Quantum computing is emerging as the next frontier in technology and it has the potential to solve problems that today’s computers cannot touch; transforming industries from cryptography to drug discovery. Yet, despite billions invested and headlines touting breakthroughs, practical quantum advantage remains years away. Investors should watch this space carefully but resist the temptation to chase the hype.

This article breaks down the key components of the quantum computing ecosystem, from processors and infrastructure to software and real-world use cases, exploring how investors and business leaders can participate in its growth. We cover the main hardware technologies, supporting infrastructure providers, early commercial applications, current public investment opportunities, risks to watch and some principles for investing in the space.

Understanding quantum computing

Quantum computing is an emerging field in computer science and engineering that leverages the principles of quantum mechanics to tackle problems that exceed the capabilities of even the most powerful classical computers. The field of quantum computing includes a range of disciplines, including quantum hardware and quantum algorithms.

Classical computers, from smartphones to supercomputers, process information using bits (i.e., they are in one of the two states ‘1’ or ‘0’). These computers handle tasks by manipulating bits through logical operations, often in parallel across multiple processors to speed up computations. However, their performance is limited by the need to evaluate solutions step-by-step for complex problems, such as factoring large numbers or simulating chemical reactions.

Quantum computers use quantum bits (qubits), which differ fundamentally from classical bits. Due to a property called superposition, a qubit can represent 0, 1, or a combination of both states simultaneously. This enables quantum computers to process multiple potential solutions at once. Additionally, qubits can be entangled, meaning the state of one qubit is linked to another, allowing coordinated computations that classical systems cannot replicate. These properties make quantum computers potentially far faster for certain tasks such as cryptography, molecular modelling or risk analysis, though they are not universally superior and require specialised algorithms to outperform classical systems.

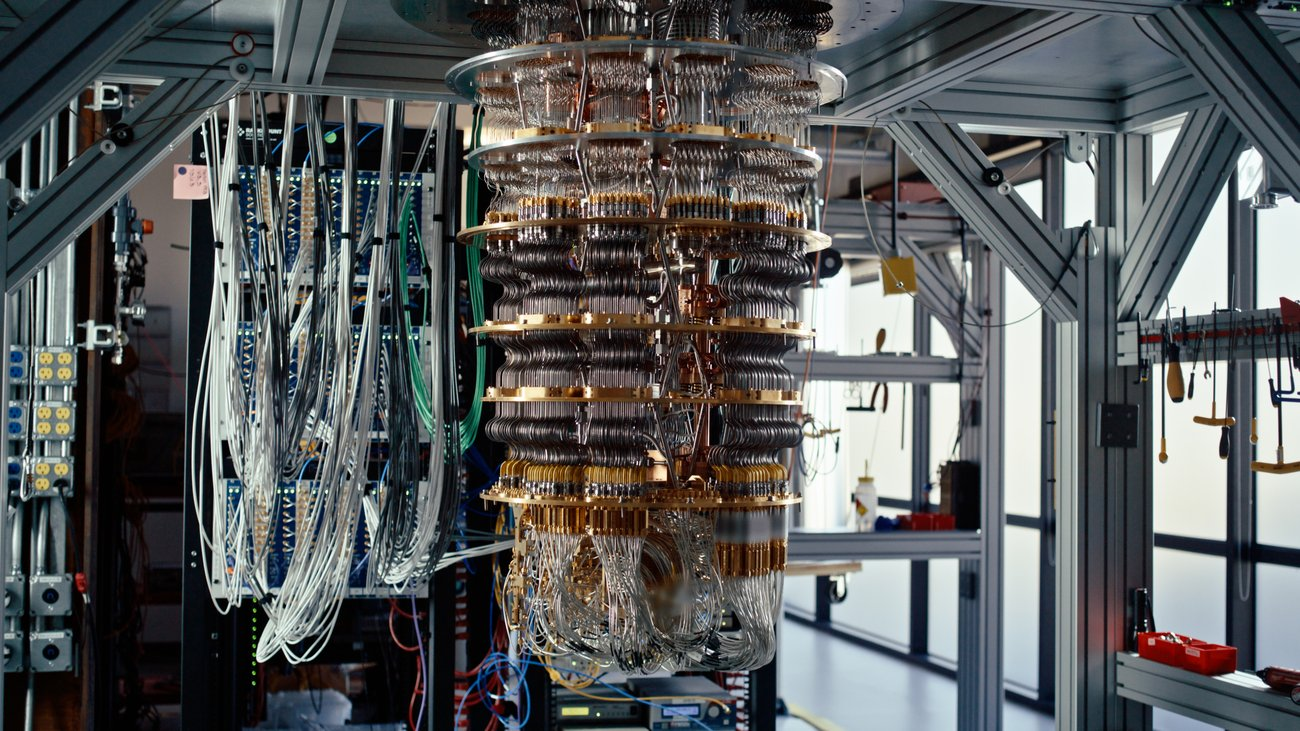

Google’s Quantum AI Lab

Source: Google

Hardware: The core engine

As discussed above, qubits are at the heart of the quantum computing revolution. Unlike bits that are binary, qubits operate using quantum superposition and entanglement, allowing them to represent multiple states simultaneously. A key challenge is that qubits are extraordinarily fragile; the slightest vibration, temperature change, or electromagnetic interference causes “decoherence” (i.e., the qubit loses its quantum properties).

Currently, three main approaches compete to build stable qubits:

- Superconducting qubits (used by IBM, Google, Rigetti): Rely on superconducting circuits at millikelvin (extremely cold) temperatures. Benefits include fast gate speeds and integration with CMOS-compatible fabrication, but they suffer from decoherence (losing quantum properties within microseconds) and scaling issues.

- Trapped ion qubits (IonQ, Quantinuum): Leverage ions suspended in electromagnetic fields. Highly accurate with longer coherence times, but gate speeds are slower and hardware is more difficult to scale.

- Photonic qubits (PsiQuantum, Xanadu): Use photons as carriers of quantum information, promising scalability and room-temperature operation, though achieving reliable operation remains a challenge.

The modalities have different commercial prospects and timelines to scale. Investors should view this like the early days of semiconductors, with multiple competing technologies and no clear winner yet. Rather than focus on one approach, a prudent approach might be to consider companies with strong IP portfolios and proprietary fabrication capabilities. Partnerships with national labs or hyperscalers (e.g., Microsoft + Quantinuum) signal credibility. Furthermore, as discussed in the next section, the picks and shovels of this area might also be worth further investigation.

More than just chips

Quantum computing systems are extremely delicate, and their operation requires a complete redesign of the computing stack. That includes:

- Cryogenic refrigeration: Dilution refrigerators are essential for superconducting qubits, often operating below 15 millikelvin. Bluefors and Oxford Instruments dominate this niche, offering high-margin components with little competition.

- Control and readout electronics: Precise microwave pulses must control each qubit, which requires specialised signal generators and converters. Keysight and Zurich Instruments provide these critical components.

- Quantum interconnects: Low-loss coaxial cables, optical fibre links for photonic setups, and waveguides are all part of the infrastructure.

