,000 Jaguar I-PACE vehicles in 2026 and expand its services to more cities. Additionally, their new integration plant in Mesa, announced in May 2025, is expected to be capable of building tens of thousands of fully autonomous Waymo vehicles per year when fully operational.

Figure B. Waymo market share versus competitors in San Francisco

Source: Bond, Trends – Artificial Intelligence 2025

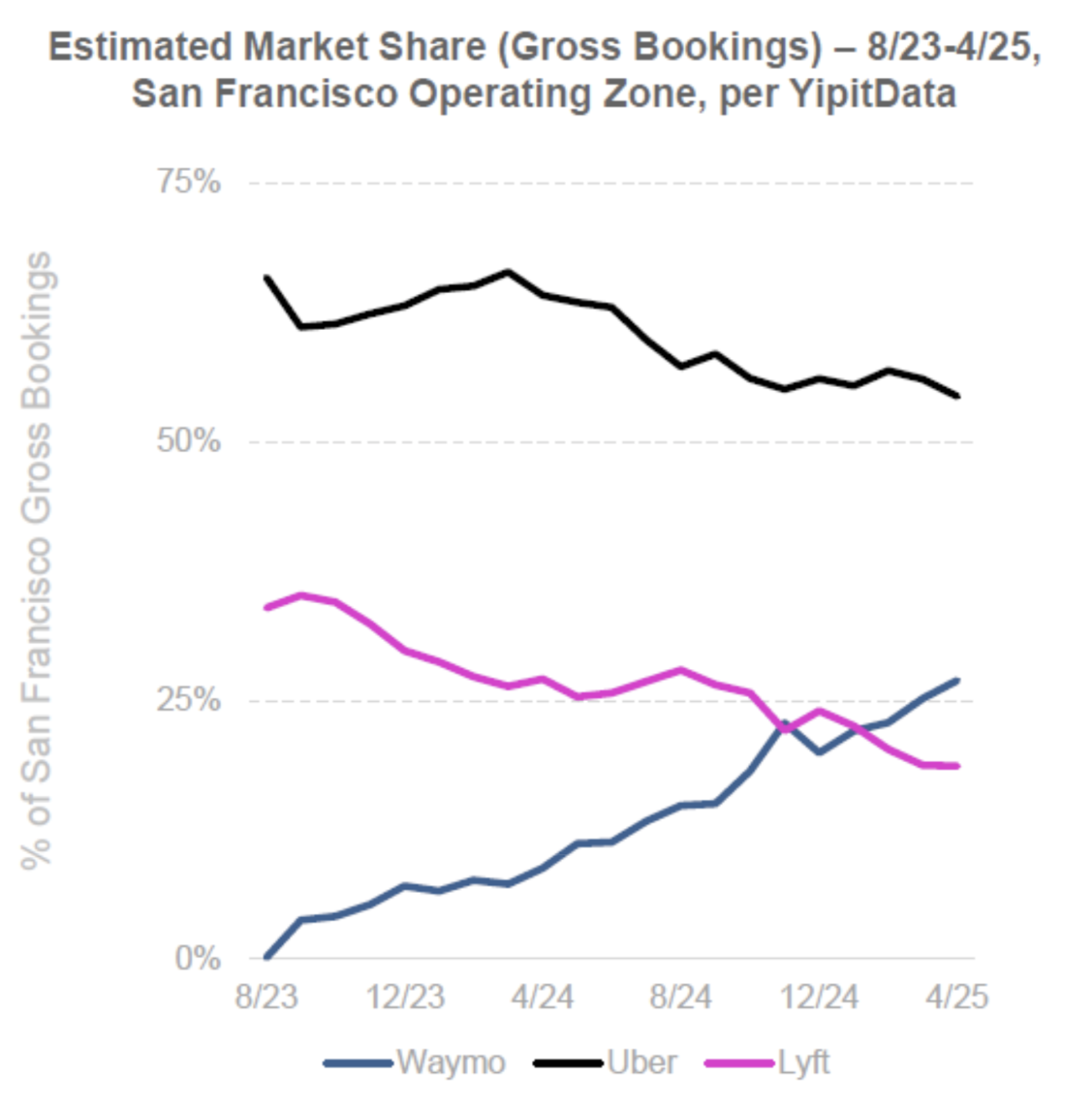

Chinese autonomous mobility companies have also made strong progress, led by Baidu’s Apollo Go, often described as the Waymo of China. As of May 2025, Apollo Go had completed 11 million cumulative ride-hailing trips, slightly ahead of Waymo’s 10 million at the same time (Figure C). In Q2 2025 alone it delivered 2.2 million rides, representing 148% year-on-year growth. Since February 2025, Apollo Go has been operating fully driverless across China with no safety drivers and now serves 16 cities globally.

