Quantum computing is emerging as the next frontier in technology and it has the potential to solve problems that today’s computers cannot touch; transforming industries from cryptography to drug discovery. Yet, despite billions invested and headlines touting breakthroughs, practical quantum advantage remains years away. Investors should watch this space carefully but resist the temptation to chase the hype.

This article breaks down the key components of the quantum computing ecosystem, from processors and infrastructure to software and real-world use cases, exploring how investors and business leaders can participate in its growth. We cover the main hardware technologies, supporting infrastructure providers, early commercial applications, current public investment opportunities, risks to watch and some principles for investing in the space.

Understanding quantum computing

Quantum computing is an emerging field in computer science and engineering that leverages the principles of quantum mechanics to tackle problems that exceed the capabilities of even the most powerful classical computers. The field of quantum computing includes a range of disciplines, including quantum hardware and quantum algorithms.

Classical computers, from smartphones to supercomputers, process information using bits (i.e., they are in one of the two states ‘1’ or ‘0’). These computers handle tasks by manipulating bits through logical operations, often in parallel across multiple processors to speed up computations. However, their performance is limited by the need to evaluate solutions step-by-step for complex problems, such as factoring large numbers or simulating chemical reactions.

Quantum computers use quantum bits (qubits), which differ fundamentally from classical bits. Due to a property called superposition, a qubit can represent 0, 1, or a combination of both states simultaneously. This enables quantum computers to process multiple potential solutions at once. Additionally, qubits can be entangled, meaning the state of one qubit is linked to another, allowing coordinated computations that classical systems cannot replicate. These properties make quantum computers potentially far faster for certain tasks such as cryptography, molecular modelling or risk analysis, though they are not universally superior and require specialised algorithms to outperform classical systems.

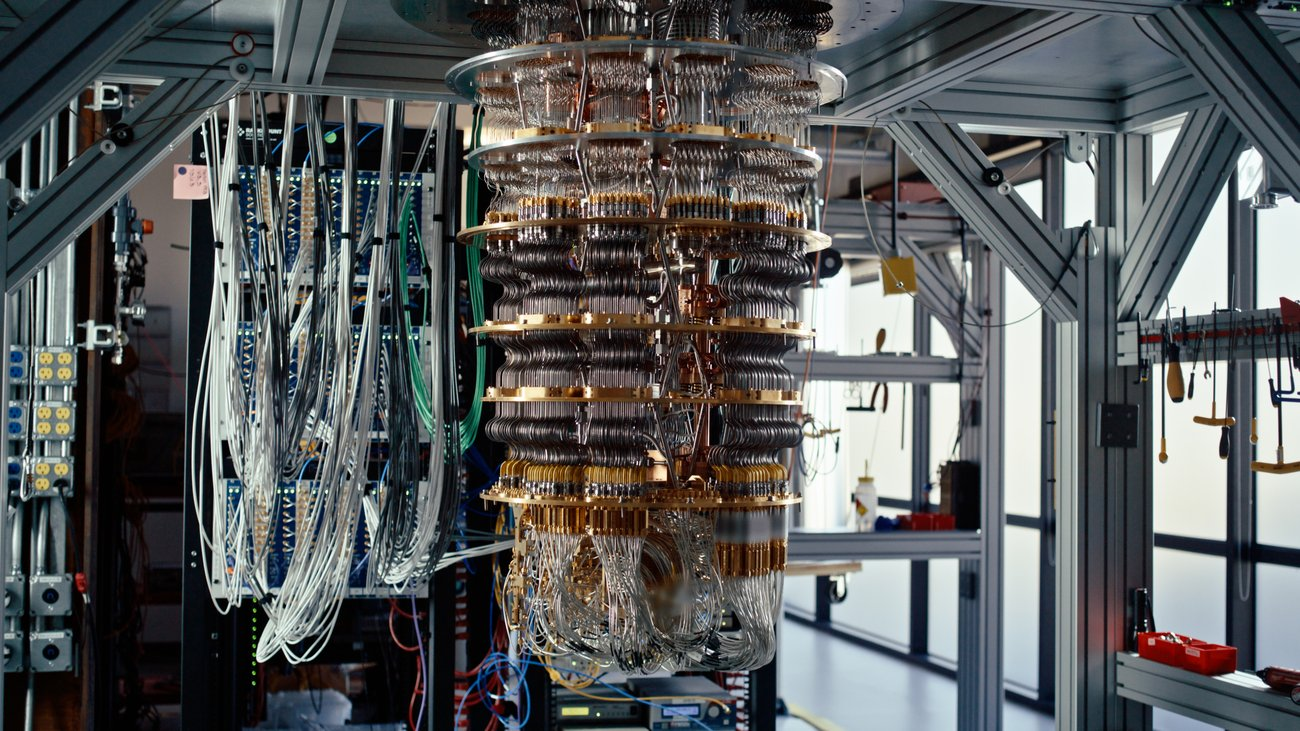

Google’s Quantum AI Lab

Source: Google

Hardware: The core engine

As discussed above, qubits are at the heart of the quantum computing revolution. Unlike bits that are binary, qubits operate using quantum superposition and entanglement, allowing them to represent multiple states simultaneously. A key challenge is that qubits are extraordinarily fragile; the slightest vibration, temperature change, or electromagnetic interference causes "decoherence" (i.e., the qubit loses its quantum properties).

