Introduction

Although there are still concerns that the AI market may be in a bubble, industry investment continues at pace with little sign of slowing. Hyperscalers continue to guide towards record capital expenditure, consultancies report surging AI bookings, and enterprise software vendors are racing to embed agentic capabilities into their platforms. As with other major technology shifts, it will take time before the returns from this investment become fully visible. Even so, for investors it remains important to monitor how AI is being adopted and used in practice, as this helps assess whether current developments are on track to realise its long-term promise.

In this note, we focus on enterprise AI and examine how organisations are moving beyond chatbots and narrow point solutions to embed AI deeper into business workflows. In the first section, we look at AI adoption and find that it is widespread but generally remains shallow, with most organisations in the early phases of deployments. We then explore the key challenges and limitations shaping adoption, where reliability currently remains an important constraint. Finally, we assess the rise of AI platforms and the emerging competition to become the organising layer for enterprise AI.

Overall, the evidence points to early signs of real value being realised, even if deployments remain constrained at this stage. Given the early stage of the cycle and the pace of ongoing advances, we remain optimistic that enterprise AI is on a healthy trajectory with substantially more value still to be unlocked.

Enterprise adoption

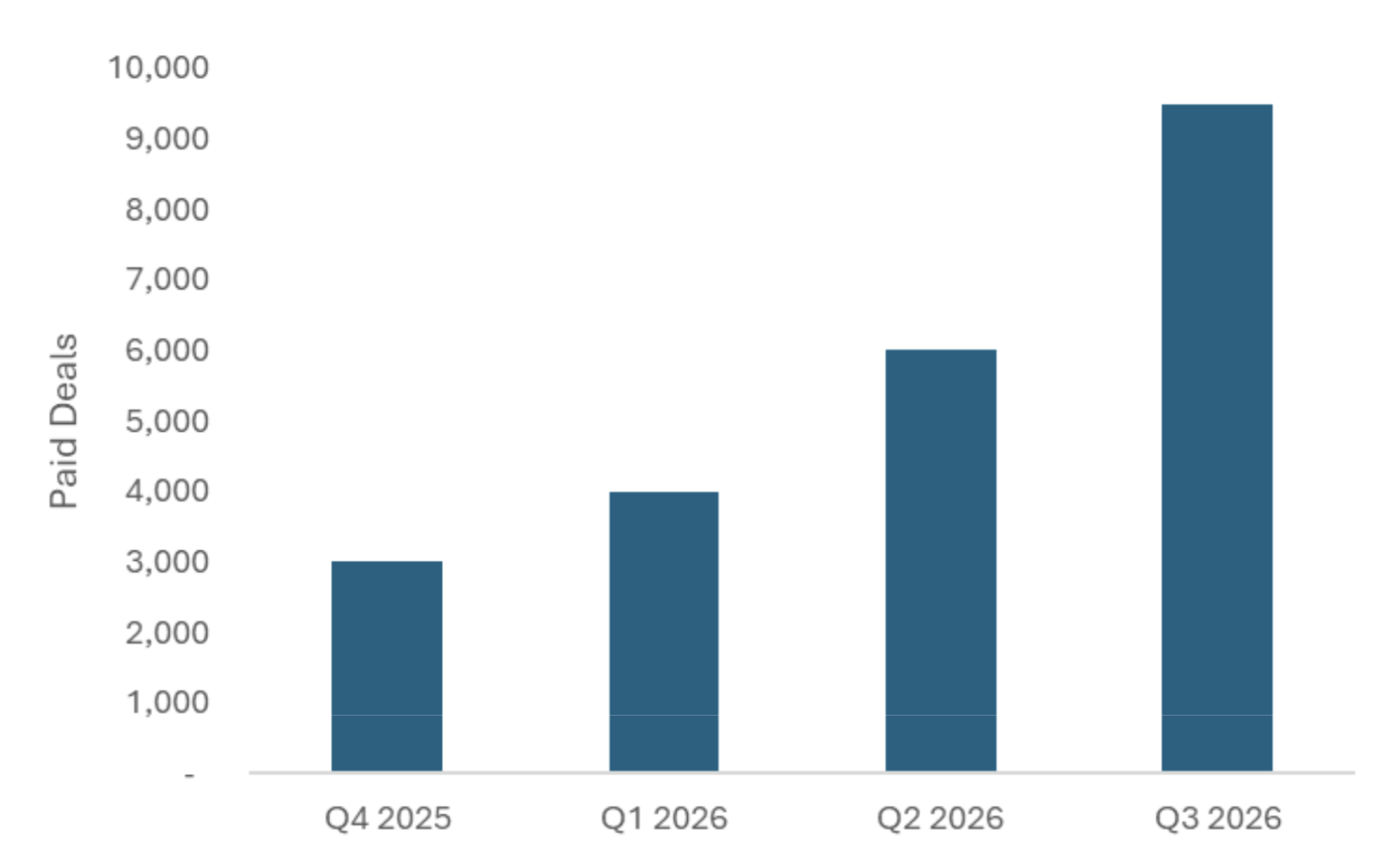

In general, enterprises appear eager to embrace AI. A McKinsey study which surveyed organisations in the summer of 2025 found that 88% use AI in at least one business function, up from 78% a year ago. Additionally, we have observed strong demand for AI services at consultancy companies such as Accenture and Capgemini. Accenture reached US$1.8 billion in AI bookings in Q4 2025 (ended 31 August) and for FY25 it achieved US$5.9 billion, nearly doubling year-over-year and representing over 7% of total company bookings. Similarly, Capgemini’s AI bookings in Q3 2025 (ended 30 September) were 8% of total bookings. This shows growing willingness among enterprises to commit budget to AI initiatives.

Figure 1: Accenture’s Generative AI Quarterly Bookings (Fiscal Year end August)

Source: Accenture

However, breadth of adoption does not imply depth. Most enterprise AI deployments remain incremental rather than transformative. These deployments are typically augmenting existing workflows with copilots and chatbots rather than fundamentally redesigning processes or enabling entirely new capabilities.

This shallow pattern is evident in the data. According to the McKinsey study, 62% of organisations are still in the AI experimentation and piloting phase, whereas just 7% have AI fully deployed and integrated across their organisation.

