“We are also on the cusp of something really tremendous with Optimus, which I think is likely to be, has the potential to be, the biggest product of all time.”

Elon Musk, Tesla CEO, Q3 2025

Introduction

Over recent years, humanoid robots have made tremendous progress driven by advances in hardware and AI. Dozens of companies have entered the space and several are now moving from proof of concept toward mass production. The goal is to build machines that can take on physical labour, performing the dull, dangerous and dirty tasks that humans would rather avoid, both in factories and in households. If this vision can be achieved, many founders and analysts alike expect that over the long run there will be billions of humanoids on the planet, becoming as ubiquitous as cars and smartphones.

Yet the path ahead remains full of challenges. Most notably, general robotics has not yet been solved. Although today’s humanoids can perform demonstrations that look impressive, from dancing to doing backflips, they still struggle with tasks humans find trivial such as folding clothes. They also lack the general adaptability needed to operate reliably in unfamiliar environments. Ultimately, the ability to carry out practical real-world tasks while adapting to changing conditions and requirements will determine how widespread and impactful these robots can become.

In this note we first discuss the benefits of general-purpose humanoids and compare them with specialised robots. We then profile three prominent players in the space: Tesla, 1X and Figure AI. Next we examine the challenges humanoids must overcome to become truly general-purpose and reach scale. Finally, we outline the size of the opportunity and discuss how the emerging humanoid market could evolve.

The case for humanoid robots

There has long been debate over why general-purpose humanoids are needed when specialised machines can often perform individual tasks better. We agree that in many cases specialised robots will be superior and they are not going away. However, many of the tasks that need to be performed are varied, intermittent and carried out in conditions that change from moment to moment. Humans are still far better suited to this kind of dynamic work and that is exactly the type of role a humanoid is designed to take on.

A useful comparison is the smartphone, which combines voice calls, photography, gaming, payments and email into one device rather than relying on separate specialised equipment. While dedicated equipment might outperform it in specific areas, most people prefer the convenience of a single, versatile device over carrying multiple specialised ones.

Versatility can also be a direct advantage for certain tasks. For example, a robot vacuum cannot move a chair to clean under a table, whereas a humanoid can. In such scenarios the general-purpose solution is not only more convenient but also more capable.

Compared to specialised robots, humanoids can also be produced in much higher volumes given the potential demand, benefiting from economies of scale through in manufacturing and supply chains. Greater scale also spreads R&D costs across more units, driving down overall unit costs.

The human form factor is also an advantage. Most physical environments are designed around human proportions, so humanoids can naturally operate equipment and move through spaces built for people. In addition, the human form factor is far easier to train. Humanoids can learn directly from human demonstrations, including motion capture data, which provides high-quality examples of how tasks should be performed. Other form factors lack a human equivalent to learn from, making training significantly more difficult.

Tesla – Optimus

“Optimus, I think, probably achieves five times the productivity of a person per year because it can operate twenty-four seven.”

Elon Musk, Tesla CEO, Q3 2025

Optimus is Tesla’s humanoid robot and today roams parts of the company’s headquarters unsupervised. Musk has said it can guide visitors through the building and already performs some tasks inside Tesla’s factories. Optimus 2.5 was also publicly showcased at the Tron premiere in October 2025 where it demonstrated Kung Fu.

Figure 1: Optimus 2.5 doing Kung Fu at the Tron premiere in October 2025

Source: Youtube – DPCcars

It is difficult to know exactly how Optimus compares with its peers, as the field is currently in a fog of war. Afterall, most humanoids are not yet deployed widely in the real world and companies in the sector remain highly secretive about their latest capabilities. Many demonstrations rely on varying levels of teleoperation, which makes it hard to assess what is truly autonomous. Musk has commented that at least one of Optimus’s Kung Fu demonstrations was AI-driven rather than teleoperated, although the limited transparency in the sector still makes broader comparisons challenging.

Despite this limited transparency, Tesla remains widely regarded as a frontrunner in the humanoid race. Early investors and industry veterans with inside access to multiple projects consistently rank Tesla highly on technical grounds, even though their visibility is still partial. Additionally, Tesla’s extensive real-world AI experience, strong electrical and mechanical engineering capabilities and considerable manufacturing scale give the company a credible path to solving the field’s twin challenges of intelligence and manufacturing. Tesla is also well capitalised and led by a founder with an exceptional track record of tackling hard problems and creating value.

Tesla is now working on Optimus 3, which Musk describes as a giant improvement over Optimus 2.5. He has said they will probably unveil a production prototype in Q1 2026 and that it will seem like a person in a robot suit with agility roughly equal to an agile human. Scale production is now aimed to start at the end of 2026, though it will take a while to ramp up production.

“Optimus at scale is the infinite money glitch.”

Elon Musk, Tesla CEO, Q3 2025

The medium and long-term targets are highly ambitious. Optimus 3 is aimed at reaching 1 million units per year before 2030 at a target cost of less than US$20,000. Optimus 4 is planned to reach 10 million units annually with production starting in 2027. Optimus 5 is planned to reach 50-100 million units annually with production starting in 2028. Musk expects that humanoids will eventually account for 80% of Tesla’s value in the long run.

1X – Neo

A dark horse in this space is 1X, which was founded in Norway in 2014 and later relocated its headquarters to Palo Alto. In 2023 it raised US$23.5 million in a Series A2 round led by OpenAI, followed by a US$100 million Series B in 2024. It is now reportedly seeking a further US$1 billion, according to The Information.

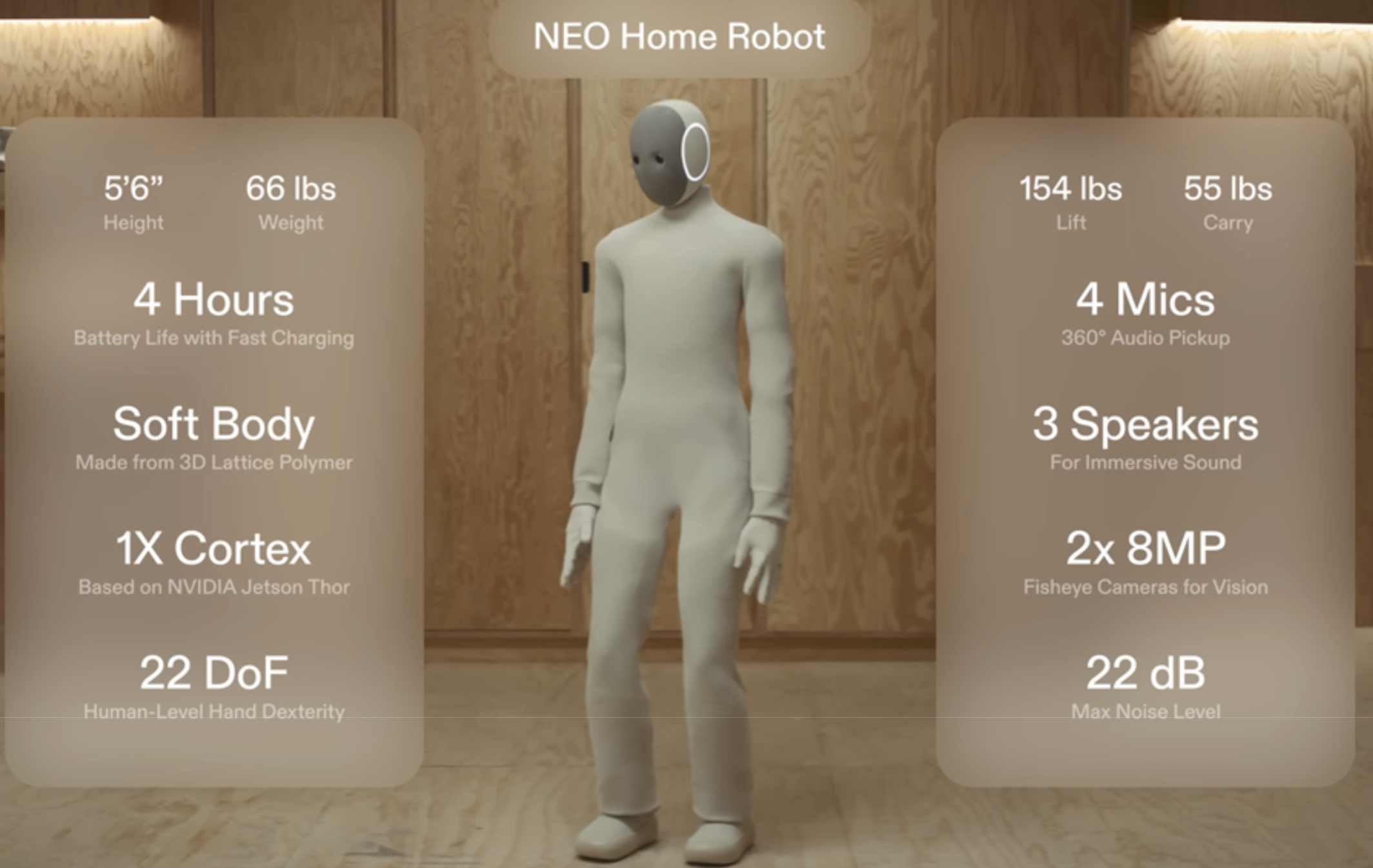

Figure 2: Neo Home Robot by 1X

Source: 1X

1X gained considerable attention in October 2025 when it announced early-access pre-orders for its home robot, Neo. This is a lightweight humanoid designed to help with chores and act as a companion, allowing users to ask questions such as where they last left their keys. US deliveries are set for 2026, with early access priced at US$20,000 or US$499 per month.

Unlike most competitors, which target more industrial settings, 1X’s focus on households presents greater safety challenges and far more environmental complexity. The company’s rationale for this, however, is that it believes consumer products scale much faster and that the variety of environments will deliver richer data, helping Neo improve more quickly.

Neo’s design centres on safety and lightness. Its finger strength matches that of a human, which is by design, because if it was excessively strong it would lose sensitivity. Instead of using traditional gear-based mechanisms commonly found in most robots, 1X has developed a proprietary actuation system called Tendon Drive, which uses high-torque motors pulling synthetic tendons inspired by biological muscles. This patented system enables smooth, quiet and safe movements while keeping the robot lightweight. It also makes the robot simpler and cheaper to produce, which has enabled 1X to already be able to manufacture Neo at an affordable cost.

Coinciding with the Neo launch announcement, the Wall Street Journal released a video interview with CEO Bernt Øyvind Børnich, showing Neo performing basic home tasks. It took around one minute to fetch a glass of water and roughly five minutes to load three items into a dishwasher. However, all demonstrations were revealed to have been conducted using teleoperations, where a human was in the loop helping the robot operate and make decisions. The video triggered an online backlash, as many felt the announcement was overhyped given Neo was not yet capable of acting autonomously.