Figure C. Ride-Hailing Trips: Apollo Go versus Waymo

Sources: Waymo, Baidu, AlphaTarget

Technology, safety and scaling

Two main architectures have emerged in the autonomous race. Waymo, along with most peers, have adopted a multi-sensor fusion approach, typically combining cameras, LiDAR and radar with high-definition (HD) maps built in advance for each city. These detailed maps (lanes, signs, kerbs, crossings), which can provide centimeter-level accuracy, enable the vehicle to localise precisely. Typically, these services run in geo-fenced areas with precise mapping and good network coverage, with the latter facilitating remote tele-operation as required.

Tesla, by contrast, uses primarily cameras with an end-to-end neural-network approach and does not use HD maps for localisation. Note that both approaches use maps for navigation and routing, but Waymo and similar architectures depend on pre-built HD maps to precisely localise the vehicle and validate its sensor-based perception, while Tesla's system determines position and driving decisions directly from camera feeds, supplemented by a microphone for detecting emergency sirens.

Waymo’s approach offers strong redundancy and precise localisation, which underpins proven commercial deployments. Waymo has also published data showing its vehicles are safer than the average human driver across several key metrics in the areas where it operates, with ‘91% fewer serious injury or worse crashes’ (Figure D). According to a TIME article in June 2025, Waymo’s Director of Field Safety, Matthew Schwall, believes the company’s autonomous vehicles are technically capable of operating safely in any American town, but widespread rollout depends on building local infrastructure and public trust.

Figure D. Waymo safety data

Source: Waymo

However, Waymo’s vehicles are still far from perfect drivers. There have been numerous reports of unpredictable behaviour, such as unexpectedly stopping in traffic. A Reuters article in August 2025 highlighted a Waymo driving into a flood and the passenger had to find a way out. Police said if the person had died, it could have led to a “serious criminal incident”. This highlights that the technology still needs refinement and has not quite yet reached the performance levels needed for widespread deployment. Additionally, the need to map out each new territory in incredible detail before autonomous operations has raised questions about its ability to scale at a meaningful pace. That said, Waymo is making progress on this front, with their 6th generation vehicle “on track to begin operating without a human behind the wheel in about half the time”.

“Once we can make it basically work in a few cities in America, we can make it work anywhere in America. Once we can make it work in a few cities in China, we can make it work anywhere in China.”

Elon Musk, Tesla CEO (Q1 2025)

One of the benefits of Tesla’s approach is that fewer sensor types simplify hardware and lower costs. The approach is also more generalisable because it does not require detailed mapping before it expands to a new city. Tesla has taken the route of rolling out its autonomous technology as an Advanced Driver Assistance System. Thus, Tesla’s customers are able to use its Full Self Driving (Supervised) solution and report back on interventions, which allows the company to iteratively improve its generalised autonomy solution. Tesla thus also has orders of magnitude more data than other autonomous mobility players given its large existing fleet, allowing it to capture a long-tail of scenarios. Its vertical integration also means it can iterate and optimise faster.

“LiDAR is a fool’s errand, and anyone relying on LiDAR is doomed”

Elon Musk, Tesla CEO (April 2019)