Currently, three main approaches compete to build stable qubits:

- Superconducting qubits (used by IBM, Google, Rigetti): Rely on superconducting circuits at millikelvin (extremely cold) temperatures. Benefits include fast gate speeds and integration with CMOS-compatible fabrication, but they suffer from decoherence (losing quantum properties within microseconds) and scaling issues.

- Trapped ion qubits (IonQ, Quantinuum): Leverage ions suspended in electromagnetic fields. Highly accurate with longer coherence times, but gate speeds are slower and hardware is more difficult to scale.

- Photonic qubits (PsiQuantum, Xanadu): Use photons as carriers of quantum information, promising scalability and room-temperature operation, though achieving reliable operation remains a challenge.

The modalities have different commercial prospects and timelines to scale. Investors should view this like the early days of semiconductors, with multiple competing technologies and no clear winner yet. Rather than focus on one approach, a prudent approach might be to consider companies with strong IP portfolios and proprietary fabrication capabilities. Partnerships with national labs or hyperscalers (e.g., Microsoft + Quantinuum) signal credibility. Furthermore, as discussed in the next section, the picks and shovels of this area might also be worth further investigation.

More than just chips

Quantum computing systems are extremely delicate, and their operation requires a complete redesign of the computing stack. That includes:

- Cryogenic refrigeration: Dilution refrigerators are essential for superconducting qubits, often operating below 15 millikelvin. Bluefors and Oxford Instruments dominate this niche, offering high-margin components with little competition.

- Control and readout electronics: Precise microwave pulses must control each qubit, which requires specialised signal generators and converters. Keysight and Zurich Instruments provide these critical components.

- Quantum interconnects: Low-loss coaxial cables, optical fibre links for photonic setups, and waveguides are all part of the infrastructure.

- Quantum-safe networking: Emerging players are enabling quantum key distribution (QKD) and post-quantum cryptographic protocols to secure classical systems against quantum decryption threats.

- Quantum cloud platforms: Big tech now offers quantum hardware via the cloud. IBM Quantum, Amazon Braket, and Azure Quantum act as intermediaries for enterprises to experiment, without capital-intensive ownership. This "quantum-as-a-service" model generates recurring revenue and lowers barriers to adoption.

Infrastructure suppliers (cryogenics, control hardware and packaging) are cash-flow positive and may see inorganic acquisition from hyperscalers or defence contractors.

Emerging use cases

Quantum computing is poised to augment classical computing by addressing specific use cases more efficiently.

In finance, current risk models can analyse thousands of scenarios. Quantum computers could analyse millions simultaneously, transforming option pricing, arbitrage strategies, risk analytics, and Monte Carlo simulations. For instance, JPMorgan Chase estimated that quantum computers could accelerate Monte Carlo simulations used in derivative pricing models by 1,000 times. Early pilots with banks show promising results.

In pharmaceuticals, quantum computing’s potential to model protein folding, ligand binding, and drug target interactions is expanding rapidly, with partnerships such as Roche collaborating with quantum computing firm Cambridge Quantum. Materials science benefits from quantum-powered molecular simulations that accelerate the discovery of new catalysts, with Chevron and BASF actively investing in this space.

The energy sector looks to quantum computing to optimise power grids, simulate fusion processes, and advance battery chemistry. These efforts are strongly supported by government initiatives focused on achieving net-zero carbon emissions.

Logistics applications include vehicle routing, warehouse optimisation, and scheduling, leveraging hybrid quantum-classical solvers that are gaining traction in the industry.

Finally, cybersecurity is emerging as a critical area for quantum computing technology, focusing on post-quantum cryptography, quantum key distribution, and secure authentication to counteract future quantum decryption threats. This is driven by evolving NIST (National Institute of Standards and Technology) standards and increasing national security interests.

Firms with pilot projects or co-innovation partnerships in these domains are best positioned to capture early revenues, especially those nearing quantum computing advantage in their use cases.

Themes & opportunities

The quantum computing stack is broad, opening up multiple avenues of capital allocation:

- Quantum Computing Hardware Companies: Publicly listed companies include IonQ (IONQ), Rigetti (RGTI), and D-Wave (QBTS). In this space, one ought to monitor product roadmaps versus hype.