- Quantum-safe networking: Emerging players are enabling quantum key distribution (QKD) and post-quantum cryptographic protocols to secure classical systems against quantum decryption threats.

- Quantum cloud platforms: Big tech now offers quantum hardware via the cloud. IBM Quantum, Amazon Braket, and Azure Quantum act as intermediaries for enterprises to experiment, without capital-intensive ownership. This “quantum-as-a-service” model generates recurring revenue and lowers barriers to adoption.

Infrastructure suppliers (cryogenics, control hardware and packaging) are cash-flow positive and may see inorganic acquisition from hyperscalers or defence contractors.

Emerging use cases

Quantum computing is poised to augment classical computing by addressing specific use cases more efficiently.

In finance, current risk models can analyse thousands of scenarios. Quantum computers could analyse millions simultaneously, transforming option pricing, arbitrage strategies, risk analytics, and Monte Carlo simulations. For instance, JPMorgan Chase estimated that quantum computers could accelerate Monte Carlo simulations used in derivative pricing models by 1,000 times. Early pilots with banks show promising results.

In pharmaceuticals, quantum computing’s potential to model protein folding, ligand binding, and drug target interactions is expanding rapidly, with partnerships such as Roche collaborating with quantum computing firm Cambridge Quantum. Materials science benefits from quantum-powered molecular simulations that accelerate the discovery of new catalysts, with Chevron and BASF actively investing in this space.

The energy sector looks to quantum computing to optimise power grids, simulate fusion processes, and advance battery chemistry. These efforts are strongly supported by government initiatives focused on achieving net-zero carbon emissions.

Logistics applications include vehicle routing, warehouse optimisation, and scheduling, leveraging hybrid quantum-classical solvers that are gaining traction in the industry.

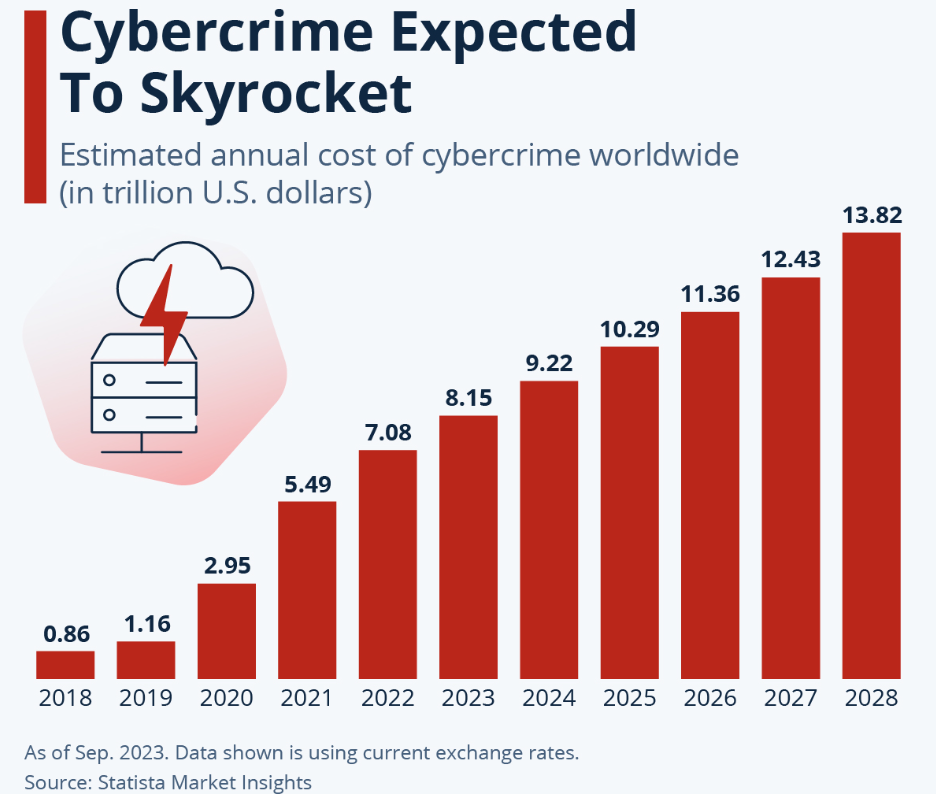

Finally, cybersecurity is emerging as a critical area for quantum computing technology, focusing on post-quantum cryptography, quantum key distribution, and secure authentication to counteract future quantum decryption threats. This is driven by evolving NIST (National Institute of Standards and Technology) standards and increasing national security interests.

Firms with pilot projects or co-innovation partnerships in these domains are best positioned to capture early revenues, especially those nearing quantum computing advantage in their use cases.

Themes & opportunities

The quantum computing stack is broad, opening up multiple avenues of capital allocation:

- Quantum Computing Hardware Companies: Publicly listed companies include IonQ (IONQ), Rigetti (RGTI), and D-Wave (QBTS). In this space, one ought to monitor product roadmaps versus hype.

- Infrastructure and Tooling Suppliers: Cryogenics (Bluefors), microwave components (Keysight), dilution refrigerators (Janis Research), and control systems (Zurich Instruments). These firms are typically overlooked but benefit from early-stage adoption and defence applications.

- Quantum-as-a-Service (QaaS) Providers: Microsoft Azure Quantum, Amazon Braket, and IBM Cloud are developing pay-as-you-go pricing models. They offer recurring SaaS-style revenue with high customer switching costs.

- Quantum Computing Middleware & Software Tooling: SDKs like Qiskit (IBM), Cirq (Google), and tket (Quantinuum). Compilers, noise mitigation tools, and quantum optimisers are early bets with parallels to early AI tooling stacks.

- Application-Level Startups: While mostly private, those that go public or get acquired will benefit from early proven vertical quantum computing advantage.

The key players

Quantum computing is still in its early innings as a commercial industry, but a handful of companies already exist in the public markets, either as pure plays or through broader technology portfolios. For investors, these companies represent a mix of long-term potential, near-term uncertainty and varying levels of exposure to quantum computing.

IonQ (NYSE: IONQ)

IonQ was the first quantum computing company to go public via a SPAC in 2021 and remains one of the few true “pure plays.” It develops trapped-ion quantum processors, known for longer coherence times and high gate fidelity. IonQ offers hardware access via AWS, Azure, and Google Cloud. It is starting to generate revenue (US$43 million TTM) through quantum-as-a-service and research contracts. Its market capitalisation is US$9.8 billion, reflecting high expectations.

Rigetti Computing (Nasdaq: RGTI)

Rigetti develops superconducting quantum processors and hybrid classical-quantum systems. It builds its own hardware and cloud platform, aiming for vertical integration. Despite operational challenges, it has secured government contracts and research partnerships. TTM revenue is US$9 million and its market capitalisation is US$3.3 billion, reflecting high expectations.

D-Wave Quantum (NYSE: QBTS)

D-Wave focuses on quantum annealing, a specific type of quantum computing best suited to optimisation problems. Its technology is deployed commercially in logistics and manufacturing and is accessible via its Leap cloud platform. TTM revenue is US$21 million and its market capitalisation is US$4.9 billion, reflecting high expectations.