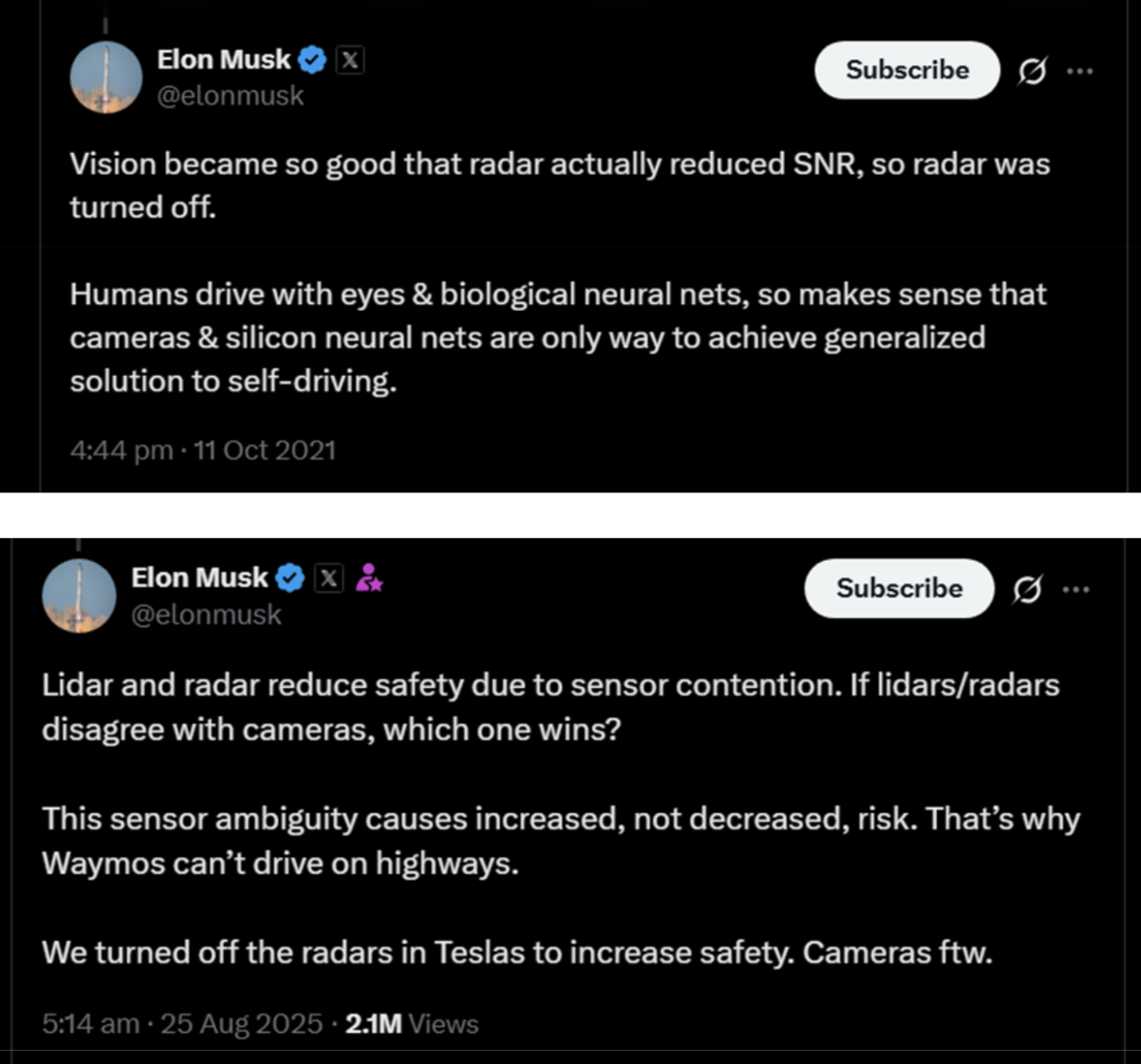

Many, however, question whether a camera-only system can meet the safety threshold for driverless operations. Musk argues that a multi-sensor approach increases complexity, potentially reducing signal-to-noise ratio (Figure E). Tesla’s “photons to control” approach utilises raw camera feeds, with their high dynamic range providing rich visual information, for both model training and inference at run-time.

Figure E. Elon Musk’s posts on autonomous technology

Source: X

In June 2025, Tesla soft-launched its robotaxi service in Austin, with many riders reporting that the vehicles felt smoother than Waymos (e.g. fewer instances of phantom braking). However, the rollout is at a very small scale and by invitation only, so it is likely that participants were to some extent biased. Additionally, there were safety monitors in the passenger seat, though Musk has said these will be removed by the end of the year.

Musk has also outlined exceptionally ambitious scaling targets. On the Tesla Q2 2025 earnings call, he stated that he expects the number of autonomous vehicles in operation to grow at a hyper-exponential rate and projected that Tesla would offer autonomous ride-hailing to half the US population by the end of the year. He has also previously said that its new Cybercab vehicle, designed for ride-hailing, is targeted for volume production in 2026, targeting 2 million units per year and potentially 4 million at full scale. These targets illustrate the scale of Tesla’s ambition relative to its peers, who generally speak in terms of thousands of units rather than millions.