- Infrastructure and Tooling Suppliers: Cryogenics (Bluefors), microwave components (Keysight), dilution refrigerators (Janis Research), and control systems (Zurich Instruments). These firms are typically overlooked but benefit from early-stage adoption and defence applications.

- Quantum-as-a-Service (QaaS) Providers: Microsoft Azure Quantum, Amazon Braket, and IBM Cloud are developing pay-as-you-go pricing models. They offer recurring SaaS-style revenue with high customer switching costs.

- Quantum Computing Middleware & Software Tooling: SDKs like Qiskit (IBM), Cirq (Google), and tket (Quantinuum). Compilers, noise mitigation tools, and quantum optimisers are early bets with parallels to early AI tooling stacks.

- Application-Level Startups: While mostly private, those that go public or get acquired will benefit from early proven vertical quantum computing advantage.

The key players

Quantum computing is still in its early innings as a commercial industry, but a handful of companies already exist in the public markets, either as pure plays or through broader technology portfolios. For investors, these companies represent a mix of long-term potential, near-term uncertainty and varying levels of exposure to quantum computing.

IonQ (NYSE: IONQ)

IonQ was the first quantum computing company to go public via a SPAC in 2021 and remains one of the few true “pure plays.” It develops trapped-ion quantum processors, known for longer coherence times and high gate fidelity. IonQ offers hardware access via AWS, Azure, and Google Cloud. It is starting to generate revenue (US$43 million TTM) through quantum-as-a-service and research contracts. Its market capitalisation is US$9.8 billion, reflecting high expectations.

Rigetti Computing (Nasdaq: RGTI)

Rigetti develops superconducting quantum processors and hybrid classical-quantum systems. It builds its own hardware and cloud platform, aiming for vertical integration. Despite operational challenges, it has secured government contracts and research partnerships. TTM revenue is US$9 million and its market capitalisation is US$3.3 billion, reflecting high expectations.

D-Wave Quantum (NYSE: QBTS)

D-Wave focuses on quantum annealing, a specific type of quantum computing best suited to optimisation problems. Its technology is deployed commercially in logistics and manufacturing and is accessible via its Leap cloud platform. TTM revenue is US$21 million and its market capitalisation is US$4.9 billion, reflecting high expectations.

Arqit Quantum (Nasdaq: ARQQ)

Arqit focuses on quantum-safe encryption and security via its QuantumCloud platform. It operates at the intersection of quantum computing and enterprise security, appealing to investors interested in post-quantum cryptography. Revenue is still tiny and the market capitalisation is US$545 million.

Honeywell (Nasdaq: HON)

Though not a pure quantum computing play, Honeywell owns Quantinuum (from Honeywell Quantum Solutions and Cambridge Quantum). Quantinuum develops trapped-ion systems and middleware/encryption tools, offering indirect quantum computing exposure.

IBM (NYSE: IBM)

IBM is a pioneer in quantum computing R&D, offering superconducting qubit systems via IBM Quantum and an open-source software development kit (Qiskit). Its roadmap targets scaling to thousands of qubits and integrating quantum computing with cloud services.

Alphabet (Nasdaq: GOOGL)

Google’s Quantum AI group has made landmark achievements, including controversial but significant quantum computing supremacy claims. For instance, the company’s 105-qubit Willow chip (unveiled in December 2024) is said to perform a random circuit sampling task in under five minutes, which Alphabet estimates would take a supercomputer 10 septillion (10^25) years. Critics argue the task lacks practical use and classical algorithms may close the gap. While experimental, Google’s quantum computing efforts are part of its broader innovation portfolio.

NVIDIA (Nasdaq: NVDA)

Not a quantum computing hardware company but an enabler through GPU-based quantum simulators and hybrid classical-quantum infrastructure like cuQuantum. NVIDIA represents a “picks and shovels” investment in the quantum computing ecosystem.

Challenges & risks

Even though quantum computing appears to have a long growth runway, investors must approach this area with realistic expectations:

- Scalability limits: Many architectures remain under 100 qubits; fault-tolerant systems require thousands.

- Error correction overhead: Surface code error correction demands 1,000+ physical qubits per logical qubit.

- Hardware fragility: Qubits are sensitive to noise, vibrations, and temperature fluctuations.

- IP uncertainty: Overlapping patents and licensing disputes may slow innovation.

- Geopolitical tension: Quantum computing is a national security priority for the US, China, EU, and UK. Export controls and regulations could impact deals.

- Time-to-profitability: Many firms may take 5–10 years before they generate meaningful cash flows and profits.

In our view, in many ways quantum computing is similar to biotechnology, with potentially highly binary outcomes and long timelines.