Arqit Quantum (Nasdaq: ARQQ)

Arqit focuses on quantum-safe encryption and security via its QuantumCloud platform. It operates at the intersection of quantum computing and enterprise security, appealing to investors interested in post-quantum cryptography. Revenue is still tiny and the market capitalisation is US$545 million.

Honeywell (Nasdaq: HON)

Though not a pure quantum computing play, Honeywell owns Quantinuum (from Honeywell Quantum Solutions and Cambridge Quantum). Quantinuum develops trapped-ion systems and middleware/encryption tools, offering indirect quantum computing exposure.

IBM (NYSE: IBM)

IBM is a pioneer in quantum computing R&D, offering superconducting qubit systems via IBM Quantum and an open-source software development kit (Qiskit). Its roadmap targets scaling to thousands of qubits and integrating quantum computing with cloud services.

Alphabet (Nasdaq: GOOGL)

Google’s Quantum AI group has made landmark achievements, including controversial but significant quantum computing supremacy claims. For instance, the company’s 105-qubit Willow chip (unveiled in December 2024) is said to perform a random circuit sampling task in under five minutes, which Alphabet estimates would take a supercomputer 10 septillion (10^25) years. Critics argue the task lacks practical use and classical algorithms may close the gap. While experimental, Google’s quantum computing efforts are part of its broader innovation portfolio.

NVIDIA (Nasdaq: NVDA)

Not a quantum computing hardware company but an enabler through GPU-based quantum simulators and hybrid classical-quantum infrastructure like cuQuantum. NVIDIA represents a “picks and shovels” investment in the quantum computing ecosystem.

Challenges & risks

Even though quantum computing appears to have a long growth runway, investors must approach this area with realistic expectations:

- Scalability limits: Many architectures remain under 100 qubits; fault-tolerant systems require thousands.

- Error correction overhead: Surface code error correction demands 1,000+ physical qubits per logical qubit.

- Hardware fragility: Qubits are sensitive to noise, vibrations, and temperature fluctuations.

- IP uncertainty: Overlapping patents and licensing disputes may slow innovation.

- Geopolitical tension: Quantum computing is a national security priority for the US, China, EU, and UK. Export controls and regulations could impact deals.

- Time-to-profitability: Many firms may take 5–10 years before they generate meaningful cash flows and profits.

In our view, in many ways quantum computing is similar to biotechnology, with potentially highly binary outcomes and long timelines.

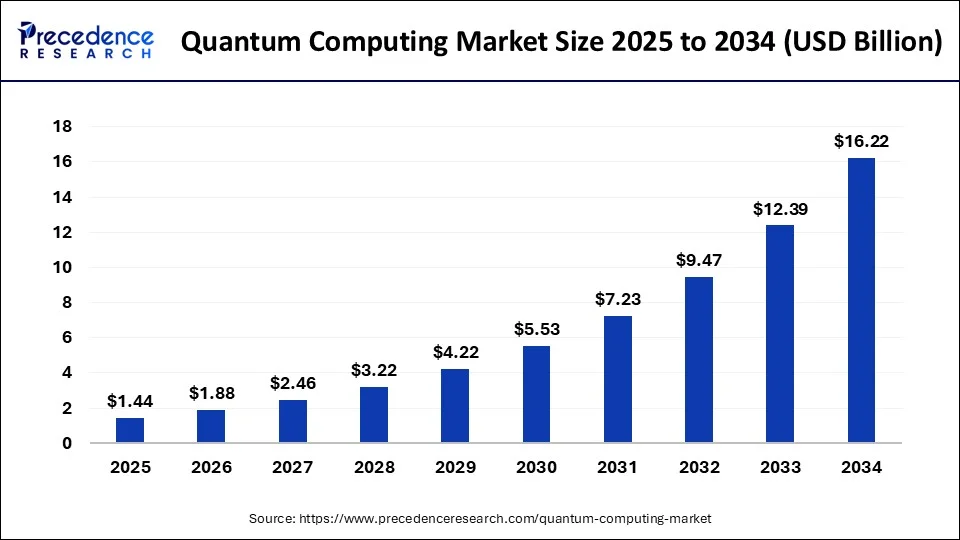

Sizing the opportunity

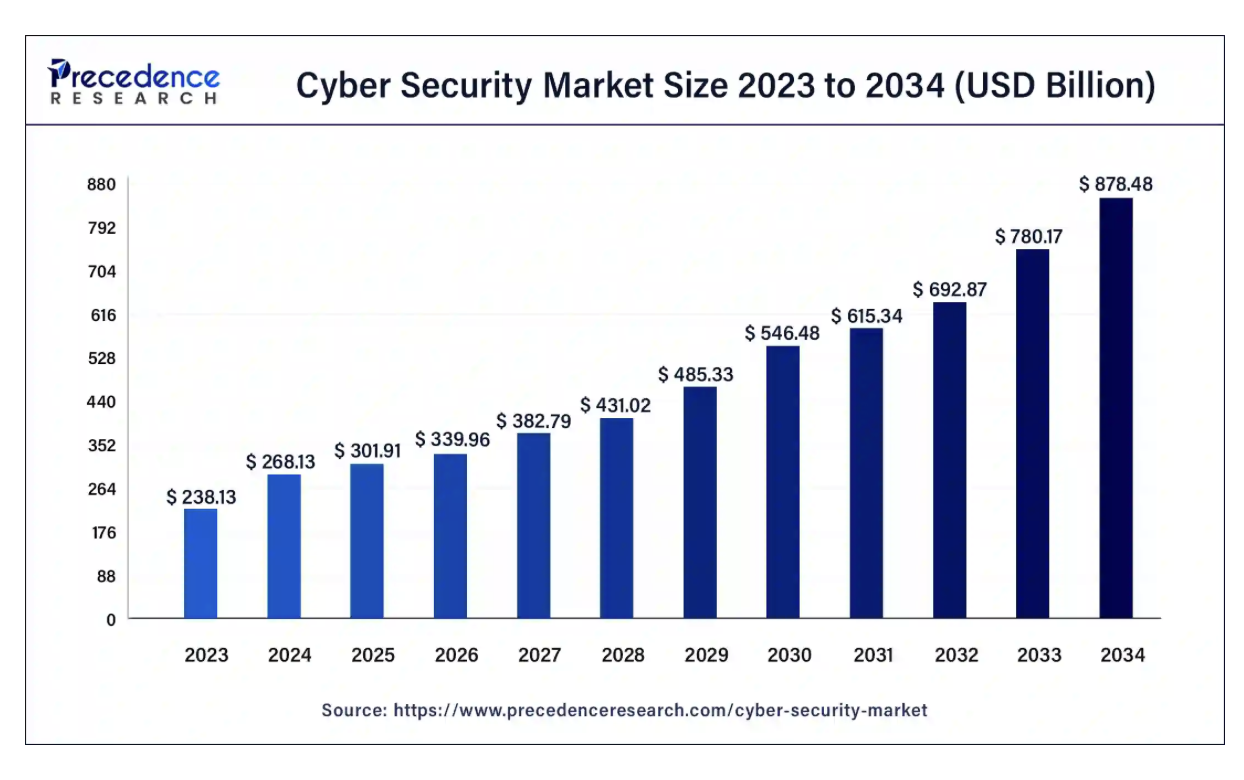

Beyond the technology and individual companies, the potential growth of the quantum computing opportunity demands attention. As shown in Figure A, Precedence Research projects that the quantum computing market will reach US$16.22 billion by 2034 from US$1.44 billion today, representing a compound annual growth rate (CAGR) of 31%. North America accounted for US$1.1 billion in 2024, and is expected to expand at a CAGR of 31% during the forecast period.