“So when you get your Neo in 2026, it will do most of the things in your home autonomously. The quality of that work will vary and will improve quite fast as we get data.”

Bernt Øyvind Børnich, 1X CEO, October 2025 (WSJ)

Børnich explained however that the model shipping in 2026 will be more advanced than the one shown in the interview and mostly autonomous. Nevertheless, it will still rely to some degree on teleoperation or assistance from the owner’s voice commands for more challenging tasks. This will enable the robot to learn. Børnich reiterated that the version shipping in 2026 is meant for early adopters who understand the product is not perfect but insisted it will quickly become very useful. He has also noted that the Neo unit currently in his own home can autonomously retrieve a Coke from the fridge successfully around 50% of the time.

By 2027, 1X aims to ship 100,000 units, by which time Børnich expects Neo to be fully autonomous with no human in the loop. By 2028, he expects shipments to reach 1 million units, which is even more ambitious than Tesla’s target for Optimus 3.

Figure AI – Figure

Despite being founded in 2022, US-based Figure AI is already considered one of the frontrunners in the humanoid race. In September 2025, it raised over US$1 billion in a Series C round at a US$39 billion valuation with backers such as Nvidia, Qualcomm and Salesforce.

Figure 3: Evolution of Figure humanoids (Dreamforce 2025)

Source: Salesforce – Dreamforce 2025

Figure has also secured a notable commercial agreement. In January 2024 it signed a deal with BMW to bring its robots into automotive production. Reporting has been mixed on how much useful work the robots have actually been doing since the announcement. However, CEO Brett Adcock recently said that a robot has been operating autonomously for 10-hour shifts over the past five months and has now reached operational readiness.

Adcock had initially planned to focus on commercial/industrial applications before tackling domestic use. Over the past year however, his view has shifted and he now sees the home as a solvable challenge within a few years, possibly by 2026. He also insists they will not go to market using “silly” teleoperations like his competitors. Adcock also emphasised that adding a consumer focus will not come at the expense of their commercial efforts.

Currently, the company is on its third humanoid iteration, Figure 03, which was revealed in October 2025. In a Time profile, they witnessed Figure 03 successfully load items into a dishwasher but struggled with folding T-shirts. However, handling clothes and towels is one of the harder challenges for humanoids, given that fabric changes form upon interaction.

Unlike its predecessors, which were experimental prototypes, Figure 03 is engineered with cost and high-volume manufacturing in mind. Figure’s dedicated manufacturing facility, BotQ, will initially be able to produce around 12,000 robots annually, with a goal of producing 100,000 units in total over the next four years.

Challenges ahead

“You have to … be able to like just talk to it and have it do anything you’d want it to do in unseen locations. That problem is not solved. That problem is 10 times, 50 times, 100 times harder than making a humanoid robot.”

Brett Adcock, Figure AI CEO, October 2025 (Nvidia GTC)

Despite humanoids seeing tremendous progress in recent years, major challenges remain. One persistent issue is the supply chain, as many of the components needed to build an advanced humanoid simply did not exist. This includes powerful motors, specialised sensors and more broadly, components with the durability to withstand continuous operation for many years.

Because a broader ecosystem has never really formed, companies have had to develop and manufacture a large portion of components themselves, forcing heavy vertical integration across the industry. As a result, humanoid companies are effectively building their own supply chains from scratch, a constraint that is likely to weigh on the industry for some time.

A further challenge is building a useful robotic hand and forearm. Several founders have highlighted that the hand is the hardest part of the humanoid to design because humans rely on them for almost every task and they require a huge range of precise, coordinated movements. Without a truly capable hand, even advanced humanoids will struggle with a wide range of basic tasks.

Beyond hardware, humanoid robots also face regulatory uncertainty, particularly for domestic applications. Governments will need to establish safety standards, liability frameworks and potentially certification processes before widespread home deployment can occur. Data privacy and cybersecurity present further concerns as robots with cameras, microphones and internet connectivity operating in homes could become targets for hacking or surveillance, raising questions that manufacturers have yet to fully address publicly.

Perhaps the most significant challenge, however, is developing general-purpose robotic systems. Adcock views this as the primary bottleneck, far outweighing manufacturing constraints. A key limitation today is the scarcity of high-quality real-world data for training, which companies are now trying to address in different ways. Figure plans to allocate much of its recent US$1 billion funding to hiring humans for first-person video data collection, while 1X intends to gather much of its data from its early-access Neos shipping in 2026.

However, experts question whether feeding models more data alone will suffice. Meta’s Chief AI Scientist and renowned ML expert, Yann LeCun, has warned that current approaches may excel at specific tasks but fall short of true generality (the ability to handle open-ended tasks and unfamiliar situations) without fundamental breakthroughs:

“The big secret of the industry is that none of those companies has any idea how to make those robots smart enough to be useful. Or I should say, smart enough to be generally useful.”

Yann LeCun, Meta Chief AI Scientist, October 2025 (MIT)

Legendary programmer John Carmack echoes this scepticism:

“I am more skeptical than a lot of people in the tech space about the near term utility of humanoid robots. Long term, driven by AGI, sure, they are going to be an enormous economic engine, but business plans that have them making a dent in the next five years seem unlikely.”

John Carmack, November 2024 (X)

The founders themselves remain more optimistic. Musk has highlighted a potential breakthrough threshold that he thinks Tesla can achieve, where Optimus would learn new tasks simply by watching YouTube or how-to videos, much like a human. Meanwhile, Adcock and Børnich believe fully autonomous general-purpose humanoids are just two years away. Time will tell whether more data can overcome today’s limits, or if progress stalls until deeper AI breakthroughs arrive.

The humanoid market

“There will be more humanoids on the planet than there are people. There’s absolutely no doubt about that. At least everyone wants a humanoid, but you want way more than that.”

Bernt Øyvind Børnich, 1X CEO, October 2025 (The Casey Adams Show)

CEOs of humanoid companies forecast massive TAMs, expecting billions of units in the long run. Adcock sees this as a roughly US$40 trillion opportunity, essentially all the labour in the current global economy. These companies attribute this scale to broad adoption across many sectors, from industry to the home, driven by the promise of cheap, flexible labour. Demand will also be supported by the ageing population, as labour shortages intensify and humanoids are needed to assist with elderly care.

Yet ubiquity will take time. Even if general-purpose humanoids arrive tomorrow, creating the infrastructure to manufacture billions of units will be challenging and likely encounter multiple issues that need to be solved. This includes potential regulatory hurdles and component shortages (e.g. chips). Additionally, most consumers currently cannot afford a US$20,000 robot and therefore prices would need to come down or income per capita would need to rise substantially.

Morgan Stanley estimates that by 2050 there will be nearly 1 billion humanoids, with 90% in industrial and commercial use cases, representing a US$4.7 trillion market.

Figure 4: Long-term forecast of humanoid revenue

Source: Morgan Stanley Research

This is similar to Bank of America’s forecast, which expects just over 1 billion humanoids by 2050 and 3 billion by 2060. However, unlike Morgan Stanley, it expects household robots to make up the majority of units. This reflects the uncertainty of how the industry will evolve.

Figure 5: Long-term forecast of humanoid units

Source: Bank of America Research

“What matters is shipping a product at scale that can generate the data to increase intelligence and reduce cost. That’s who wins in my mind. Like who’s the first through a million robots in market? That’s a big marker that will help determine like the leader.”

Brett Adcock, Figure AI CEO, November 2025 (WTF Online – Nikhil Kamath)

What also remains unclear is the future market structure, whether it will be fragmented or dominated by a few players. Many factors will shape the outcome, though one key factor could be a data moat. Adcock has argued that humanoid robotics could become a natural monopoly, as each additional robot deployed generates real-world data that improves all others. This creates a powerful flywheel: the leader in deployed units gains a growing data advantage, enabling smarter robots, driving more sales and widening the gap with competitors.

Yet this outcome is not guaranteed, as it depends on whether additional data continues to yield meaningful improvements or eventually flattens out. Future models may also require less data to learn, which could reduce the advantage of scale.

“We are not in a race against China… it doesn’t matter if China makes a million humanoid robots tomorrow. They just don’t work very well to be frank.”

Brett Adcock, Figure AI CEO, November 2025 (WTF Online – Nikhil Kamath)

Geographic leadership is also debated. Many have argued that China will have a distinct advantage due to its manufacturing capacity. Adcock downplays this, arguing that Chinese humanoids are nowhere near Figure’s capabilities and that manufacturing is not the main bottleneck. He also argues that manufacturing robots will be significantly easier than manufacturing cars as he sees humanoids as being more akin to consumer electronics products.

However, Tesla’s own well-documented manufacturing challenges with vehicles, despite Musk’s expertise, and acknowledging the complex nature of humanoid systems, suggests that scaling production to millions of units annually may prove more difficult than Adcock anticipates, particularly given the need for vertical integration across novel supply chains.

Ultimately, we see humanoid robots becoming a multi-trillion-dollar market, but forecasting unit volumes or market share with any precision remains difficult given the uncertainty around future AI breakthroughs. However, much of the current fog of war should begin to lift in 2026 as companies move from prototypes into mass production and robots start appearing more frequently in real-world settings. At that point, we will gain a clearer sense of how the market is likely to evolve.

Conclusion

Humanoid robotics stands on the brink of shifting from science fiction to economic reality. The abundance of cheap labour would be transformative to the global economy, substantially reducing the cost of goods and services, with some like Musk believing it could even abolish poverty. Yet the path ahead remains steep and uncharted. True general-purpose autonomy is still unsolved and the manufacturing challenge will be immense. However, the companies leading this charge are well capitalised and technically formidable. Over the next five to ten years, humanoid robotics will likely be one of the most exciting fields in technology, with rapid iteration and fierce competition that could ultimately give rise to the next generation of economic giants.

At AlphaTarget, we invest our capital in the most promising disruptive businesses at the forefront of secular trends; and utilise stage analysis and other technical tools to continuously monitor our holdings and manage our investment portfolio. AlphaTarget produces cutting-edge research and our subscribers gain exclusive access to information such as the holdings in our investment portfolio, our in-depth fundamental and technical analysis of each company, our portfolio management moves and details of our proprietary systematic trend following hedging strategy to reduce portfolio drawdowns. To learn more about our research service, please visit alphatarget.com/subscriptions/.

In 2025, the autonomous vehicle (AV) race accelerated sharply. Waymo’s weekly rides increased more than fivefold in just under a year, putting it neck and neck with China’s Apollo Go in cumulative autonomous miles. Meanwhile, Tesla launched its robotaxi pilot mid-year and is currently gearing up for mass production of its Cybercab, targeting 2 million units annually.

In our previous note, Driving Towards Autonomy (2024), we provided a primer on the autonomous vehicle space. This report builds on that foundation, examining key developments over the past year. We explore the surge in autonomous ride-hailing, expanding partnerships, unit economics and why we believe the AV sector is now at an inflection point.