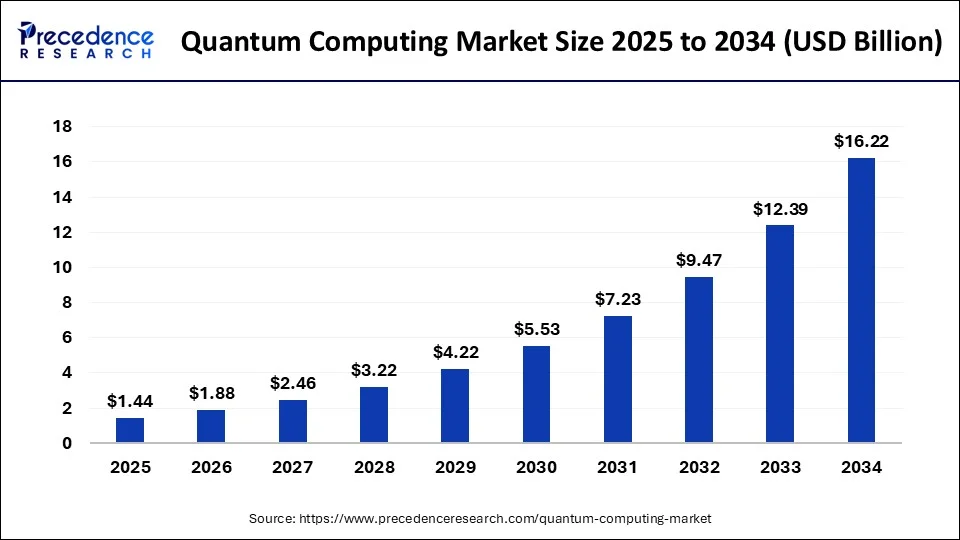

Sizing the opportunity

Beyond the technology and individual companies, the potential growth of the quantum computing opportunity demands attention. As shown in Figure A, Precedence Research projects that the quantum computing market will reach US$16.22 billion by 2034 from US$1.44 billion today, representing a compound annual growth rate (CAGR) of 31%. North America accounted for US$1.1 billion in 2024, and is expected to expand at a CAGR of 31% during the forecast period.

Figure A: Quantum Computing - long growth runway

Source: Precedence Research

Over the longer term, McKinsey & Company estimates that the quantum computing market could be worth US$45 billion to US$131 billion by 2040.

This opportunity spans multiple sectors. In pharmaceuticals, quantum modelling may significantly accelerate drug discovery and personalised medicine, unlocking billions in R&D productivity. In finance, faster and more accurate risk modelling, arbitrage, and portfolio optimisation are poised for major transformation. In materials science and energy, the simulation of atomic structures and chemical reactions could lead to breakthroughs in battery technology, sustainable fuels, and next-generation industrial catalysts.

Adjacent markets like quantum-safe cybersecurity, cloud-delivered QaaS platforms, and hybrid high-performance computing infrastructure further broaden the potential. In addition, government investment, including multibillion-dollar national quantum computing initiatives across the U.S., China, EU, and others, provides a baseline of funding that de-risks early-stage development.

For investors, this means that quantum computing could turn out to be a platform shift on par with classical computing, cloud and AI; opening the door to high returns for those who time the inflection point correctly.

Conclusion

Quantum computing stands at the threshold of reshaping global industries, from finance and pharmaceuticals to energy and logistics. The real economic opportunity lies not just in building quantum computers, but in constructing the infrastructure and software that enable scale. The best investments will combine long-term vision with near-term validation, and reward those who position capital accordingly.

Key considerations for investors include recognising that infrastructure returns often come early; while hardware may take years to generate meaningful ROI, companies providing essential tools, cryogenics, and quantum-as-a-service platforms are already producing cash flow. Valuing quantum computing companies requires a hybrid approach, measuring technical milestones such as qubit count and fidelity, intellectual property strength, customer pilots, and partnership depth alongside traditional fundamental metrics. Mid-layer enablers like refrigeration, signal control, and middleware SDKs appear to be underpriced, offering “picks and shovels” opportunities with less hype but stronger customer entrenchment.

This market is akin to investing in AI infrastructure circa 2015, as it is still in the pre-explosion phase. Just as Nvidia and TSMC capitalised on the AI boom by supplying foundational infrastructure, quantum computing infrastructure players may also drive the next wave of computational transformation.

At AlphaTarget, we invest our capital in some of the most promising disruptive businesses at the forefront of secular trends; and utilise stage analysis and other technical tools to continuously monitor our holdings and manage our investment portfolio. AlphaTarget produces cutting-edge research and our subscribers gain exclusive access to information such as the holdings in our investment portfolio, our in-depth fundamental and technical analysis of each company, our portfolio management moves and details of our proprietary systematic trend following hedging strategy to reduce portfolio drawdowns. To learn more about our research service, please visit alphatarget.com/subscriptions/.