Currently, the jury is still out on which approach will ultimately prove superior. Tesla must demonstrate it can safely operate its robotaxis without safety monitors and show it can scale meaningfully, even if not fully to its most ambitious targets. Meanwhile, Waymo will need to refine its technology to reduce occasional unpredictable behaviour and improve the efficiency of scaling operations over time. Both companies face critical milestones and the path to broad autonomous adoption will hinge on how well each can meet these challenges.

Expansion via partnerships

“Leveraging our partners' local market presence, we can accelerate market entry across different continents and achieve faster deployment while maintaining a cost-efficient asset-light business model.”

Robin Yanhong Li, Baidu CEO (Q2 2025)

To accelerate deployment, autonomous driving companies are increasingly forming partnerships with established ride-hailing services and automotive players. In the US, Waymo continues to collaborate with both Uber and Lyft across multiple cities, integrating its autonomous vehicles directly into their ride-hailing apps. In Japan, Waymo announced a partnership in late 2024 with taxi platform GO and operator Nihon Kotsu, where vehicles will initially be manually driven in Tokyo to refine local performance before autonomous operations begin. Waymo has also expanded its OEM relationships, including with Hyundai, whose IONIQ 5 SUV will join the Waymo One fleet and Toyota, with which it is co-developing technologies to enhance both personally owned vehicles and future fleet models.

Similarly, Apollo GO has also struck a range of partnerships to further expand its operations. For instance, in August 2025 it partnered with Lyft to deploy autonomous rides across Europe, with initial deployments planned for Germany and the UK in 2026, pending regulatory approval. The agreement sees the fleet scaling to thousands of vehicles in the following years, with Apollo Go providing the vehicles and comprehensive technical support and Lyft owning the operational value chain. It also struck a similar deal with Uber in July 2025 for a range of markets outside of the US and mainland China. Initial target markets are Asia and the Middle East, with Dubai emerging as a key hub given its goal for at least 25% of all trips to be driverless by 2030.

These partnerships with ride-hailing platforms allow autonomous driving companies to focus on their core expertise while leveraging partners’ established user bases and operational capabilities. This creates natural synergies and removes the need for autonomous mobility players to spend heavily and compete on customer acquisition. Going forward, we would expect these types of partnerships to continue and become a standard go-to-market channel.

Chinese autonomous players are also increasingly looking to shift to an asset-light approach, choosing not to own the vehicles themselves. This model reduces capital intensity and transfers fleet management to partners better equipped to maximise utilisation and minimise operating costs, which should ultimately enable more efficient scaling.

The road to profitability

“Looking into the longer-term, we see a clear path to profitability as hardware and labour costs keep coming down and our growing operational scale brings more efficiencies.”

Robin Yanhong Li, Baidu CEO (Q1 2025)

A key question for the autonomous vehicle industry is if and when robotaxi operations can achieve profitability. While removing the human driver eliminates a major cost, the high expense of autonomous hardware and ongoing operating overheads, including the need for tele-operators, have historically made positive unit economics difficult to achieve.

A Wall Street Journal analysis in December 2024 estimated the cost of a Waymo vehicle at roughly US$125,000, comprising about US$50,000 for the Jaguar I-PACE base car and the remainder for autonomous components, including LiDAR, cameras, radar and external audio receivers (EARs). Assuming US$15–20 billion in capital investment and a fleet of 20,000 vehicles, the analysis suggested a breakeven period of around 10 years.

“With 13 cameras, 4 LiDAR, 6 radar and an array of external audio receivers (EARs), our new sensor suite is optimised for greater performance at a significantly reduced cost, without compromising safety.”

Satish Jeyachandran, Vice President of Engineering Waymo (August 2024)

Although Waymo faces less pressure to cut costs given its parent Alphabet has significant resources, cost reductions have been an important focus. When it announced its 6th generation Waymo Driver in August 2024, cost optimisation was a key highlight. Additionally, its partnership with Hyundai, adding the more affordable IONIQ 5 relative to the Jaguar I-PACE, suggests a focus on improving unit economics.