Autonomous ride-hailing surge

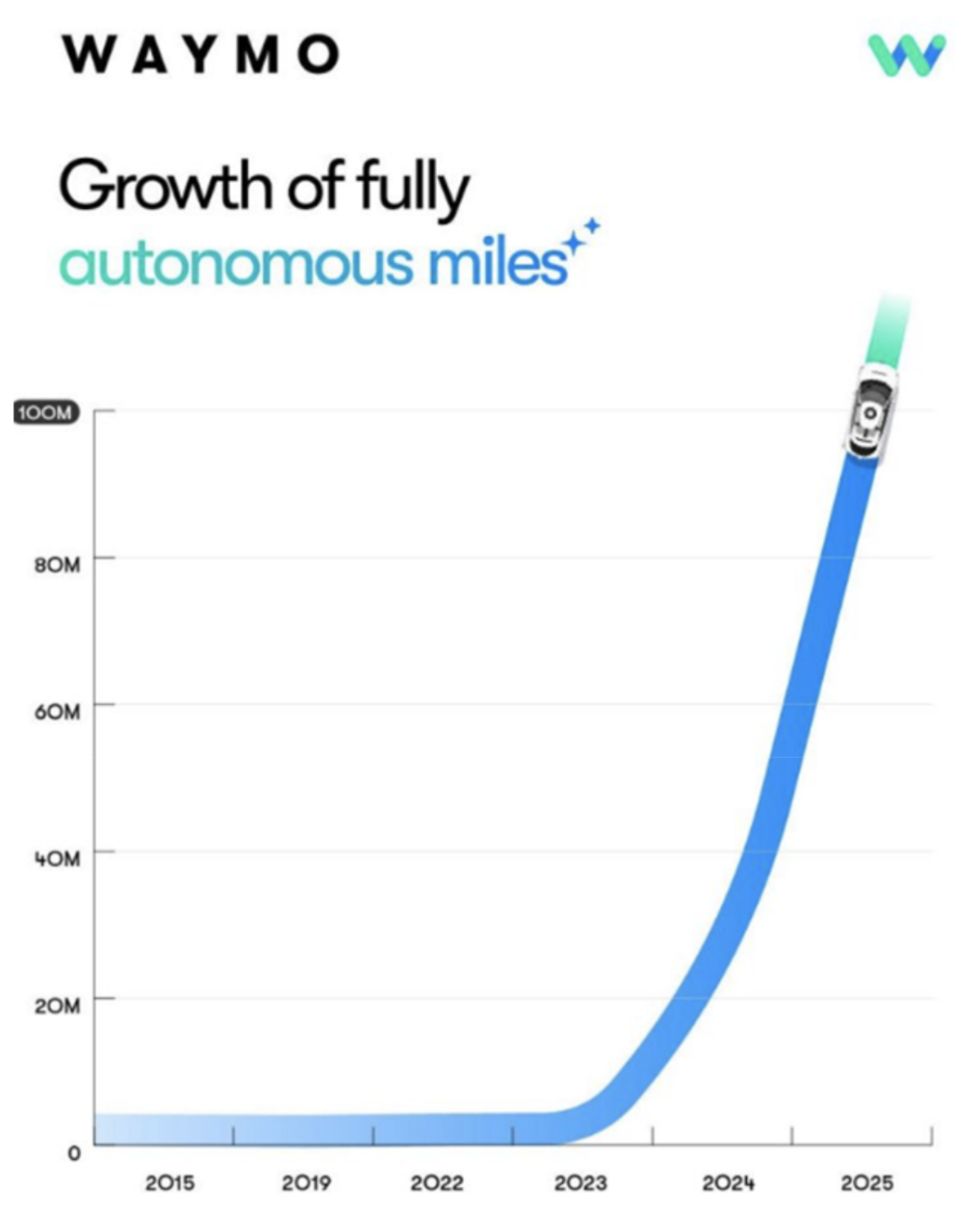

Ride-hailing has seen strong momentum over the last 12 months. Waymo’s cumulative autonomous miles reached 100 million in July 2025 (Figure A), supported by more than 250,000 trips per week across five major US cities and a fleet of over 1,500 vehicles.

Figure A. Waymo’s cumulative autonomous miles

Source: Waymo, X

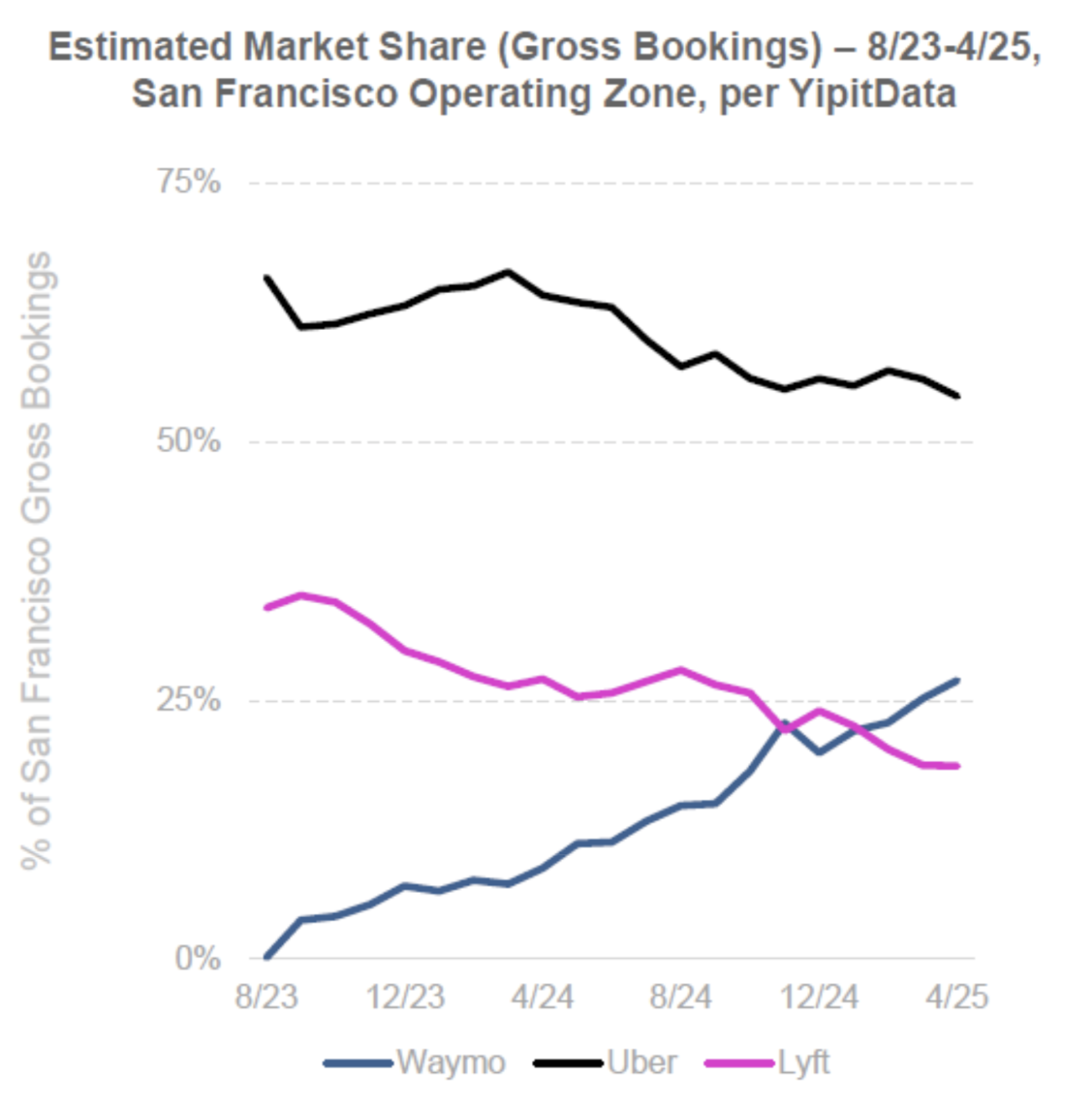

Waymo has also taken market share from other ride hailing services, surpassing Lyft in San Francisco in late 2024 (Figure B). Waymo now plans to add an additional 2,000 Jaguar I-PACE vehicles in 2026 and expand its services to more cities. Additionally, their new integration plant in Mesa, announced in May 2025, is expected to be capable of building tens of thousands of fully autonomous Waymo vehicles per year when fully operational.