In terms of deeper AI deployments using agents (systems that autonomously execute multi-step tasks using a model and tools within defined constraints), only 23% of organisations report that they are scaling these somewhere within their organisation, though usually limited to 1-2 business functions. An additional 39% of organisations are still experimenting. The relative scarcity of agentic deployments underscores the gap between current practice and AI's fuller potential: agents represent a shift from AI as a tool that assists human workers to AI as a participant that executes tasks with meaningful autonomy.

Figure 2: Phase of AI agent use by business function (% of respondents)

Source: McKinsey

Challenges, constraints and value

The fact that adoption remains shallow reflects not only the early stage of the cycle, but also a range of practical challenges and constraints.

Organisational readiness: Many departments lack leadership ownership for AI initiatives, as these often involve upfront costs and the redesign of workflows, which can represent a short-term burden. Resistance to change is compounded by the lack of talent to both understand which workflows can be optimised and the ability to implement these changes.

Technical foundations: Many companies lack the necessary data infrastructure and carry significant technical debt that limits their ability to support AI initiatives. Clean, accessible, well-governed data is a prerequisite for most meaningful AI applications, yet remains elusive for many organisations.

Risk and governance: Finally, there is ongoing hesitation driven by concerns around data privacy and cybersecurity risks.

Once AI initiatives are implemented, organisations often face a range of issues that they need to mitigate, with inaccuracies and explainability emerging as the two factors associated with the most negative consequences. Inaccuracy risk is particularly acute for customer-facing or regulated applications, where errors carry reputational or compliance costs. Explainability, specifically the ability to understand and justify why an AI system produced a given output, matters both for internal trust and external accountability.

Figure 3: AI-related negative consequence and risk mitigation in the past year (% of respondents)

Source: McKinsey

Reliability and Architectural Considerations

In the study “Measuring Agents in Production” (December 2025) by researchers from UC Berkeley, Stanford University and IBM Research, 68% of production AI agents perform at most ten steps autonomously before human intervention. This is to manage reliability, computational time and costs. Additionally, 74% of teams rely on human-in-the-loop oversight or feedback to judge the agent’s answers. This is because it is difficult to automatically evaluate whether the AI is performing correctly for specialised business tasks, so companies still lean on users to review results.