“RT6 is now running at a meaningful scale across multiple cities. And its unit cost is below $30,000, far better than anyone else on the planet.”

Robin Yanhong Li, Baidu CEO (Q1 2025)

In contrast, Baidu’s Apollo Go has achieved meaningfully lower vehicle costs and already reached positive unit economics in China, despite significantly lower average fares. In our discussions with another Chinese autonomous player, they have also seen significant cost reductions in recent times on multiple fronts. For instance, the hardware has become much more affordable, especially since they were able to move from expensive mechanical LiDAR to the more affordable solid-state and semi-solid state LiDAR. Additionally, as the AV industry continues to expand, the supply chain has benefitted from economies of scale, driving down costs. Operating expenses have also fallen through more efficient algorithms that consume less power and by reducing remote safety supervision to one operator per 30 vehicles.

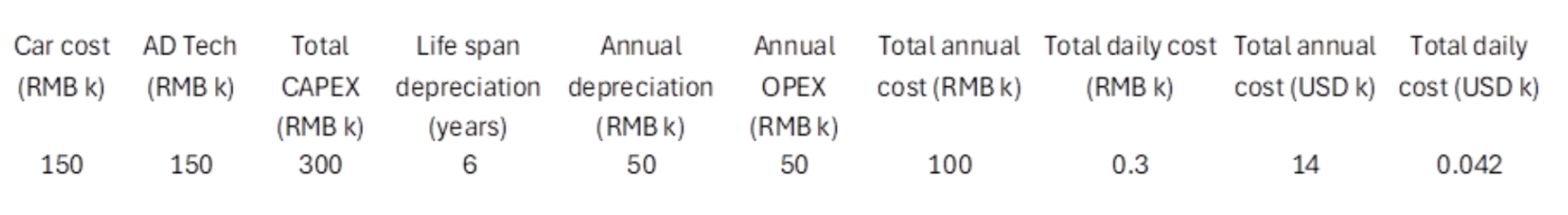

This provider estimated total daily costs of around RMB300 (US$42) for its next generation vehicle, including OPEX and depreciation (Figure F). With taxi drivers in Chinese markets earning up to RMB600 (US$82) per day and autonomous fleets capable of continuous operation, they too appear well positioned to achieve positive unit economics. As fleets scale, fixed overheads should become an even smaller share of total costs, paving the way for profitability at the organisational level.

Figure F. Autonomous vehicle unit cost for a Chinese autonomous mobility company

Source: Chinese autonomous mobility company

Tesla’s Cybercab is also set to be highly cost effective. Musk has stated the cost was expected to be below $30k, with no pedals, steering wheel or driver dashboard. It is designed for a “gentle ride”, with lower top end speed and more efficient tires than its other models, optimised fully for cost per mile, estimated at around $0.3-$0.4.