Figure B. Waymo market share versus competitors in San Francisco

Source: Bond, Trends – Artificial Intelligence 2025

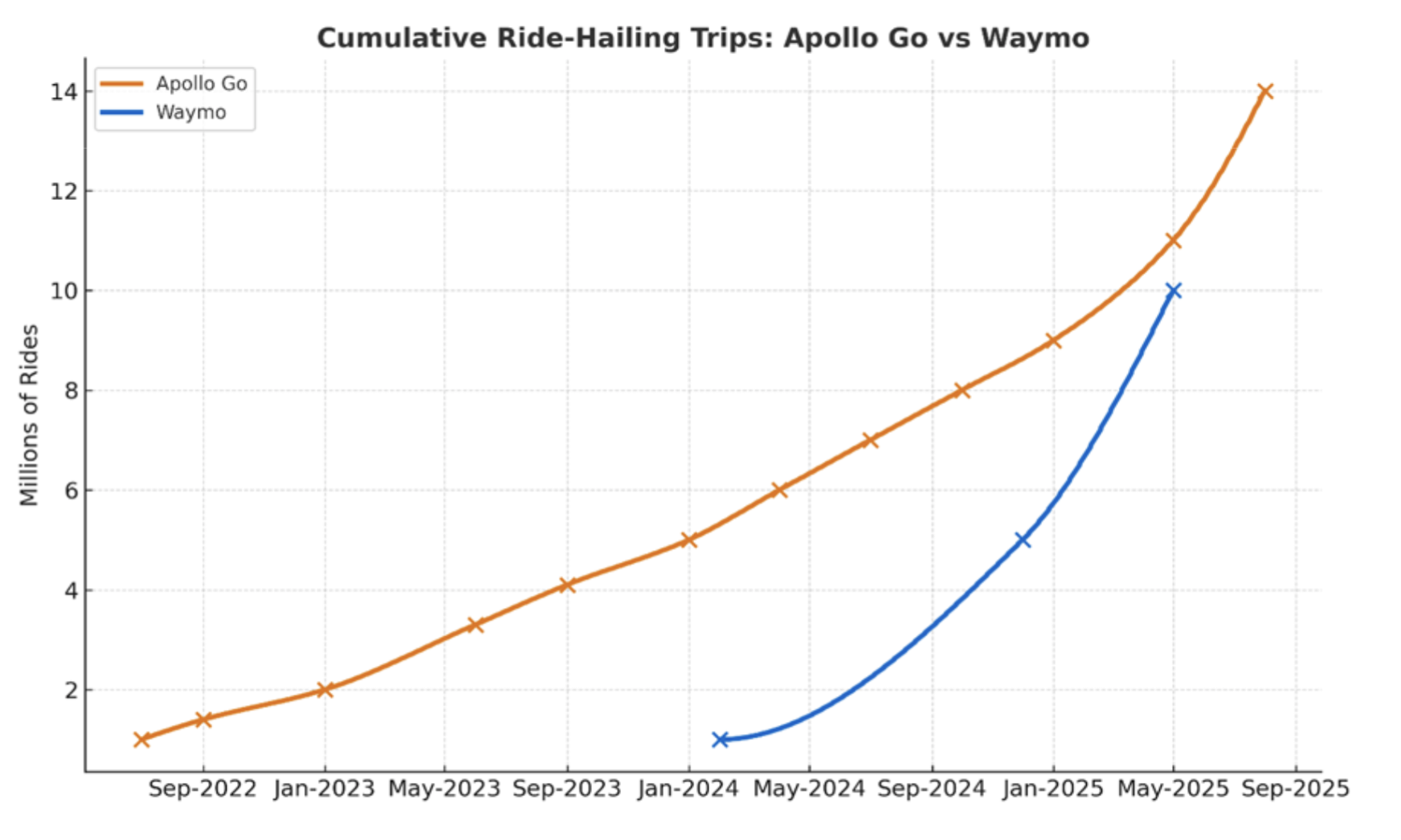

Chinese autonomous mobility companies have also made strong progress, led by Baidu’s Apollo Go, often described as the Waymo of China. As of May 2025, Apollo Go had completed 11 million cumulative ride-hailing trips, slightly ahead of Waymo’s 10 million at the same time (Figure C). In Q2 2025 alone it delivered 2.2 million rides, representing 148% year-on-year growth. Since February 2025, Apollo Go has been operating fully driverless across China with no safety drivers and now serves 16 cities globally.

Figure C. Ride-Hailing Trips: Apollo Go versus Waymo

Sources: Waymo, Baidu, AlphaTarget

Technology, safety and scaling

Two main architectures have emerged in the autonomous race. Waymo, along with most peers, have adopted a multi-sensor fusion approach, typically combining cameras, LiDAR and radar with high-definition (HD) maps built in advance for each city. These detailed maps (lanes, signs, kerbs, crossings), which can provide centimeter-level accuracy, enable the vehicle to localise precisely. Typically, these services run in geo-fenced areas with precise mapping and good network coverage, with the latter facilitating remote tele-operation as required.

Tesla, by contrast, uses primarily cameras with an end-to-end neural-network approach and does not use HD maps for localisation. Note that both approaches use maps for navigation and routing, but Waymo and similar architectures depend on pre-built HD maps to precisely localise the vehicle and validate its sensor-based perception, while Tesla’s system determines position and driving decisions directly from camera feeds, supplemented by a microphone for detecting emergency sirens.

Waymo’s approach offers strong redundancy and precise localisation, which underpins proven commercial deployments. Waymo has also published data showing its vehicles are safer than the average human driver across several key metrics in the areas where it operates, with ‘91% fewer serious injury or worse crashes’ (Figure D). According to a TIME article in June 2025, Waymo’s Director of Field Safety, Matthew Schwall, believes the company’s autonomous vehicles are technically capable of operating safely in any American town, but widespread rollout depends on building local infrastructure and public trust.

Figure D. Waymo safety data

Source: Waymo

However, Waymo’s vehicles are still far from perfect drivers. There have been numerous reports of unpredictable behaviour, such as unexpectedly stopping in traffic. A Reuters article in August 2025 highlighted a Waymo driving into a flood and the passenger had to find a way out. Police said if the person had died, it could have led to a “serious criminal incident”. This highlights that the technology still needs refinement and has not quite yet reached the performance levels needed for widespread deployment. Additionally, the need to map out each new territory in incredible detail before autonomous operations has raised questions about its ability to scale at a meaningful pace. That said, Waymo is making progress on this front, with their 6th generation vehicle “on track to begin operating without a human behind the wheel in about half the time”.

“Once we can make it basically work in a few cities in America, we can make it work anywhere in America. Once we can make it work in a few cities in China, we can make it work anywhere in China.”

Elon Musk, Tesla CEO (Q1 2025)

One of the benefits of Tesla’s approach is that fewer sensor types simplify hardware and lower costs. The approach is also more generalisable because it does not require detailed mapping before it expands to a new city. Tesla has taken the route of rolling out its autonomous technology as an Advanced Driver Assistance System. Thus, Tesla’s customers are able to use its Full Self Driving (Supervised) solution and report back on interventions, which allows the company to iteratively improve its generalised autonomy solution. Tesla thus also has orders of magnitude more data than other autonomous mobility players given its large existing fleet, allowing it to capture a long-tail of scenarios. Its vertical integration also means it can iterate and optimise faster.

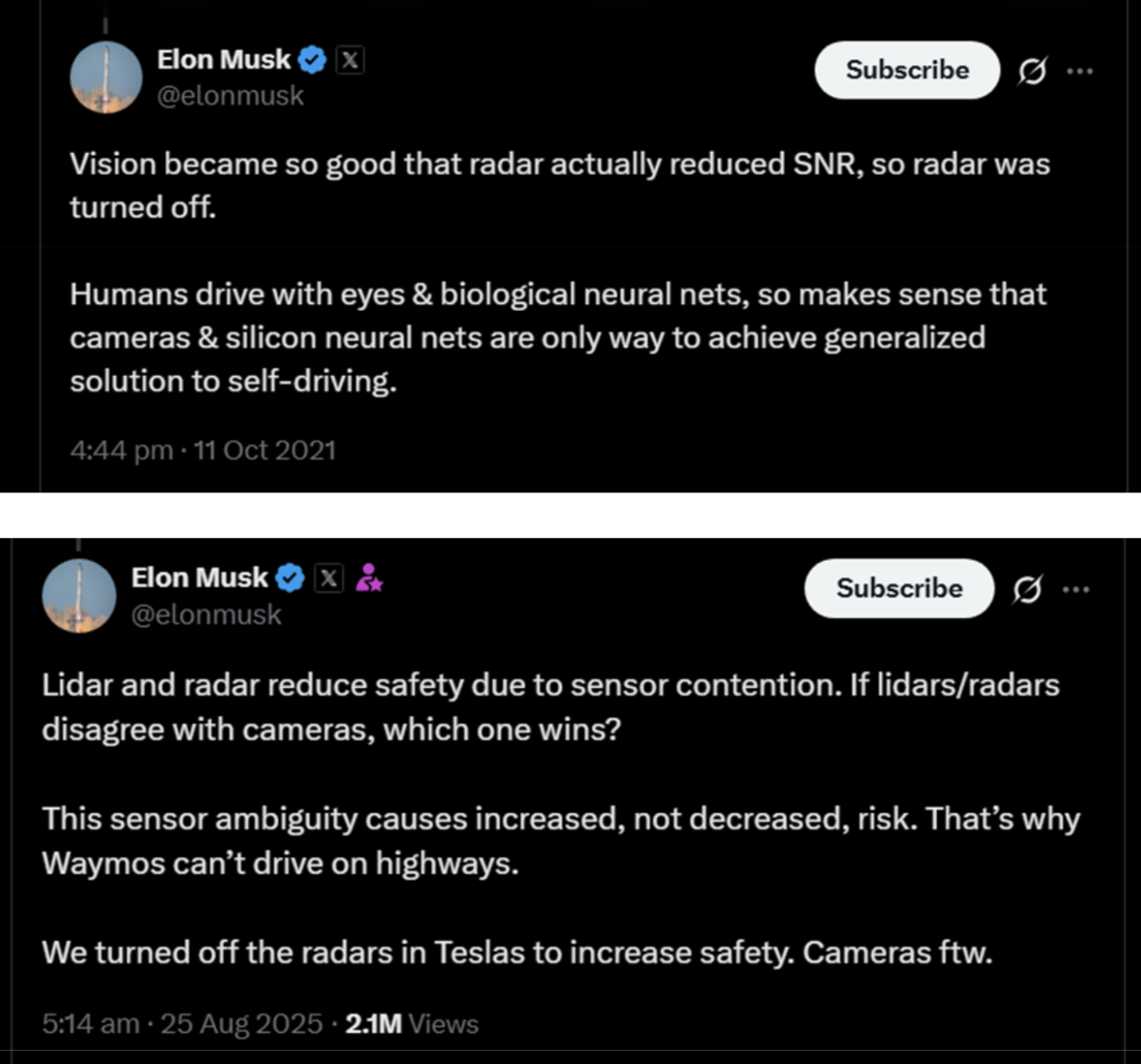

“LiDAR is a fool’s errand, and anyone relying on LiDAR is doomed”

Elon Musk, Tesla CEO (April 2019)

Many, however, question whether a camera-only system can meet the safety threshold for driverless operations. Musk argues that a multi-sensor approach increases complexity, potentially reducing signal-to-noise ratio (Figure E). Tesla’s “photons to control” approach utilises raw camera feeds, with their high dynamic range providing rich visual information, for both model training and inference at run-time.

Figure E. Elon Musk’s posts on autonomous technology

Source: X

In June 2025, Tesla soft-launched its robotaxi service in Austin, with many riders reporting that the vehicles felt smoother than Waymos (e.g. fewer instances of phantom braking). However, the rollout is at a very small scale and by invitation only, so it is likely that participants were to some extent biased. Additionally, there were safety monitors in the passenger seat, though Musk has said these will be removed by the end of the year.

Musk has also outlined exceptionally ambitious scaling targets. On the Tesla Q2 2025 earnings call, he stated that he expects the number of autonomous vehicles in operation to grow at a hyper-exponential rate and projected that Tesla would offer autonomous ride-hailing to half the US population by the end of the year. He has also previously said that its new Cybercab vehicle, designed for ride-hailing, is targeted for volume production in 2026, targeting 2 million units per year and potentially 4 million at full scale. These targets illustrate the scale of Tesla’s ambition relative to its peers, who generally speak in terms of thousands of units rather than millions.

Currently, the jury is still out on which approach will ultimately prove superior. Tesla must demonstrate it can safely operate its robotaxis without safety monitors and show it can scale meaningfully, even if not fully to its most ambitious targets. Meanwhile, Waymo will need to refine its technology to reduce occasional unpredictable behaviour and improve the efficiency of scaling operations over time. Both companies face critical milestones and the path to broad autonomous adoption will hinge on how well each can meet these challenges.

Expansion via partnerships

“Leveraging our partners’ local market presence, we can accelerate market entry across different continents and achieve faster deployment while maintaining a cost-efficient asset-light business model.”