Due to reliability and cost considerations, enterprises are increasingly deploying AI agents within deterministic workflow scaffolding rather than granting full autonomy. Most production systems fix the sequence of steps an agent must follow and limit model discretion to bounded stages A common example is an insurance agent that always moves through coverage lookup, medical-necessity review and risk checks in a fixed order, even though the model may still improvise within each subtask. This pattern is reflected in the Measuring Agents in Production study, which finds that 80% of real deployments use structured, stepwise flows. This approach improves predictability, auditability and cost efficiency by reducing variance, unnecessary model calls and failure loops. As a result, enterprises are typically deploying LLMs inside deterministic shells, particularly in standardised and regulated processes, rather than relying on free-form autonomous agents.

Despite current challenges and limitations, available evidence suggests AI agents are already delivering meaningful productivity benefits. In-depth interviews in the Measuring Agents in Production study reveal that organisations tolerate minutes-long execution times because agents still outperform human baselines on the tasks they replace. Among practitioners with deployed agents who evaluated alternatives, 82.6% preferred the agentic solutions for production deployment, indicating superior performance relative to non-agentic approaches. Consistent with this, McKinsey found that 39% of organisations using AI report some impact on EBIT at the enterprise level, suggesting that early productivity gains are beginning to translate into financial outcomes.

AI platform wars

“The CEOs are kind of getting the picture. Many of them have killed these proof-of-concept scenarios. One had 900 proof-of-concepts going on in the company and said it was uncontrollable, and they killed them all. And they went with ServiceNow.”

Bill McDermott, ServiceNow CEO, Q3 2025

Due to the challenges of building and implementing in-house agents, many organisations have now turned to their existing software vendors such as ServiceNow and Salesforce who offer out-of-the-box agents and AI platforms. These solutions require less setup, less in-house expertise and benefit from agents being tightly integrated with the workflows of the parent system.

ServiceNow

ServiceNow, which now calls itself the “AI Platform for business transformation,” offers a wide range of AI solutions to help optimise workflows across areas such as IT, CRM and HR. Not only does it let customers build their own agents, but it also has over 100 pre-packaged agentic workflows. Additionally, ServiceNow offers the AI Control Tower product, which provides visibility, governance, security and centralised control. Furthermore, its AI Agent Fabric product, a communication and integration layer, allows connections to third party AI agents and tools to enhance agentic workflow orchestration.

In its Q3 2025 (ended September) earnings call, ServiceNow management stated that its AI products are on track to exceed US$500 million for the full year. For FY2026 the company is targeting US$1 billion in AI product revenue, though it is aiming to surpass this target.

Salesforce

Similarly, Salesforce has also gone all-in on becoming a leading AI platform company. This transition underpinned its recent US$8 billion acquisition of the data cloud management company Informatica, as it sought to strengthen its data infrastructure to support agentic workflows. Salesforce also rebranded many of its core offerings with the Agentforce label, where Sales Cloud is now Agentforce Sales, Service Cloud is now Agentforce Service, and the platform layer was renamed to Agentforce 365 Platform.

According to reporting from Business Insider, Salesforce CEO Marc Benioff said customers no longer want to talk about “the cloud” and instead frame their needs primarily around AI agents, a shift Salesforce validated in pre-Dreamforce focus groups. The rebrand appears to be so significant that Benioff even told Business Insider he “would not be shocked” if Salesforce ultimately renamed the entire company to Agentforce.

During its annual Dreamforce conference in October 2025, Salesforce provided several examples of global enterprises already deploying its new AI capabilities in production. Case studies included Williams-Sonoma, Pandora, PepsiCo, FedEx and Dell.

The Williams-Sonoma case study demonstrated how Agentforce can power fully branded consumer-facing agents, launching “Olive,” an AI sous-chef, built in just 30 days. It provides personalised recipe guidance, tutorials and product-aware recommendations based on items a customer already owns.

In the PepsiCo case study, Salesforce showed how Agentforce enhanced sales, marketing and field operations by embedding agents directly into customer and employee workflows. Prospective retailers now receive personalised product recommendations and automated follow-up emails, while sellers use Slack-based insights to prepare for meetings and identify risks. Field technicians benefit from pre-work briefs, real-time troubleshooting and automatic post-work summaries, with Agentforce also highlighting bespoke upsell opportunities to drive incremental revenue.

The FedEx case study highlighted efficiency improvements when its customers ask sales reps complex international-shipping questions. Previously, when reps posed these queries to their chatbot they would often get back a 200-page tariff PDF that they would have to wade through to get an answer. Now however, it instead returns precise and complete shipping recommendations while governance rules mask sensitive data.