Figure A: Quantum Computing – long growth runway

Source: Precedence Research

Over the longer term, McKinsey & Company estimates that the quantum computing market could be worth US$45 billion to US$131 billion by 2040.

This opportunity spans multiple sectors. In pharmaceuticals, quantum modelling may significantly accelerate drug discovery and personalised medicine, unlocking billions in R&D productivity. In finance, faster and more accurate risk modelling, arbitrage, and portfolio optimisation are poised for major transformation. In materials science and energy, the simulation of atomic structures and chemical reactions could lead to breakthroughs in battery technology, sustainable fuels, and next-generation industrial catalysts.

Adjacent markets like quantum-safe cybersecurity, cloud-delivered QaaS platforms, and hybrid high-performance computing infrastructure further broaden the potential. In addition, government investment, including multibillion-dollar national quantum computing initiatives across the U.S., China, EU, and others, provides a baseline of funding that de-risks early-stage development.

For investors, this means that quantum computing could turn out to be a platform shift on par with classical computing, cloud and AI; opening the door to high returns for those who time the inflection point correctly.

Conclusion

Quantum computing stands at the threshold of reshaping global industries, from finance and pharmaceuticals to energy and logistics. The real economic opportunity lies not just in building quantum computers, but in constructing the infrastructure and software that enable scale. The best investments will combine long-term vision with near-term validation, and reward those who position capital accordingly.

Key considerations for investors include recognising that infrastructure returns often come early; while hardware may take years to generate meaningful ROI, companies providing essential tools, cryogenics, and quantum-as-a-service platforms are already producing cash flow. Valuing quantum computing companies requires a hybrid approach, measuring technical milestones such as qubit count and fidelity, intellectual property strength, customer pilots, and partnership depth alongside traditional fundamental metrics. Mid-layer enablers like refrigeration, signal control, and middleware SDKs appear to be underpriced, offering “picks and shovels” opportunities with less hype but stronger customer entrenchment.

This market is akin to investing in AI infrastructure circa 2015, as it is still in the pre-explosion phase. Just as Nvidia and TSMC capitalised on the AI boom by supplying foundational infrastructure, quantum computing infrastructure players may also drive the next wave of computational transformation.

At AlphaTarget, we invest our capital in some of the most promising disruptive businesses at the forefront of secular trends; and utilise stage analysis and other technical tools to continuously monitor our holdings and manage our investment portfolio. AlphaTarget produces cutting-edge research and our subscribers gain exclusive access to information such as the holdings in our investment portfolio, our in-depth fundamental and technical analysis of each company, our portfolio management moves and details of our proprietary systematic trend following hedging strategy to reduce portfolio drawdowns. To learn more about our research service, please visit alphatarget.com/subscriptions/.

Artificial intelligence (AI) is reshaping industries – from healthcare diagnostics to financial trading – but its transformative power depends on an often-overlooked foundation: AI infrastructure. This specialised ecosystem of hardware, software, and connectivity enables technologies such as chatbots, recommendation systems, and autonomous vehicles to operate effectively.

Unlike traditional cloud computing, which supports general applications such as e-commerce platforms or media streaming, AI infrastructure is purpose-built to meet immense computational demands of machine learning. Training sophisticated AI models, such as large language models (LLMs) that power virtual assistants, requires processing vast datasets across thousands of specialised processors. Deploying these models for real-time tasks, like generating instant recommendations, demands both speed and scalability. This dual challenge — training and deployment — necessitates unique architectural designs optimised for parallel processing, high-speed data transfer, and energy efficiency.

This article explores the core components of AI infrastructure, how it differs from traditional cloud systems, the innovative companies driving its evolution, and the investment opportunities within this dynamic sector. From specialised chips to energy-efficient data centres, AI infrastructure is a critical enabler of technological progress. For investors, it offers a way to gain exposure to AI’s growth through the foundational technologies that will shape industries for decades.

Nuts and bolts of AI infrastructure

AI infrastructure is the technological foundation for building, training, and deploying AI models, particularly large language models (LLMs) that fuel applications ranging from virtual assistants to personalised content recommendations. Unlike general-purpose computing, AI infrastructure is engineered for two distinct phases:

Training: The resource-intensive process of developing an AI model by processing vast datasets to optimise billions of parameters. This phase is comparable to a student spending months mastering complex subjects – requiring significant resources but occurring only once per model version.

Inference: The application of a trained model to deliver real-time outputs, such as answering user queries or generating recommendations. This phase prioritises speed, efficiency, and scalability – similar to a student instantly applying their knowledge across thousands of simultaneous tests.