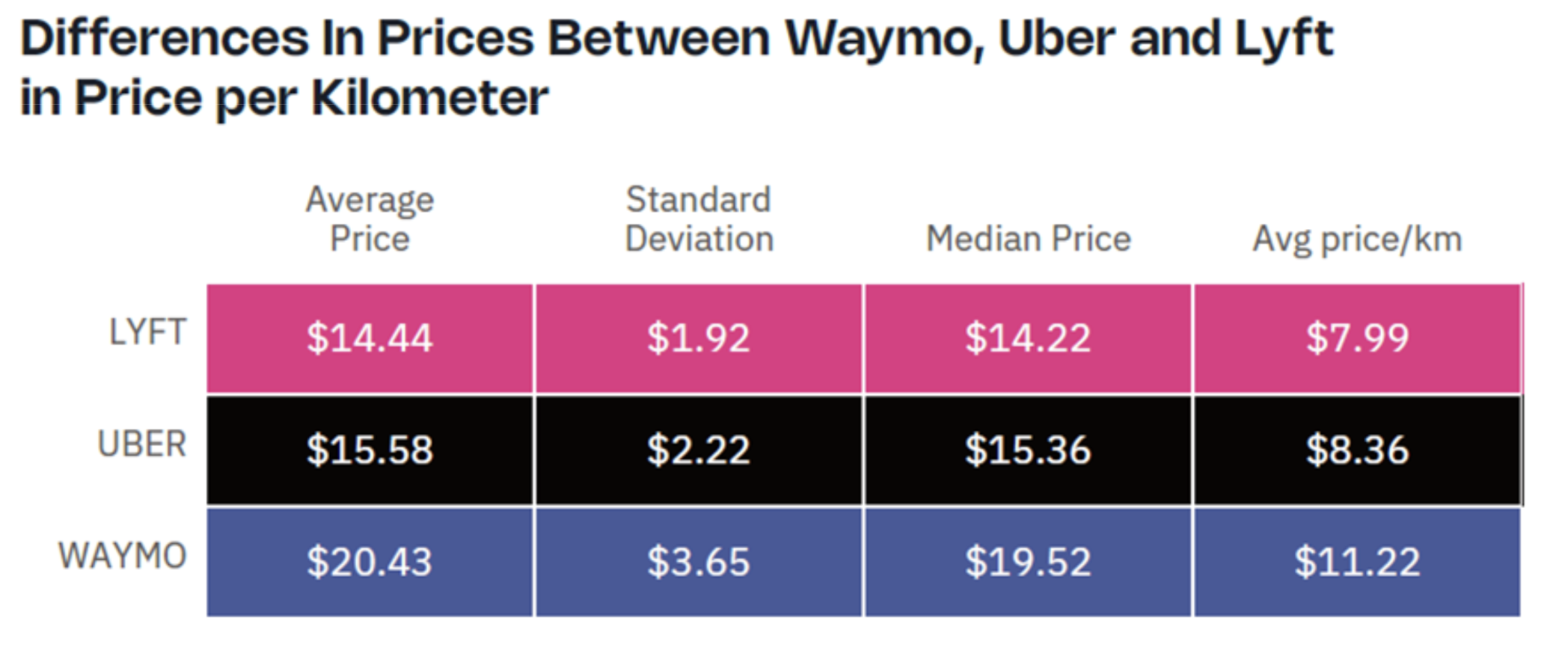

While vehicle costs are falling, early market data shows strong willingness to pay. A study by Obi found that Waymo rides were priced roughly 30–40% higher than competing services (Figure G). Among surveyed riders who had taken a Waymo, 70.2% said they preferred it, 16.7% were indifferent and 13.2% favoured traditional ride-hailing apps.