The case study also showed that when employees received a new laptop that was not properly set up (e.g. missing apps), they could simply describe this issue to Agentforce in Slack and have the device automatically configured without the need to raise an IT ticket.

The early success of Salesforce’s AI products is reflected in its numbers. Agentforce ARR (annual recurring revenue) surpassed US$0.5 billion in its Q3 2026 (ended 31 October), growing 330% year-over-year with 9,500 paid deals. Agentforce accounts in production also grew 70% quarter-over-quarter and 50% of its Agentforce and Data 360 bookings came from existing customer expansion, indicating early product-market fit as customers continue to build on and expand these deployments rather than abandoning them.

Figure 4: Salesforce’s paid deals for Agentforce (Fiscal Year end January)

Source: Salesforce

AI platform competition

Looking ahead over the medium term, we expect demand for AI platforms embedded within existing enterprise software to remain strong, reflecting customer appetite for agentic capabilities within established workflows. However, given organisations often have a vast number of different software vendors, this is likely to result in organisations operating multiple AI platforms across different software ecosystems. For example, FedEx utilises both Salesforce’s and ServiceNow’s AI platforms in production.

However, the true unlock lies in enabling agents and workflows to operate seamlessly across the entire organisation rather than remaining confined to the parent ecosystems. This capability is increasingly a stated goal of leading platforms, and we are already seeing moves in this direction, for example through Salesforce’s integration with Microsoft Teams. Achieving this cross-enterprise orchestration would meaningfully strengthen platform positioning, stickiness and long-term value capture.

This prize is therefore driving intensifying competition. It is not only ServiceNow and Salesforce that are pursuing this role, but also a range of other players seeking to become the organising layer for enterprise AI, ranging from Google with Gemini Enterprise to platforms such as Dataiku and UiPath, each approaching the opportunity from a different angle. Microsoft, with its Copilot suite deeply integrated across Office 365 and Azure, represents perhaps the most formidable competitor given its existing enterprise footprint.

However, delivering true cross-enterprise orchestration remains difficult in practice. Each organisation has a unique application landscape, data architecture and workflow structure, and it is not yet clear whether any single platform will be able to integrate deeply enough across the full enterprise to meet most use cases. If platforms struggle to operate across the enterprise, companies may increasingly need to build custom in-house agents and agentic systems to bridge gaps to coordinate end-to-end workflows.