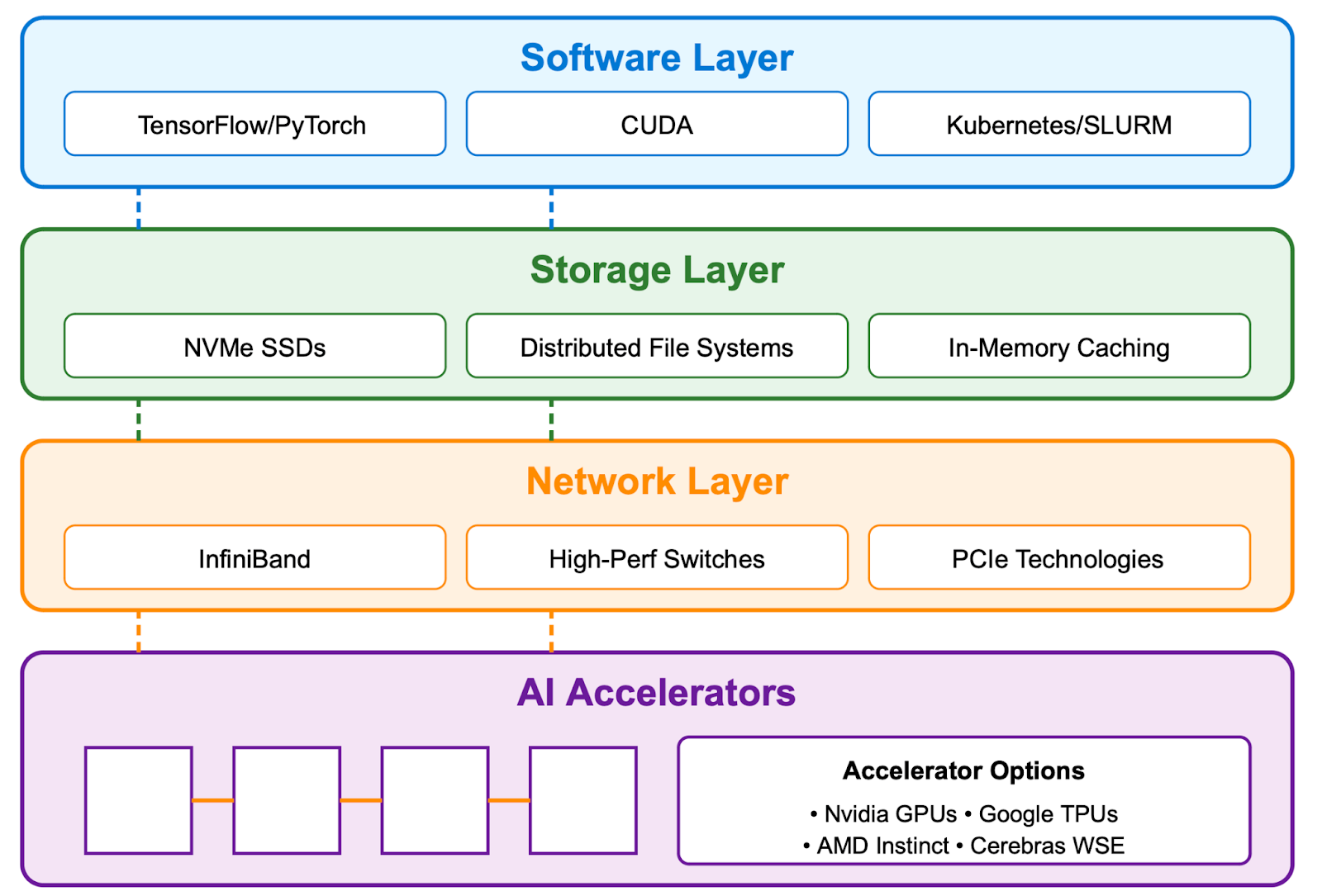

Next, we examine some of the key components of AI infrastructure (Figure A).

Figure A: AI Infrastructure Abstraction

AI accelerators: The computational engine

While traditional computing relies on Central Processing Units (CPUs), AI thrives on specialised accelerators designed for the parallel computations that dominate machine learning workloads.

- Graphics Processing Units (GPUs): Originally developed for graphics rendering, GPUs excel at performing thousands of calculations simultaneously. Nvidia currently leads the market with its Hopper and Blackwell architectures, designed for high-performance AI workloads. Its CUDA software ecosystem is widely adopted, but competitors like AMD (Instinct MI300) and Cerebras (Wafer-Scale Engine) are introducing alternatives that could challenge its position.

- Tensor Processing Units (TPUs): Google’s custom-designed AI chips, optimised for its TensorFlow and JAX frameworks. TPUs are application-specific integrated circuits (ASICs) engineered for machine learning, offering strong performance primarily within Google’s cloud ecosystem.

- Emerging Alternatives: Companies like Cerebras (with its massive Wafer-Scale Engine), AMD (Instinct MI300, focussed on cost-competitive performance), and AWS (Trainium, optimised for cloud training) are challenging Nvidia’s dominance. While these alternatives show promise, it remains to be seen whether they can match Nvidia’s blend of performance and mature software ecosystem.

Storage and connectivity: The data lifeline

While AI accelerators drive computations, storage and connectivity ensure data moves swiftly and seamlessly to support machine learning workloads. These components are vital for training (analysing vast datasets) and inference (delivering instant outputs), serving as the lifeline that keeps AI systems operational.

- High-Performance Storage: AI models demand rapid access to enormous datasets. NVMe Solid State Drives (SSDs) enable swift data retrieval, minimising delays during training and inference. Distributed file systems, such as Lustre or WekaFS, facilitate parallel access to terabytes of data across multiple servers, supporting large-scale AI tasks.

- Advanced Connectivity: AI’s processors require constant, low-latency communication, particularly when thousands operate together. High-speed interconnects, like Nvidia’s InfiniBand, provide rapid data transfer between systems. Specialised switches from providers like Arista and Broadcom manage substantial traffic flows, ensuring smooth coordination across processors. PCIe technologies, essential within servers, enable high-speed connections between GPUs and other components, maintaining efficiency in dense computing environments.

- Emerging Innovations: Novel storage solutions, such as AI-optimised cloud-native systems from AWS and Google Cloud, combine speed and scalability. In connectivity, smart Network Interface Cards (NICs) from companies like Mellanox offload data tasks, improving performance. These advancements aim to rival established systems while addressing AI’s evolving needs.

Together, storage and connectivity form the backbone of AI infrastructure, ensuring data availability and processor synchronisation. Leaders like Pure Storage, Arista, Broadcom, and cloud providers are shaping this critical layer of the intelligence era.

Software ecosystem: The orchestration layer

Hardware alone isn’t sufficient, AI infrastructure requires sophisticated software:

- AI Frameworks: Leading tools like TensorFlow, PyTorch, and JAX provide programming environments for developing and optimising machine learning models.

- Orchestration Platforms: Kubernetes and similar cloud-native orchestration platforms distribute complex workloads across thousands of processors, ensuring scalability.

- MLOps Tools: Specialised tools like MLflow and Kubeflow manage the machine learning lifecycle, from development to deployment and monitoring.

Power and cooling: The physical foundation

The extraordinary computational demands of AI create unprecedented physical challenges:

- Energy Consumption: Large-scale training clusters can consume 10-20 megawatts of power, equivalent to powering approximately 10,000 homes.

- Advanced Cooling: Solutions like direct liquid cooling are essential, as air cooling alone cannot manage the heat generated by dense AI compute clusters.

- Sustainable Design: With rising energy costs and environmental concerns, innovations like renewable energy integration and power-efficient designs are becoming competitive differentiators for infrastructure providers.

The interplay between these components determines the performance and economics of AI infrastructure. For investors, understanding how these elements fit together reveals potential bottlenecks and opportunities across the AI stack.

The rise of specialised AI infrastructure players

The explosive demand for AI compute has driven the emergence of a new breed of technology providers focused exclusively on AI infrastructure. Unlike traditional cloud providers like AWS, Microsoft Azure, and Google Cloud, which serve diverse workloads from web hosting to enterprise databases, these specialised players build infrastructure optimised specifically to meet AI’s unique requirements.

Traditional cloud infrastructure, with its general-purpose CPUs and standard networking, was not designed for the intensive matrix calculations of neural networks or the massive data exchanges required by distributed training. While hyperscalers are rapidly expanding their AI offerings, specialised providers have gained momentum by focusing exclusively on optimising for AI workloads — offering superior performance, cost efficiency, and access to scarce compute resources.

A key factor driving this specialisation is the current scarcity of high-performance AI accelerators, particularly Nvidia’s coveted H100 and Blackwell GPUs. Access to these chips has become a strategic advantage, with the most successful providers securing multi-year allocations through partnerships with Nvidia. This supply constraint has created a market dynamic where specialised providers with secured GPU supply can command premium pricing and long-term contracts.