Robin Yanhong Li, Baidu CEO (Q2 2025)

To accelerate deployment, autonomous driving companies are increasingly forming partnerships with established ride-hailing services and automotive players. In the US, Waymo continues to collaborate with both Uber and Lyft across multiple cities, integrating its autonomous vehicles directly into their ride-hailing apps. In Japan, Waymo announced a partnership in late 2024 with taxi platform GO and operator Nihon Kotsu, where vehicles will initially be manually driven in Tokyo to refine local performance before autonomous operations begin. Waymo has also expanded its OEM relationships, including with Hyundai, whose IONIQ 5 SUV will join the Waymo One fleet and Toyota, with which it is co-developing technologies to enhance both personally owned vehicles and future fleet models.

Similarly, Apollo GO has also struck a range of partnerships to further expand its operations. For instance, in August 2025 it partnered with Lyft to deploy autonomous rides across Europe, with initial deployments planned for Germany and the UK in 2026, pending regulatory approval. The agreement sees the fleet scaling to thousands of vehicles in the following years, with Apollo Go providing the vehicles and comprehensive technical support and Lyft owning the operational value chain. It also struck a similar deal with Uber in July 2025 for a range of markets outside of the US and mainland China. Initial target markets are Asia and the Middle East, with Dubai emerging as a key hub given its goal for at least 25% of all trips to be driverless by 2030.

These partnerships with ride-hailing platforms allow autonomous driving companies to focus on their core expertise while leveraging partners’ established user bases and operational capabilities. This creates natural synergies and removes the need for autonomous mobility players to spend heavily and compete on customer acquisition. Going forward, we would expect these types of partnerships to continue and become a standard go-to-market channel.

Chinese autonomous players are also increasingly looking to shift to an asset-light approach, choosing not to own the vehicles themselves. This model reduces capital intensity and transfers fleet management to partners better equipped to maximise utilisation and minimise operating costs, which should ultimately enable more efficient scaling.

The road to profitability

“Looking into the longer-term, we see a clear path to profitability as hardware and labour costs keep coming down and our growing operational scale brings more efficiencies.”

Robin Yanhong Li, Baidu CEO (Q1 2025)

A key question for the autonomous vehicle industry is if and when robotaxi operations can achieve profitability. While removing the human driver eliminates a major cost, the high expense of autonomous hardware and ongoing operating overheads, including the need for tele-operators, have historically made positive unit economics difficult to achieve.

A Wall Street Journal analysis in December 2024 estimated the cost of a Waymo vehicle at roughly US$125,000, comprising about US$50,000 for the Jaguar I-PACE base car and the remainder for autonomous components, including LiDAR, cameras, radar and external audio receivers (EARs). Assuming US$15–20 billion in capital investment and a fleet of 20,000 vehicles, the analysis suggested a breakeven period of around 10 years.

“With 13 cameras, 4 LiDAR, 6 radar and an array of external audio receivers (EARs), our new sensor suite is optimised for greater performance at a significantly reduced cost, without compromising safety.”

Satish Jeyachandran, Vice President of Engineering Waymo (August 2024)

Although Waymo faces less pressure to cut costs given its parent Alphabet has significant resources, cost reductions have been an important focus. When it announced its 6th generation Waymo Driver in August 2024, cost optimisation was a key highlight. Additionally, its partnership with Hyundai, adding the more affordable IONIQ 5 relative to the Jaguar I-PACE, suggests a focus on improving unit economics.

“RT6 is now running at a meaningful scale across multiple cities. And its unit cost is below $30,000, far better than anyone else on the planet.”

Robin Yanhong Li, Baidu CEO (Q1 2025)

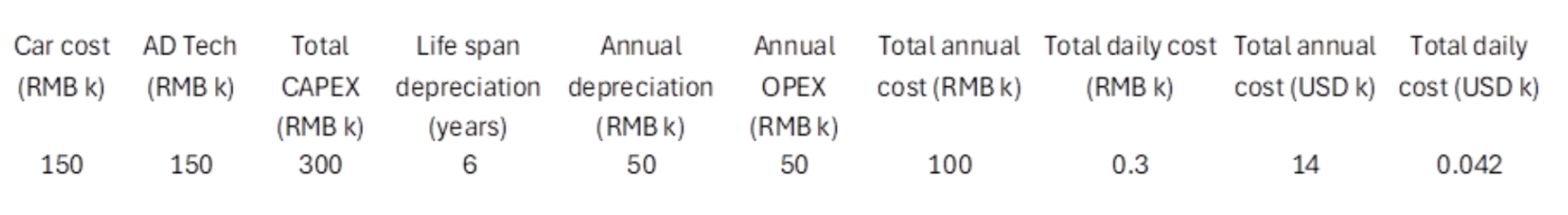

In contrast, Baidu’s Apollo Go has achieved meaningfully lower vehicle costs and already reached positive unit economics in China, despite significantly lower average fares. In our discussions with another Chinese autonomous player, they have also seen significant cost reductions in recent times on multiple fronts. For instance, the hardware has become much more affordable, especially since they were able to move from expensive mechanical LiDAR to the more affordable solid-state and semi-solid state LiDAR. Additionally, as the AV industry continues to expand, the supply chain has benefitted from economies of scale, driving down costs. Operating expenses have also fallen through more efficient algorithms that consume less power and by reducing remote safety supervision to one operator per 30 vehicles.

This provider estimated total daily costs of around RMB300 (US$42) for its next generation vehicle, including OPEX and depreciation (Figure F). With taxi drivers in Chinese markets earning up to RMB600 (US$82) per day and autonomous fleets capable of continuous operation, they too appear well positioned to achieve positive unit economics. As fleets scale, fixed overheads should become an even smaller share of total costs, paving the way for profitability at the organisational level.

Figure F. Autonomous vehicle unit cost for a Chinese autonomous mobility company

Source: Chinese autonomous mobility company

Tesla’s Cybercab is also set to be highly cost effective. Musk has stated the cost was expected to be below $30k, with no pedals, steering wheel or driver dashboard. It is designed for a “gentle ride”, with lower top end speed and more efficient tires than its other models, optimised fully for cost per mile, estimated at around $0.3-$0.4.

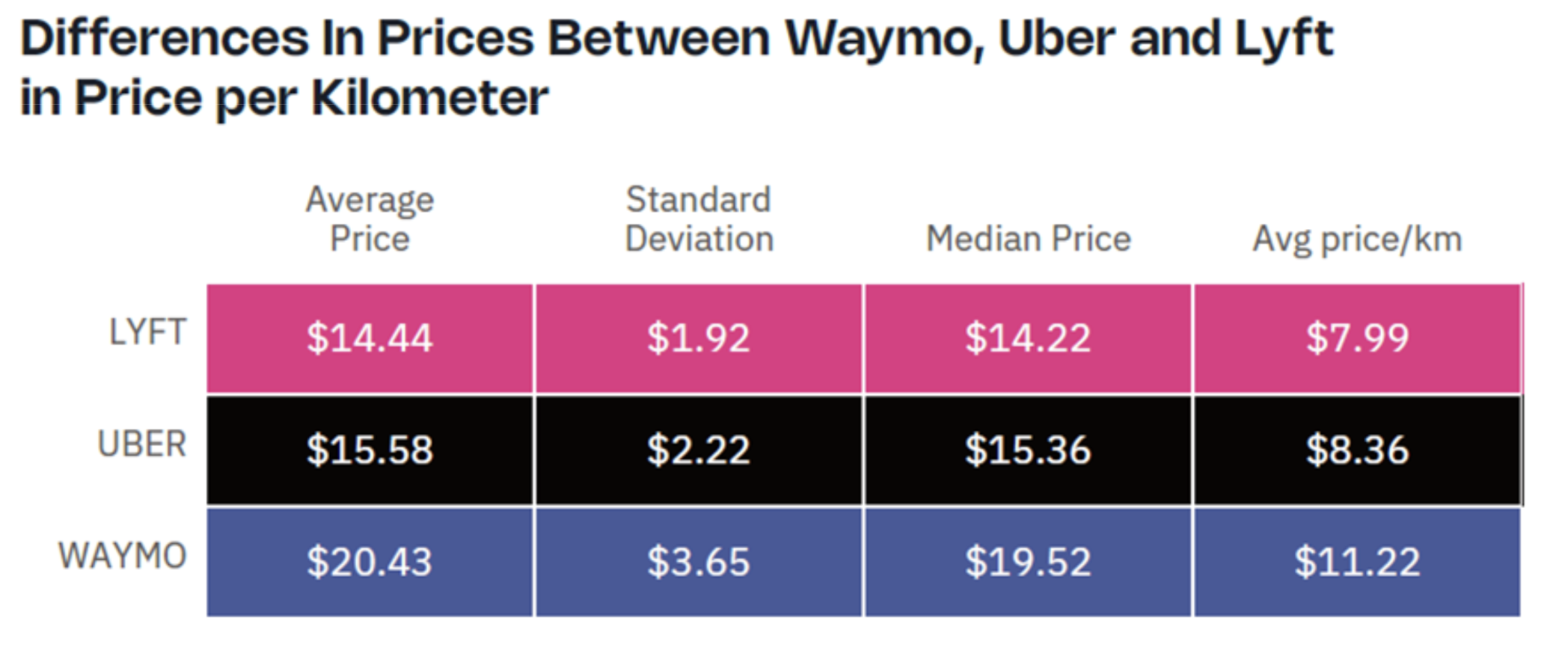

While vehicle costs are falling, early market data shows strong willingness to pay. A study by Obi found that Waymo rides were priced roughly 30–40% higher than competing services (Figure G). Among surveyed riders who had taken a Waymo, 70.2% said they preferred it, 16.7% were indifferent and 13.2% favoured traditional ride-hailing apps.