Figure G. Price comparison between Waymo and other ride-hailing apps

Source: Obi, The Roach Ahead: Pricing Insights On Waymo, Uber and Lyft

Notes: n: 88,998, Dates: 25 March – 25 April 2025, Place: San Francisco

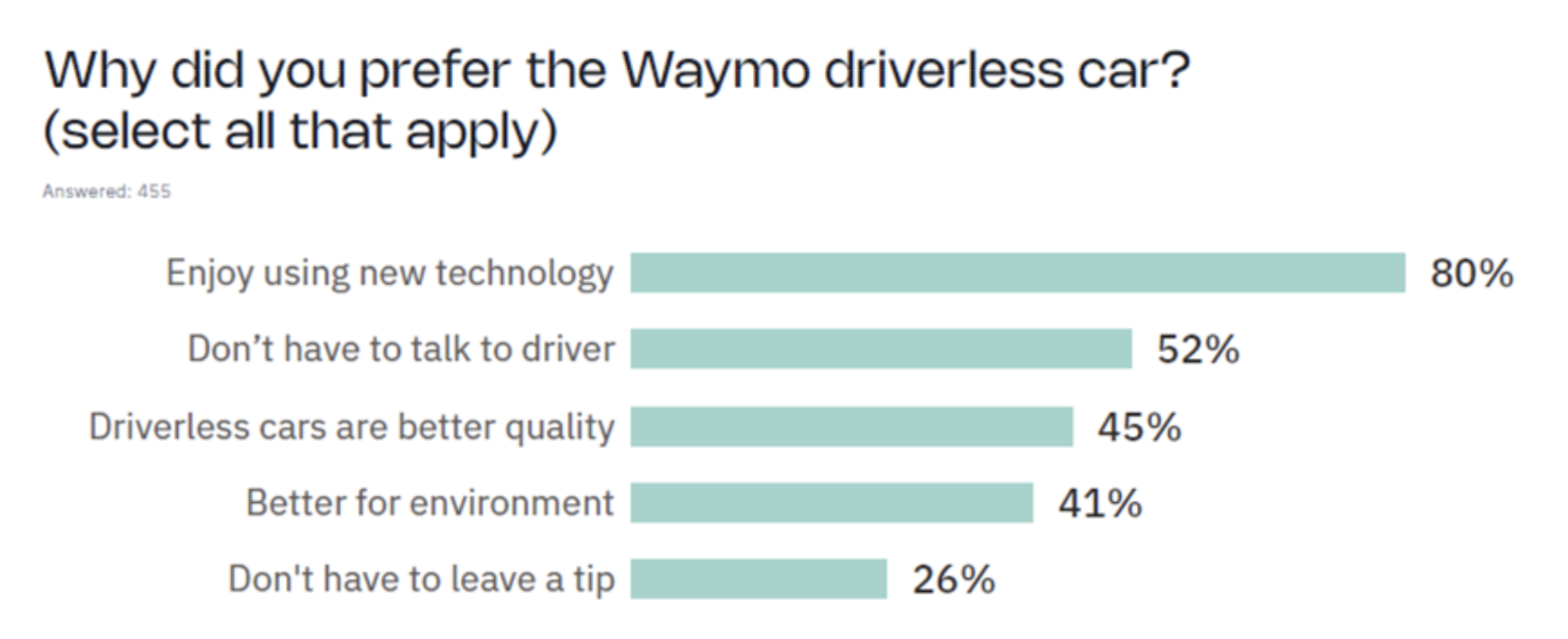

When respondents were asked why they preferred the Waymo, 52% of respondents said it was because they did not need to speak to the driver (Figure H). It is also likely that some riders feel safer without a human driver, though that was not an option on the questionnaire. We assume these factors can to some extent explain its growing market share and its ability to command a premium.

Figure H. Survey for why riders preferred Waymo

Source: Obi, The Roach Ahead: Pricing Insights On Waymo, Uber and Lyft

“We are moving towards a future where taking a robotaxi will be half the cost of taking a taxi today.”

Robin Yanhong Li, Baidu CEO (July 2022)

Although riders are currently willing to pay a premium, we do not expect elevated pricing to persist. In the long run, we would expect fares to fall materially below current ride-hailing rates as cost savings from removing human labour and using purpose-built vehicles are competed away. However, lower prices should drive significantly higher adoption and utilisation rates, as autonomous services become more accessible to a broader segment of consumers.

We still expect healthy margins over time, however. We do not anticipate the autonomous driving market to resemble today’s car industry with over 100 brands and structurally low profitability. Once leading players achieve scale, accumulate large amounts of proprietary driving data and demonstrate superior safety performance, barriers to entry should rise sharply, limiting competition and supporting healthy margins. At the same time, we do not foresee monopoly-like outcomes, as large national governments are unlikely to allow a single foreign operator to dominate domestic mobility infrastructure and are expected to support local champions.

Sizing the opportunity

Autonomous vehicles will potentially impact multiple trillion-dollar markets including transportation, logistics and urban infrastructure. This potential stems from fundamental changes to cost structures and asset utilisation across these sectors, although the early stage of the technology makes precise market sizing challenging.