In this section, we review some of the key players in this emerging segment.

CoreWeave

CoreWeave operates over 250,000 GPUs in 32 data centers, making it a top provider of AI infrastructure for companies like Microsoft and OpenAI. Its platform uses Nvidia’s fast networking and a system called SLURM on Kubernetes to manage workloads efficiently. This setup delivers up to 20% better performance (Model FLOPs Utilisation, or MFU) than competitors, accelerating AI training and processing.

CoreWeave’s business is built on long-term contracts, with a US$27 billion backlog (14 times its 2024 revenue of US$1.92 billion) reflecting both the supply-constrained market and customer confidence. These contracts typically span over four years, providing revenue visibility but introducing customer concentration risk, with two clients accounting for 77% of 2024 revenue.

The company’s recent acquisition of Weights & Biases enhances its software stack, offering developer tools for model training and positioning it as a full-stack provider rather than merely a hardware operator. CoreWeave has secured Nvidia GPU allocations through partnerships, supporting its global expansion. However, its reliance on Nvidia chips exposes it to supply chain risks, and competitors are exploring alternative accelerators.

Lambda Labs

While privately held Lambda Labs operates at a smaller scale than CoreWeave, it has carved out a niche serving startups, researchers, and small-to-medium enterprises. Its developer-friendly interfaces and on-demand pricing reduces barriers to entry for smaller clients, contrasting with hyperscalers’ enterprise-focused models.

Lambda Labs leverages Nvidia GPUs and high-performance networking to support training and inference for mid-scale models. Its focus on accessibility has made it a preferred choice for academic institutions and AI startups, enabling rapid prototyping and experimentation without the burden of long-term commitments.

The company’s smaller scale limits its ability to secure large GPU allocations or compete for enterprise contracts, but its agility positions it well for niche segments, particularly in democratising access to AI infrastructure for emerging players.

Nebius

Spun off from Yandex, Nebius has rapidly established itself as a distinctive player in the AI infrastructure market, operating a full-stack AI cloud with 30,000 Nvidia H200 GPUs as of March 2025 and plans to deploy over 22,000 Blackwell GPUs. Its platform, rebuilt in October 2024, integrates in-house hardware, energy-efficient data centres, and software tools like AI Studio – an inference-as-a-service offering with token-based pricing that has attracted nearly 60,000 users since launch.

Energy efficiency is one key differentiator for Nebius. Its Finland data centre features server-heat recovery systems and one of the world’s lowest power usage effectiveness (PUE) ratings, significantly reducing energy costs. The company’s proprietary servers, designed to operate at higher temperatures (40°C) with air cooling, lower maintenance costs and enable faster deployment.

On the software side, Nebius offers Soperator, a SLURM-based workload manager that optimises job scheduling, while its MLOps suite streamlines the AI lifecycle. Targeting developers, AI labs, and enterprises, Nebius is expanding in Europe and the U.S., with a focus on data sovereignty, which could be a strategic advantage in regulated markets.

Cerebras

Cerebras Systems, which is in the process of going public, takes a fundamentally different approach with its Wafer-Scale Engine (WSE), a massive chip integrating compute, memory, and interconnects for AI training and inference. Unlike GPU-based providers, Cerebras offers up to 10x faster training for certain LLMs compared to GPU clusters by eliminating much of the communication overhead inherent in distributed systems.

Its CS-3 system, powered by the third-generation WSE, competes with Nvidia’s DGX clusters for frontier AI research, while its Condor Galaxy supercomputers provide exascale compute for global AI development. Cerebras’ integrated hardware and software approach simplifies model development but targets a premium segment focussed on ultra-large models.

The current market heavily favours providers with access to Nvidia’s high-end GPUs, which are in short supply due to their dominance in AI workloads. This scarcity gives CoreWeave, Nebius, and Lambda Labs a competitive edge, as their GPU allocations attract clients unable to secure chips directly. However, the rise of alternative AI accelerators – like Cerebras’ WSE, AMD’s Instinct MI300, Google’s TPUs, and AWS’s Trainium – could disrupt this dynamic. If these accelerators match or surpass Nvidia’s performance, demand for Nvidia GPUs could slow, favouring hyperscalers with broader infrastructure, diverse chip portfolios, and greater financial resources to integrate alternatives. Hyperscalers’ economies of scale and established client bases could outpace specialised providers in a less supply-constrained market. Additionally, the capital intensity of scaling GPU clusters and data centres remains a significant barrier, requiring substantial debt financing and exposing providers to financial risks – especially if market dynamics shift.

Further, it is important to consider the broader risks facing these specialised AI infrastructure pure plays. Demand uncertainty looms, as long-term monetisation of AI applications remains unproven, potentially leading to industry consolidation around hyperscalers if GPU supply normalises. Customer concentration, such as CoreWeave’s reliance on two clients for 77% of 2024 revenue, introduces volatility. Capital intensity for expanding infrastructure, coupled with geopolitical factors like U.S.-China chip export restrictions and data sovereignty laws, could disrupt supply chains.

Energy constraints, too, are becoming critical, with AI’s massive power demands straining grids, necessitating sustainable solutions. These hurdles require specialised providers to innovate continuously while navigating a competitive, capital-intensive environment.

Sizing the opportunity

According to industry analysts, the AI infrastructure market is likely to experience rapid growth, driven by surging demand for high-performance computing and widespread AI adoption. Efficiency gains are accelerating this expansion, as lower costs enable broader deployment. This phenomenon is known as the Jevons Paradox – the idea that increased efficiency drives higher resource consumption.

As shown in Figure B, Precedence Research projects that “the global artificial intelligence infrastructure market size will grow from US$47 billion in 2024 to USD 499 billion by 2034 (CAGR of 26.60%). North America currently leads with US$19.36 billion in 2024, driven by innovation, mergers, and hyperscaler investments. The report highlights particularly strong growth in inference infrastructure, projected at a 31% CAGR compared to 23% for training infrastructure, reflecting the broader deployment of AI applications across sectors.

Figure B: The AI Infrastructure Market Opportunity

Source: Precedence Research, February 2025.

Morgan Stanley, in a recent report, offers an even more aggressive outlook, projecting cumulative AI infrastructure spending exceeding US$3 trillion by 2028, with US$2.6 trillion allocated to data centers (chips and servers).

Further, it appears we are approaching what could be called an “Inference Inflection Point” in the market. While media attention and investment have concentrated on training infrastructure – driven by GPU scarcity and the prestige of foundation model development – the long-term volume opportunity is increasingly shifting toward inference.

This inflection point could significantly shift competitive dynamics in the coming years. Providers with global distribution, energy-efficient designs for sustainable scaling, and flexible pricing models may capture disproportionate value as inference workloads explode. For investors, this suggests looking beyond today’s training-dominated headlines to identify companies well-positioned for the expanding inference market that will follow the current training-focussed boom.