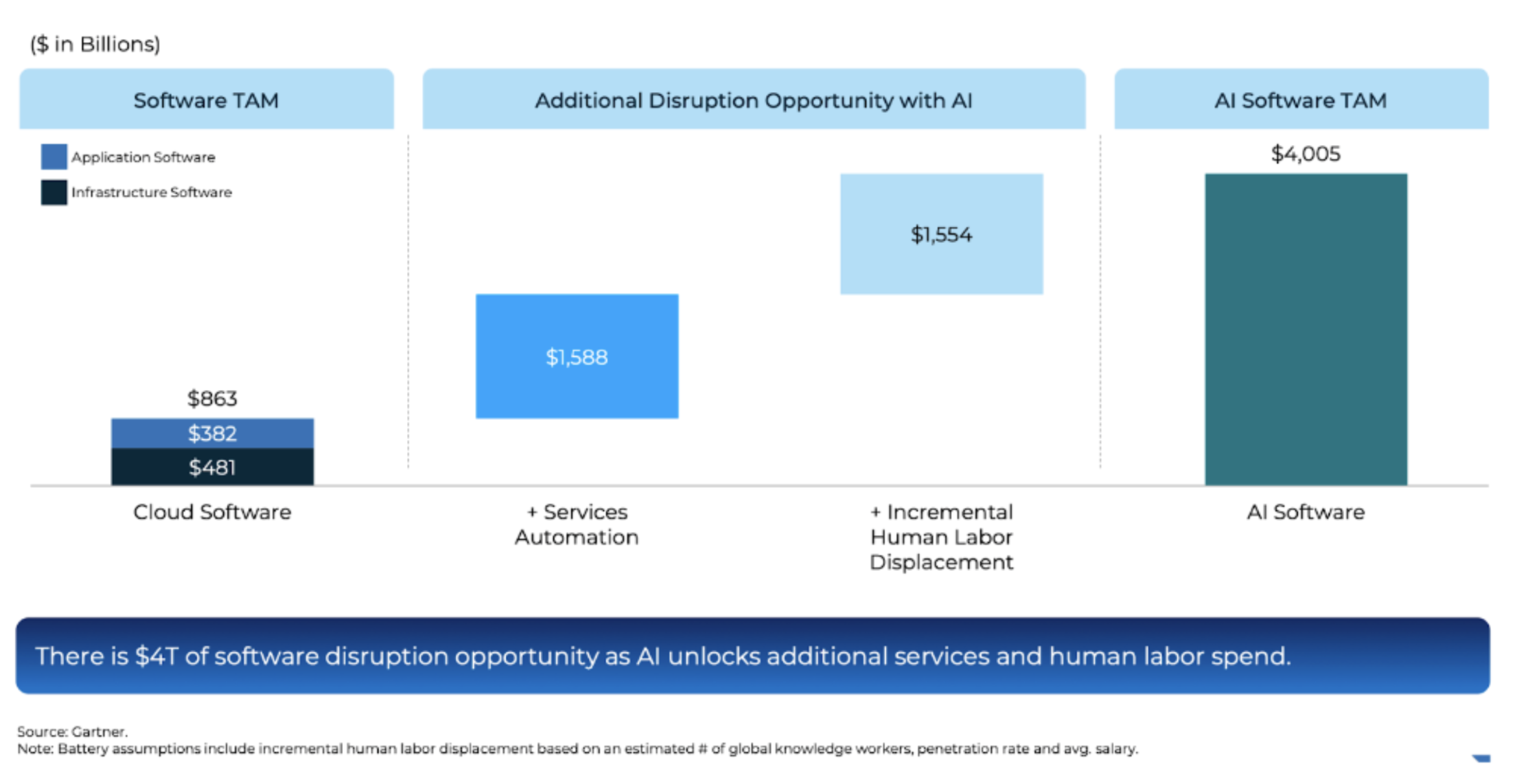

Sizing the opportunity

While precise market sizing for enterprise AI remains difficult given the early stage of adoption, the scale of the opportunity is clearly substantial. Battery Ventures estimates that AI could underpin a roughly US$4 trillion software opportunity by expanding traditional application and infrastructure markets while also unlocking incremental services automation and partial displacement of human labour.

Figure 5: The massive AI market opportunity

Source: Battery Ventures, State of the OpenCloud

Conclusion

The evidence points to early but tangible signs of value realisation in enterprise AI, even as adoption remains uneven and constrained by practical challenges. Many organisations remain in the experimentation and piloting phases, with limitations around reliability, integration, talent availability and human oversight persisting. There are, however, clear indications of productivity gains and, in some cases, early impacts on EBIT. That said, it remains too early to determine whether these gains will ultimately justify the substantial capital expenditures being made across the sector. Nevertheless, the progress to date is encouraging, particularly when viewed against historical precedent, as it took roughly 15 years before PCs drove widespread productivity improvements across the economy.

Looking ahead, we expect continued progress as multiple reinforcing factors improve. Advances in hardware and models should increase capability while lowering costs, while accumulated implementation know-how and more mature architectures should reduce execution risk. Together, these dynamics are likely to expand the set of economically viable use cases and support further deployment of both custom-built agents and AI platforms embedded within enterprise workflows.

The eventual structure of the enterprise AI landscape remains uncertain however, especially amid the intensifying "AI platform wars" as vendors vie for dominance in cross-enterprise orchestration. Over the long run, it is unclear whether organisations will persist with multiple AI platforms siloed across different software ecosystems, converge on a single governing platform, or lean more heavily on custom in-house agentic systems to achieve seamless integration. That said, we expect forward-thinking enterprises to increasingly pursue agentic workflows that span the entire organisation, unlocking deeper efficiencies and strategic advantages.

Overall, while still early in the cycle, the foundations for realising substantial value from enterprise AI are beginning to take shape.At AlphaTarget, we invest our capital in some of the most promising disruptive businesses at the forefront of secular trends; and utilise stage analysis and other technical tools to continuously monitor our holdings and manage our investment portfolio. AlphaTarget produces cutting edge research and our subscribers gain exclusive access to information such as the holdings in our investment portfolio, our in-depth fundamental and technical analysis of each company, our portfolio management moves and details of our proprietary systematic trend following hedging strategy to reduce portfolio drawdowns. To learn more about our research service, please visit https://alphatarget.com/subscriptions/.