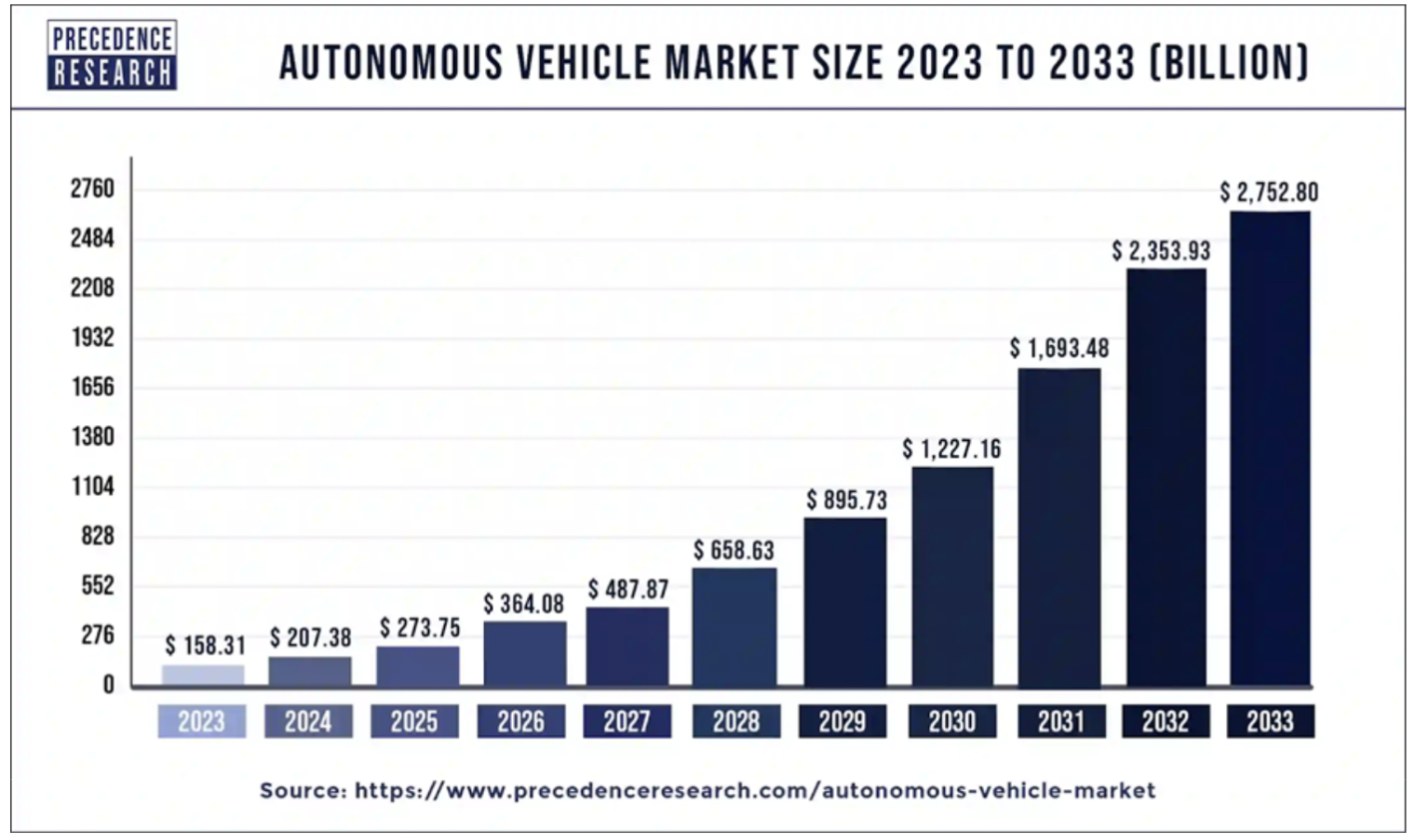

Since autonomous technologies are still in the very early stages of their rollout, the estimates for total addressable market (TAM) vary significantly across forecasts. For instance, according to Fortune Business Insights, the global autonomous vehicle market was valued at just over US$1.9 trillion in 2023 and is expected to grow to US$13.6 trillion by 2030 (representing a CAGR of 32.3%)! On the other end of the spectrum, Precedence Research has a relatively conservative estimate for the Autonomous Vehicle Market at US$158.3 billion in 2023, set to grow to US$2.75 trillion by 2033 (Figure I).

Figure I: Autonomous Vehicle Market Size, 2023 to 2033

Source: Precedence Research

Conclusion

The autonomous vehicle (AV) market remains nascent, with leading robotaxi fleets currently numbering around 1,000–1,500 vehicles and most new partnerships involving only a few thousand units. This is orders of magnitude smaller than the global vehicle total, estimated at 1.6 billion. However, growth is accelerating as technology advances, regulatory support increases and partnerships proliferate across regions. Crucially, we see emerging positive unit economics as a catalyst, giving companies the confidence and economic capacity to scale more aggressively. We therefore believe the industry is now at an inflection point and we would not be surprised to see fleet sizes doubling or tripling annually for many years to come.

At AlphaTarget, we invest our capital in the most promising disruptive businesses at the forefront of secular trends; and utilise stage analysis and other technical tools to continuously monitor our holdings and manage our investment portfolio. AlphaTarget produces cutting-edge research and our subscribers gain exclusive access to information such as the holdings in our investment portfolio, our in-depth fundamental and technical analysis of each company, our portfolio management moves and details of our proprietary systematic trend following hedging strategy to reduce portfolio drawdowns. To learn more about our research service, please visit alphatarget.com/subscriptions/.