We can already see strategic positioning for this shift among the major players. CoreWeave, while currently focused on training contracts, is expanding its inference capabilities. Nebius has aggressively developed its AI Studio platform specifically targeting inference workloads with token-based pricing. Even Cerebras, despite its high-end training focus, is exploring how its architecture can serve certain inference applications efficiently.

Conclusion

AI infrastructure is a cornerstone of the intelligence era, enabling transformative technologies through specialised hardware, advanced connectivity, and tailored software. Its evolution from traditional cloud computing marks a pivotal shift, driven by the demands of training and inference.

Specialised providers such as CoreWeave, Lambda Labs, Nebius, and Cerebras are redefining the landscape with innovative designs and full-stack solutions, but success hinges on several critical factors.

Key considerations for the sector’s future include:

- The pace of AI adoption and the scalability of infrastructure solutions across industries.

- Innovations in energy efficiency, connectivity, and hardware to address power and performance constraints.

- Competition between hyperscalers and specialised providers, differentiated by pricing, software, and niche expertise.

- Geopolitical and regulatory developments impacting supply chains and market access.

The likely winners will be companies that balance technological innovation with practical scalability, addressing enterprise needs while navigating capital and energy constraints. The opportunity extends beyond infrastructure providers to the broader ecosystem of semiconductor, software, and edge computing players.

AI infrastructure represents a transformative force, but its path forward requires careful analysis of technological capabilities, market dynamics, and disciplined execution.

At AlphaTarget, we invest our capital in some of the most promising disruptive businesses at the forefront of secular trends; and utilise stage analysis and other technical tools to continuously monitor our holdings and manage our investment portfolio. AlphaTarget produces cutting edge research and our subscribers gain exclusive access to information such as the holdings in our investment portfolio, our in-depth fundamental and technical analysis of each company, our portfolio management moves and details of our proprietary systematic trend following hedging strategy to reduce portfolio drawdowns. To learn more about our research service, please visit https://alphatarget.com/subscriptions/.

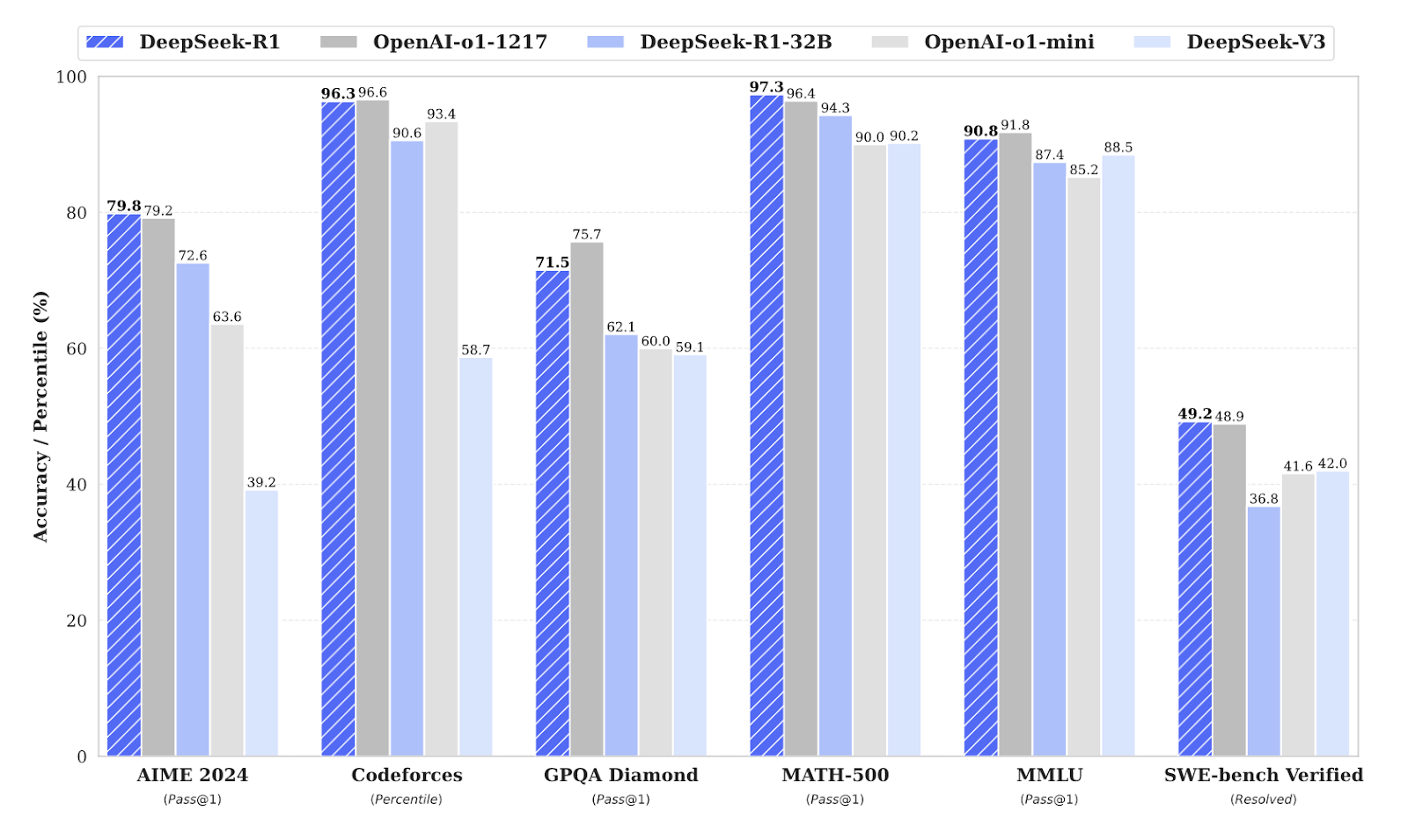

Chinese company DeepSeek has taken the AI world by storm with their recent unveiling of cutting-edge large language models (LLMs), specifically DeepSeek-V3 and its reasoning-focused variant DeepSeek-R1. These open-source models demonstrate performance comparable to leading competitors (Figure A) at roughly 1/10th the training cost and significantly lower inference cost. In simple terms, training cost refers to the expenses incurred in developing and fine-tuning an AI model, including the computational resources, data preparation, and model optimisation required to build the model. On the other hand, inference cost refers to the ongoing costs of running the trained model to make predictions or decisions i.e. when ChatGPT answers users’ queries.

By releasing its models under an open-source license, DeepSeek allows other organisations to replicate and build upon its work. This democratises access to advanced AI technologies, enabling a broader range of entities to develop and deploy AI solutions at a much lower cost. The development raises fundamental questions about the economics of AI: While improved efficiency could accelerate AI adoption, it challenges assumptions about near-term semiconductor demand for training capex, cloud infrastructure spending, and the distribution of value across the technology landscape.

In this article, we examine DeepSeek’s key technical innovations, explain how they achieved frontier model performance despite US chip export restrictions, and analyse the broader implications for the technology industry.