Figure G. Price comparison between Waymo and other ride-hailing apps

Source: Obi, The Roach Ahead: Pricing Insights On Waymo, Uber and Lyft

Notes: n: 88,998, Dates: 25 March – 25 April 2025, Place: San Francisco

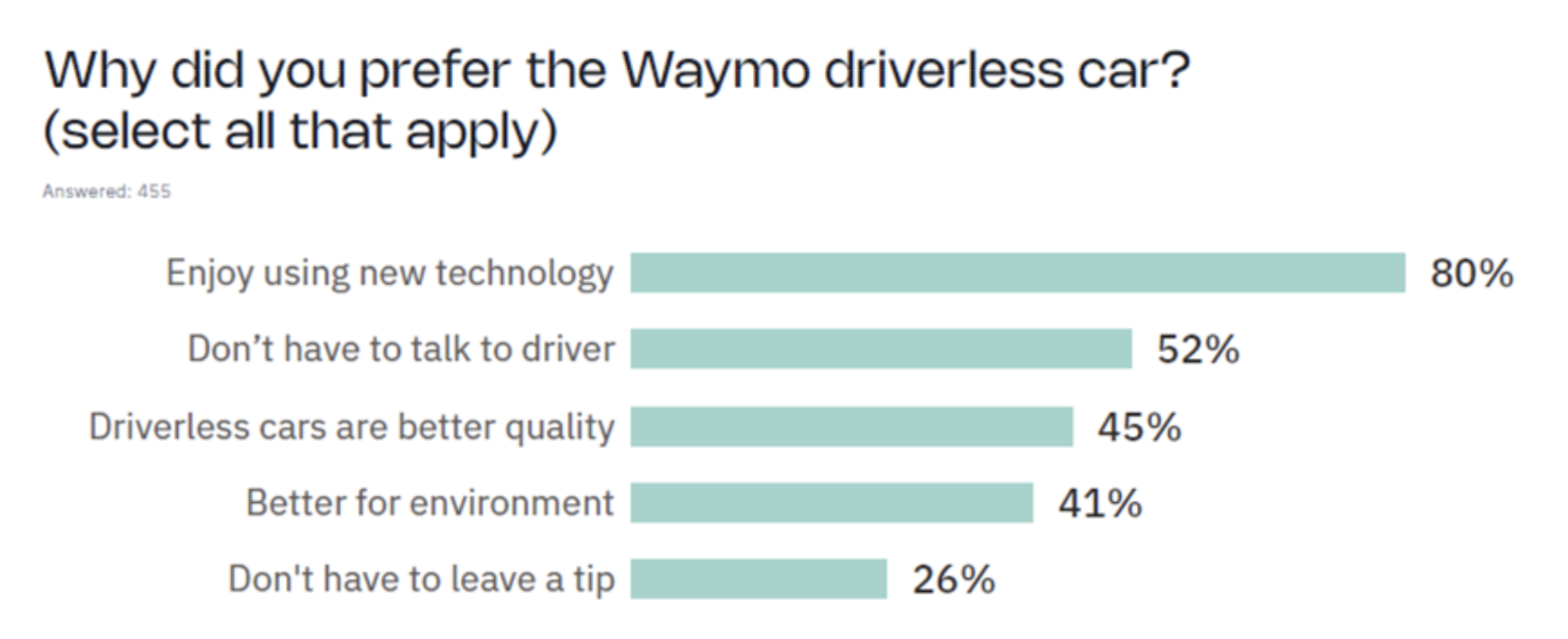

When respondents were asked why they preferred the Waymo, 52% of respondents said it was because they did not need to speak to the driver (Figure H). It is also likely that some riders feel safer without a human driver, though that was not an option on the questionnaire. We assume these factors can to some extent explain its growing market share and its ability to command a premium.

Figure H. Survey for why riders preferred Waymo

Source: Obi, The Roach Ahead: Pricing Insights On Waymo, Uber and Lyft

“We are moving towards a future where taking a robotaxi will be half the cost of taking a taxi today.”

Robin Yanhong Li, Baidu CEO (July 2022)

Although riders are currently willing to pay a premium, we do not expect elevated pricing to persist. In the long run, we would expect fares to fall materially below current ride-hailing rates as cost savings from removing human labour and using purpose-built vehicles are competed away. However, lower prices should drive significantly higher adoption and utilisation rates, as autonomous services become more accessible to a broader segment of consumers.

We still expect healthy margins over time, however. We do not anticipate the autonomous driving market to resemble today’s car industry with over 100 brands and structurally low profitability. Once leading players achieve scale, accumulate large amounts of proprietary driving data and demonstrate superior safety performance, barriers to entry should rise sharply, limiting competition and supporting healthy margins. At the same time, we do not foresee monopoly-like outcomes, as large national governments are unlikely to allow a single foreign operator to dominate domestic mobility infrastructure and are expected to support local champions.

Sizing the opportunity

Autonomous vehicles will potentially impact multiple trillion-dollar markets including transportation, logistics and urban infrastructure. This potential stems from fundamental changes to cost structures and asset utilisation across these sectors, although the early stage of the technology makes precise market sizing challenging.

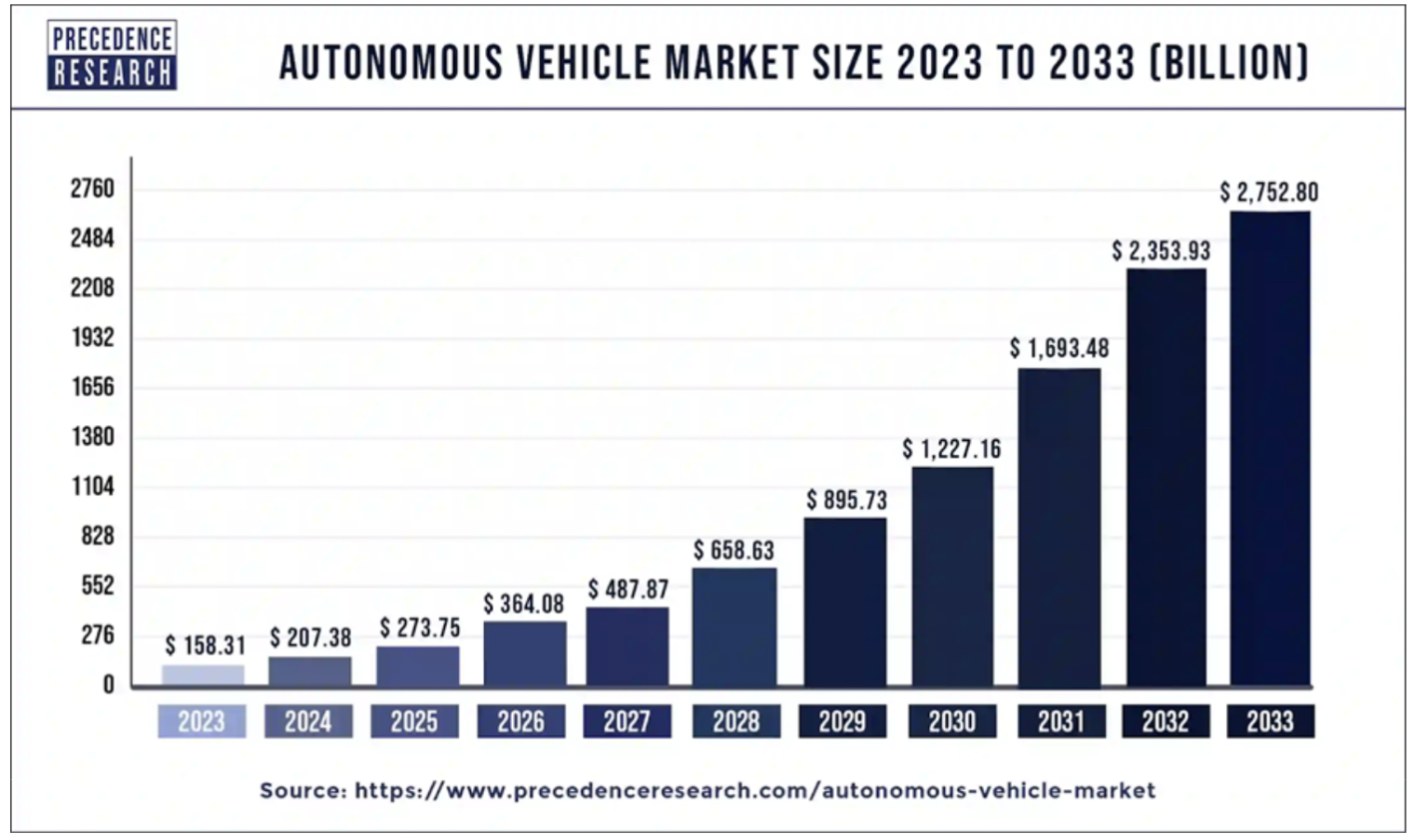

Since autonomous technologies are still in the very early stages of their rollout, the estimates for total addressable market (TAM) vary significantly across forecasts. For instance, according to Fortune Business Insights, the global autonomous vehicle market was valued at just over US$1.9 trillion in 2023 and is expected to grow to US$13.6 trillion by 2030 (representing a CAGR of 32.3%)! On the other end of the spectrum, Precedence Research has a relatively conservative estimate for the Autonomous Vehicle Market at US$158.3 billion in 2023, set to grow to US$2.75 trillion by 2033 (Figure I).

Figure I: Autonomous Vehicle Market Size, 2023 to 2033

Source: Precedence Research

Conclusion

The autonomous vehicle (AV) market remains nascent, with leading robotaxi fleets currently numbering around 1,000–1,500 vehicles and most new partnerships involving only a few thousand units. This is orders of magnitude smaller than the global vehicle total, estimated at 1.6 billion. However, growth is accelerating as technology advances, regulatory support increases and partnerships proliferate across regions. Crucially, we see emerging positive unit economics as a catalyst, giving companies the confidence and economic capacity to scale more aggressively. We therefore believe the industry is now at an inflection point and we would not be surprised to see fleet sizes doubling or tripling annually for many years to come.

At AlphaTarget, we invest our capital in the most promising disruptive businesses at the forefront of secular trends; and utilise stage analysis and other technical tools to continuously monitor our holdings and manage our investment portfolio. AlphaTarget produces cutting-edge research and our subscribers gain exclusive access to information such as the holdings in our investment portfolio, our in-depth fundamental and technical analysis of each company, our portfolio management moves and details of our proprietary systematic trend following hedging strategy to reduce portfolio drawdowns. To learn more about our research service, please visit alphatarget.com/subscriptions/.

“[T]he larger driver of our everyday activity is the fact that the software industry is completely changing with AI. It feels like the AI era of the past two years just makes the SaaS era feel like sleeping days.”

Ivan Zhao, Notion CEO (11 August 2025, The Verge)

“It’s been eight of the most exciting months, I think, of my career.”

Marc Benioff, Salesforce CEO (29 August 2025, The Logan Bartlett Show)

An agentic software future

The current artificial intelligence (AI) revolution has ignited widespread debate about its transformative potential across industries, with software playing a central and pivotal role in these changes. Many observers express concerns that AI could disrupt the very foundations of software as we know it, rendering the current software paradigm obsolete. This fear stems from the belief that AI’s generative capabilities could automate code generation to the point where bespoke applications are created with ease, bypassing the need for ongoing subscriptions to SaaS platforms. Additionally, some industry experts foresee a future where traditional software becomes redundant, as instead of interacting with a range of siloed software applications, users will interact with an agentic interface through which they can express their intent and have agents work in the background to obtain the desired outcome.

“I think the notion that business applications exist, that’s probably where they’ll all collapse, right, in the agent era.”

Satya Nadella, Microsoft CEO (12 December 2024, BG2)

High-profile voices have amplified these fears. In a recent social media post (Figure A), Musk suggested that phones and computers would effectively become edge nodes for AI, directly rendering pixels without the need for a traditional operating system or conventional apps. In that same exchange, he agreed with Replit’s CEO, Amjad Masad, who commented that AI could generate apps on demand, with agents eating traditional apps. Replit itself exemplifies this shift: its vibe coding (i.e., “rapid prototyping”) tool allows users to build and deploy apps in a fraction of the time compared to traditional software development, collapsing traditional coding barriers and enabling anyone to be a software developer.

Figure A: Elon Musk’s post on X

Source: X

We believe the AI revolution will significantly impact existing software, but that does not necessarily mean the demise of established software vendors. Presently, vibe coding tools excel at code generation and prototyping, yet have fallen short in delivering fully polished, production-ready products. We suspect that time will come too, but even then, incumbents possess moats that cannot easily be overcome in the short run. These include network effects, deeply embedded workflows and troves of user data. For instance, CRM is not just a tool but a living ecosystem of customer relationships and integrations that vibe coding cannot simply replicate. However, existing software will have to evolve significantly to meet user expectations if it is to stay relevant in the long run.

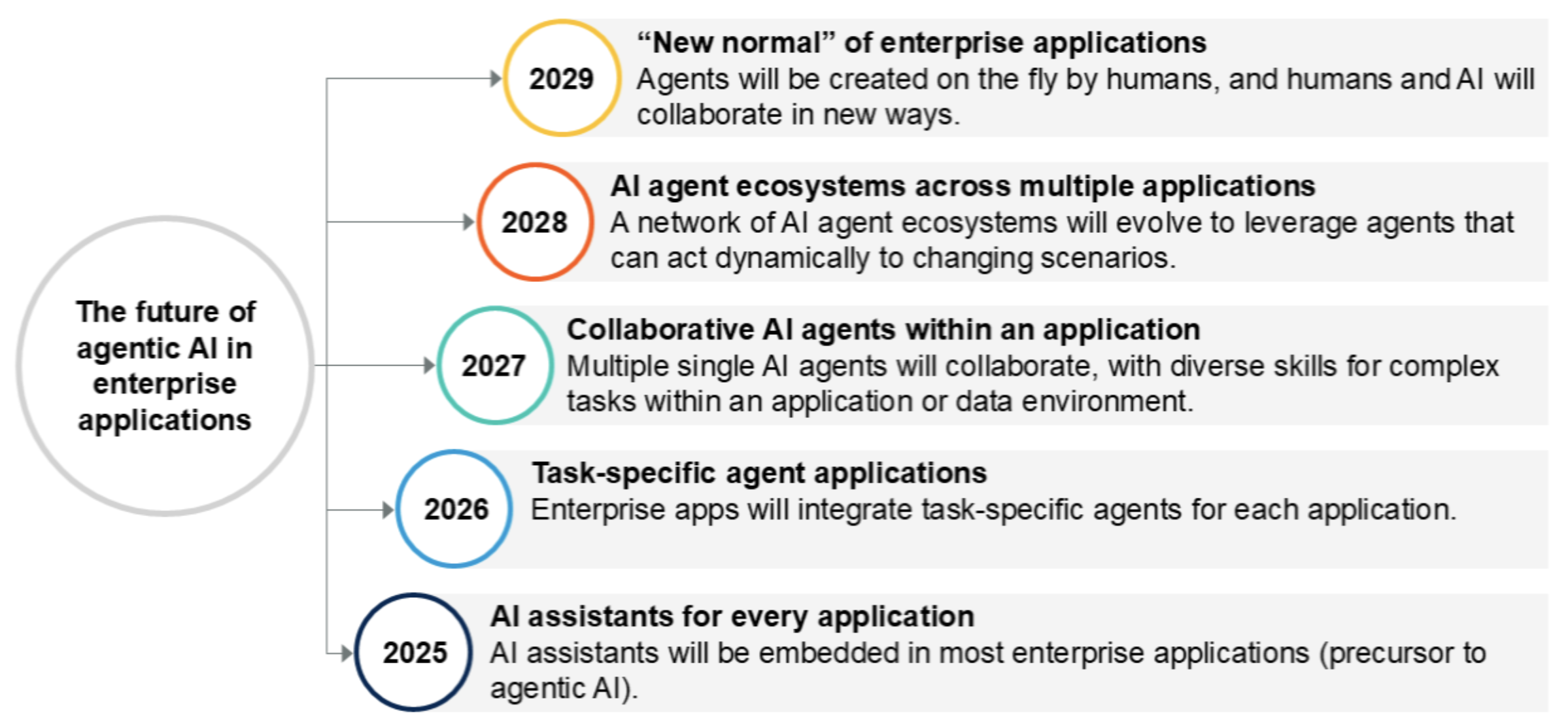

In an August 2025 report, Gartner forecasts the future evolution of AI in enterprise software, as shown below (Figure B). Although timelines are highly uncertain, we think this forecast provides a good outline of the many steps (and hurdles) and time taken before we get to a world where agentic software is mainstream.

· Stage 1. By the end of 2025, the majority of enterprise apps will have embedded AI assistants to simplify tasks and enhance user productivity. AI assistants are generally human triggered.

· Stage 2. By 2026, 40% of enterprise apps will incorporate task-specific AI agents capable of handling complex, end-to-end processes independently, such as automating cybersecurity responses or other specialised functions.

· Stage 3. By 2027, one-third of agentic AI implementations will have different agents collaborating within individual applications, combining diverse skills to manage intricate tasks.

· Stage 4. By 2028, there will be AI agent ecosystems that collaborate across multiple apps and business functions. One-third of user interactions will occur through agentic front ends.

· Stage 5. By 2029, at least 50% of knowledge workers will be able to create AI agents on demand.

Figure B: Gartner’s forecast for agentic AI in enterprise apps

Source: Gartner (August 2025)

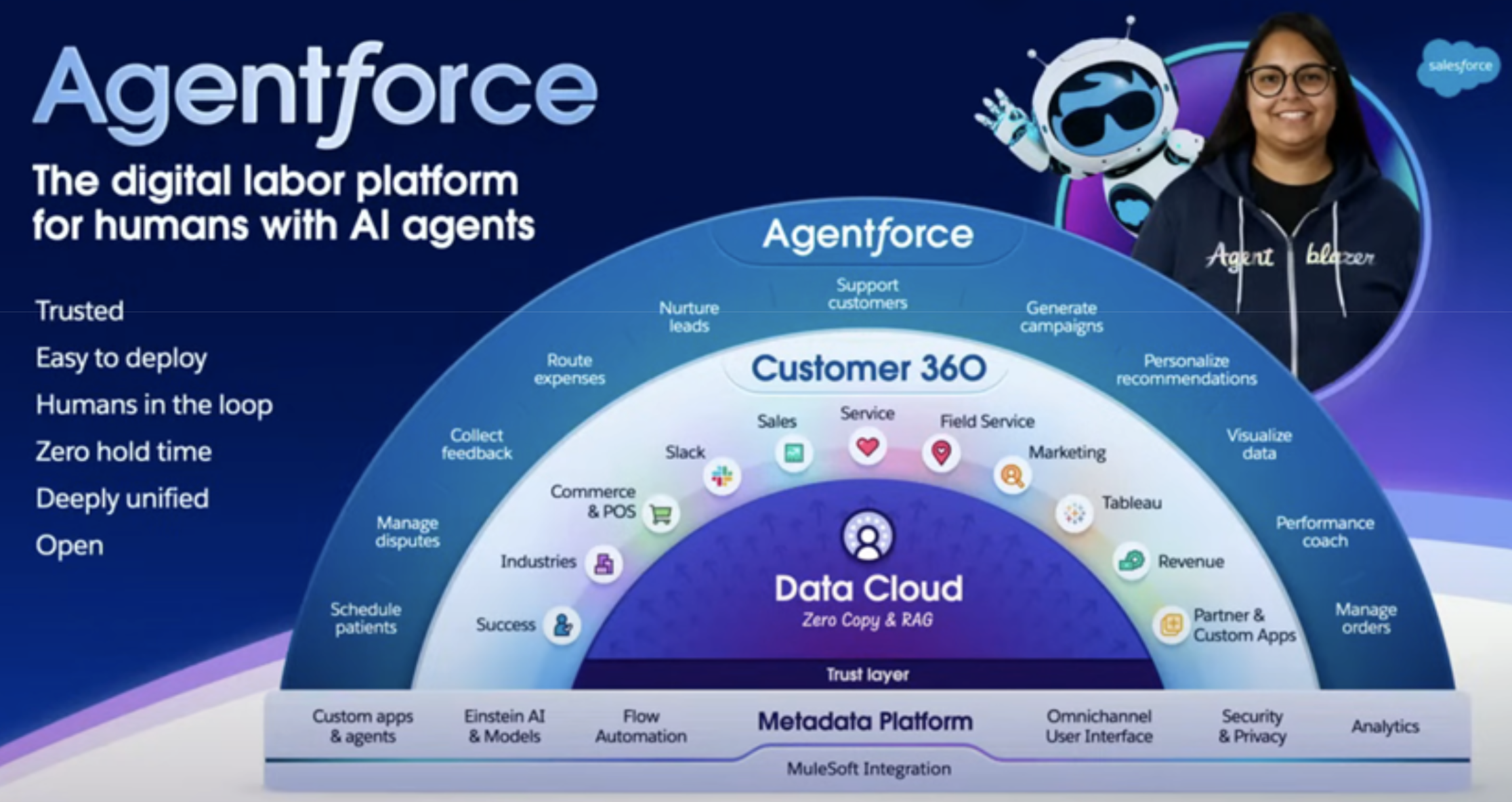

An example of this agentic evolution is the introduction of Salesforce’s Agentforce, which it launched in September 2024. This AI-powered autonomous agent platform connects to enterprise data and handles tasks across sales, service, marketing and commerce. Agentforce has seen rapid adoption, with over 12,500 deals closed by July 2025, of which 6,000 were paid. Below is an illustration of its enterprise stack (Figure C), composed of a data layer (Data Cloud), a core application layer (Customer 360) and the agentic layer (Agentforce) which orchestrates work on top. We think this is a good illustration of where the enterprise stack is heading, though we acknowledge that there will likely be variations across different companies and industries. A key challenge for incumbent companies like Salesforce however will be adapting these innovations around legacy systems rather than building AI-native solutions from scratch.

Figure C: Salesforce’s Agentforce

Source: Salesforce

The fruits of thy labour

“[T]he overall addressable market went from software to software plus labour, which is 10 times bigger.”

Yamini Rangan, HubSpot CEO (5 May 2025, Grit)

It is important to note that the rise of AI is not just a challenge for software vendors to overcome in order to stay relevant, but also a significant opportunity. Those who innovate early and integrate AI capabilities into their products can offer more advanced services, effectively monetising the additional value they create. In other words, the leaders in this AI-driven evolution can potentially charge for the extra “intelligent” work their software does, creating significant new revenue streams.

At the same time, there is an open question about how much of this value will be captured by the software vendors relative to the infrastructure and model providers e.g. Microsoft and OpenAI, who supply the inference capabilities. Although inference is getting cheaper, with some estimating it is becoming 10x cheaper per year, the amount of inference needed per task is also growing extremely quickly, especially as models become more advanced and do more work. In an article by The Wall Street Journal, they provided an estimate of tokens needed per task below, showing how inference requirements increase drastically with task complexity.

• Basic chatbot Q&A: 50 to 500 tokens

• Short document summary: 200 to 6,000 tokens

• Basic code assistance: 500 to 2,000 tokens

• Writing complex code: 20,000 to 100,000+ tokens

• Legal document analysis: 75,000 to 250,000+ tokens

• Multi-step agent workflow: 100,000 to one million+ tokens

The article also commented on how this is impacting margins: Ivan Zhao, CEO of productivity software company Notion, said his business had a gross margin of 90% two years ago, fairly standard for SaaS companies. However, approximately 10 percentage points of that margin now goes to the AI companies that power its latest offerings.

It is difficult to forecast the long-term margin impact of inference on SaaS companies, as it will depend on several factors. These include the market dominance of hardware and model providers, which determine their pricing power. Another determinant of inference costs will be the extent to which hardware and software efficiencies improve relative to inference demand. However, if the history of traditional cloud computing by big tech is any guide, inference providers are likely to capture a healthy share of the economics.

Still, we think innovative software vendors will see more upside than downside. They will be able to offer significantly more value to their clients by automating work and reducing labour costs, value that can be monetised at a strong premium. Additionally, as agent-driven systems become embedded in everyday workflows, almost like training an employee who learns a company’s specific needs, vendors could become much harder to dislodge, strengthening their moats. This, in turn, should allow them to raise prices and improve margins. ServiceNow, for instance, exemplifies this opportunity, with the company’s NowAssist AI products commanding 20%+ price premiums over standard offerings, while driving significant revenue growth.

Monetisation revamp

As software increasingly performs work through AI inference, software companies will also need to restructure their monetisation models. SaaS companies will need to shift away from their reliance on seat-based revenue towards usage-based revenue to align monetisation with value delivered. However, this transition is fraught with challenges. Seat-based pricing is more straightforward, scaling with user count. Usage-based models, however, introduce unpredictability, as costs fluctuate with consumption, making forecasting difficult for customers and businesses. It requires real-time systems to track potentially unbounded spend, unlike monthly batch processes. Complex discount structures for enterprise contracts add further intricacy, and data must be stored accurately and accessibly to maintain financial integrity and future pricing flexibility.

Operationally, incentive structures will transform. Sales teams must prioritise high-usage clients over seat counts, necessitating new compensation models. Product teams need to focus on unlocking use cases that drive usage, requiring agility to adapt to evolving customer needs. This transformation demands top-down leadership from the CEO to align sales, product, and finance teams. The right pricing model is still being figured out, with no universal solution yet, and we expect this will take time as AI models and hardware continue to rapidly improve. As seen with Salesforce’s Agentforce, it has reportedly changed its pricing model three times in a single year, reflecting rapid experimentation to find the optimal approach.

Despite challenges, usage-based pricing offers immense opportunity. By aligning monetisation with usage, companies achieve better product-market fit, capturing more value as customers derive greater benefit, fostering a flywheel of growth and innovation.

The agentic organisations

“I am on a mission to make Salesforce an agentic enterprise.”

Marc Benioff, Salesforce CEO (29 August 2025, The Logan Bartlett Show)

In addition to evolving their products and monetisation models, software vendors will also need to rethink their organisational structures. As Marc Benioff from Salesforce highlighted, it’s not just about making the product agent-driven, but about making the entire organisation agent-driven. In a recent podcast, he mentioned reducing Salesforce’s support staff from around 9,000 to 5,000 thanks to AI agents, reducing costs substantially.

Likewise with sales, AI agents are reshaping how leads are managed and converted. Benioff explained that Salesforce had accumulated over 100 million uncontacted leads over 26 years due to insufficient human resources. However, now agents call back every person who calls them, handling more than 10,000 leads weekly, engaging in conversations and funnelling them into their pipeline. This highlights how agents are not just helping cut costs, but also helping grow revenues more efficiently. We imagine there will be many more use cases where agents will enhance efficiencies significantly. We therefore see significant upside potential for companies that can transform themselves to become more agent driven.

Sizing the opportunity

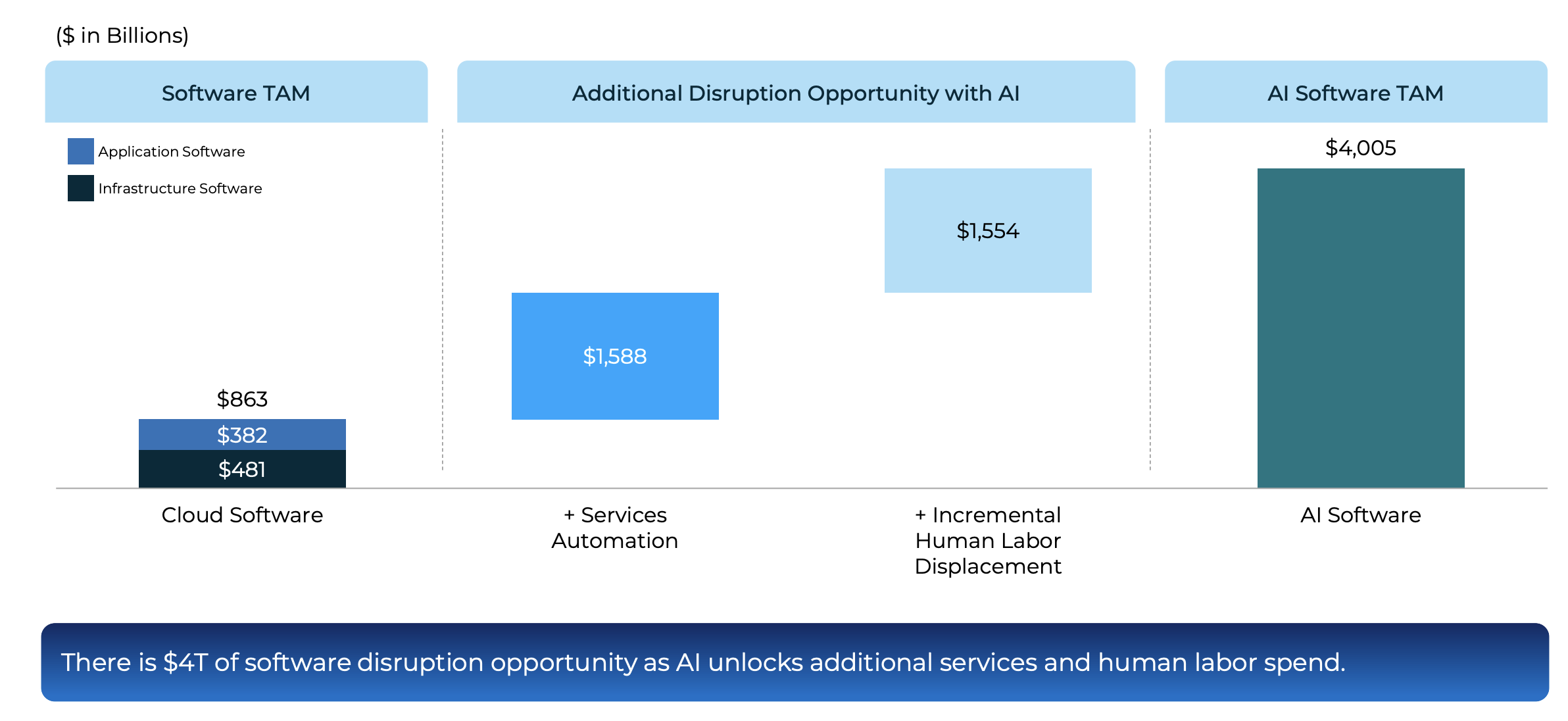

Cutting-edge software firm Palantir estimates it will be able to grow its revenue by 10x over the next 5 years, while simultaneously reducing headcount. This is a testament to the potential efficiency gains of AI. Although most firms will likely not be as operationally efficient as Palantir, we believe the potential for software to automate services and displace human labour will still lead to a substantial TAM expansion. According to Battery Ventures’ 2024 State of the OpenCloud report, the AI software TAM is worth approximatley US$4 trillion (Figure D).

Figure D: The AI Software Market Opportunity

Source: Battery Ventures, State of the OpenCloud Nov 2024

Conclusion

The current AI paradigm poses one of the greatest challenges the software industry has faced, forcing vendors to rethink many aspects of their business. Yet it also represents a powerful accelerant. Vendors could see substantial revenue uplifts by monetising the intelligent work their software performs, while also capturing significant operational efficiencies within their own organisations. Existing moats give incumbents valuable time to adapt, and as software evolves from being a critical tool to performing critical workflows, these moats may in fact deepen, making vendors harder to displace. However, Darwinism will take effect. The winners will be those agile enough to adapt quickly and embrace AI holistically, not just at the product level, but across their entire organisations.

In our view, companies that are already geared towards usage-based pricing models, will naturally benefit in this evolving AI landscape. We believe usage will rise as AI performs more tasks and we are already seeing signs of strong growth for software infrastructure companies, where usage based revenue models are native. Seat-based models on the other hand may face headwinds as businesses become more efficient and may as a consequence see less seat growth. We are therefore more cautious on vendors that remain seat-based without a clear path to transition toward usage-based models, particularly where their products have limited potential to perform meaningful work that could be monetised.

Additionally, we have a preference for infrastructure software businesses with deeply embedded workflows. Such companies are less easily disrupted than application software vendors and have more breathing room to evolve without immediate competitive threats. We also see cybersecurity as a particularly promising area. As companies expand their AI capabilities, their attack surfaces and vulnerabilities will grow. This will create more demand for advanced cybersecurity solutions. With adversaries also leveraging AI, cybersecurity firms that can help clients secure these new environments are well-positioned to benefit.

At AlphaTarget, we invest our capital in some of the most promising disruptive businesses at the forefront of secular trends; and utilise stage analysis and other technical tools to continuously monitor our holdings and manage our investment portfolio. AlphaTarget produces cutting-edge research and our subscribers gain exclusive access to information such as the holdings in our investment portfolio, our in-depth fundamental and technical analysis of each company, our portfolio management moves and details of our proprietary systematic trend following hedging strategy to reduce portfolio drawdowns. To learn more about our research service, please visit alphatarget.com/subscriptions/.