Figure A: Benchmark Performance of DeepSeek-R1

Source: DeepSeek-R1 Technical Report

Market reaction and initial impact

The US stock market awakened to DeepSeek’s disruption in the third week of January. That coincided with the release of DeepSeek-R1 (on 20 January 2025). The model, released under the MIT licence along with its source code, demonstrated exceptional capabilities in reasoning, mathematics, and coding tasks, matching the performance of OpenAI’s o1 “reasoning” model at a fraction of the cost. DeepSeek complemented this release with a web interface for free access and launched an iOS application that quickly reached the top of the App Store charts.

Given the US export ban on top-end GPUs to China, which many argued was necessary for the US to maintain its lead in the AI race, the market was shocked to see a China-based frontier model rival the capability of US-based models! By 27 January, as news of DeepSeek’s breakthrough gained widespread attention, technology stocks experienced sharp declines, with Nvidia falling 16%, Oracle 12% and smaller AI infrastructure stocks declining 20-30% in a single trading session!

While R1’s release finally got the market’s attention, the foundation was laid a month earlier when DeepSeek-V3 was released around Christmas. On 26 December 2024, Andrej Karpathy (formerly Director of AI at Tesla and founding member of OpenAI) highlighted the remarkable achievement: DeepSeek-V3 had reached frontier-grade capabilities using just 2,048 GPUs over two months – a task that traditionally required clusters of 16,000+ GPUs (Figure B). This efficiency gain fundamentally challenged assumptions regarding the computational resources required for developing advanced AI models.

Figure B: Andrej Karpathy on DeepSeek-V3

Source: X

Technical innovations

DeepSeek’s efficiency gains arise from several key architectural innovations that fundamentally rethink how large language models process and generate text.

At its core, DeepSeek employs a Mixture-of-Experts (MoE) approach – similar to relying on the most relevant specialist instead of the entire team of doctors when treating a patient. By selectively activating only 37B of 671B parameters for each piece of text (token), the system achieves remarkable efficiency gains. For perspective, Meta’s Llama 3 405B required 30.8M GPU-hours, while DeepSeek-V3 used just 2.8M GPU-hours – an 11x efficiency gain. At an assumed cost of US$4 per GPU hour, this translates to roughly US$11.2 million in training costs versus US$123.2 million for Llama 3 405B.

There are several technical innovations worth calling out that focus on efficiency, including:

- Multi-head Latent Attention (MLA): MLA compresses the information required in the “attention” mechanism through low-rank projections. MLA is analogous to a very good summary of a large document. This technique drastically reduces memory demands during inference while retaining the full performance of standard multi-head attention.

- Multi-Token Prediction (MTP): Rather than generating one word (token) at a time, MTP attempts to predict multiple future words simultaneously. This achieves an 85-90% success rate in predicting upcoming tokens, resulting in 1.8x faster text generation.

- Auxiliary-loss-free load balancing: Traditional MoE architectures struggle to balance workload across the “experts.” This is akin to a medical emergency department where some doctors are overworked versus others! DeepSeek-V3 introduced a novel “dynamic bias adjustment” mechanism that ensures balanced expert workloads without compromising performance, achieving 90% expert utilisation.

Prior to DeepSeek’s arrival, many of these architectural and design choices were already known in the research community. For instance, it was well understood that the MoE approach yields 3x to 7x efficiency gains compared to dense models. Nonetheless, DeepSeek managed to push the boundaries of efficiency even further without compromising model quality. By building DeepSeek efficiently without relying on state-of-the-art GPUs, the company demonstrated that necessity is the mother of invention

Reinforcement learning breakthrough

DeepSeek’s R1 technical paper reveals a significant step change in how reasoning capabilities can be developed in LLMs. The widely accepted standard had been to use supervised learning with human-curated datasets followed by reinforcement learning with human feedback (RLHF). DeepSeek, however, showed that sophisticated reasoning can emerge primarily through reinforcement learning alone. In its technical report, DeepSeek notes that its work is “the first open research to validate that reasoning capabilities of LLMs can be incentivized purely through RL, without the need for SFT [Supervised Fine-Tuning].”

The significance of this approach lies in its ability to transcend the limitations of human-demonstrated problem-solving patterns. Traditional supervised learning methods can only replicate reasoning strategies present in the training data. In contrast, DeepSeek’s reinforcement learning approach allows the model to discover novel problem-solving strategies through systematic exploration. This is analogous to the difference between learning chess by studying grandmaster games versus learning by playing millions of games and discovering new strategies independently.

Overcoming the US chip ban

DeepSeek’s technical reports also shed light on how the company navigated the U.S. export ban on top-end GPUs like the Nvidia H100. The H800 GPUs available (legally) to DeepSeek significantly reduced NVLink link bandwidth and double-precision computing capabilities. To overcome these limitations, DeepSeek implemented optimisations such as:

- Restricting token processing to groups of 4 GPUs, thus minimising data transfer bottlenecks.

- Developed techniques to handle internal (NVLink) and external (InfiniBand) communication concurrently.

- Implemented FP8 mixed-precision training, halving memory requirements compared to traditional approaches.

- Developed custom kernel software for efficient local expert forwarding.

Investment implications

DeepSeek’s innovations will potentially upend how value is created and captured in the AI industry. In this section, we consider some of the potential ramifications of DeepSeek’s innovations, cost efficiency, and release under an MIT license.

At a high-level, DeepSeek’s innovations and cost efficiency are likely to force a re-think on the ravenous appetite for high-end AI accelerators. However, technology history suggests that improved efficiency often leads to increased total resource consumption — a phenomenon known as the Jevons paradox. As barriers to entry fall, more organisations can experiment with and deploy AI solutions, potentially driving higher aggregate demand for AI infrastructure.

Naturally, for semiconductor companies, especially those focused on AI acceleration, these trends present both challenges and opportunities. DeepSeek’s ability to produce a top-grade frontier LLM without access to NVIDIA’s high-end GPUs suggests that some companies might have been complacent with respect to engineering and architectural optimisations, and have instead chosen to use a sledgehammer capex approach to develop increasingly sophisticated models. It is possible that DeepSeek’s success will cause some rethink on this front, which might in turn moderate high-end GPU demand for training capex. This means that companies might be able to do more with their existing GPUs and their useful lives might even be extended. However, the fundamental dynamics of AI development remain compelling: As long as scaling laws hold – where model performance improves as a power-law function of size, dataset, and compute resources – we can expect compute-hungry AI algorithms to require ever more processing power to solve increasingly challenging problems. Moreover, as AI models become more widely available, the demand for inference-optimised semiconductors (inference capex) is likely to grow substantially.

Major cloud providers’ current capital expenditure plans suggest confidence in this longer-term vision despite efficiency gains. Microsoft has reiterated its US$80 billion capex commitment, while Alphabet projects approximately US$75 billion in CapEx for 2025, up significantly from US$52.5 billion in 2024. Amazon expects to maintain its Q4 2024 quarterly investment rate of US$26.3 billion through 2025. While it is potentially too early to see strategic shifts in response to DeepSeek’s innovations, these investment levels suggest hyperscalers anticipate growing demand for AI compute, and particularly inference workloads. Notably, hyperscalers are positioning themselves as model-agnostic platform providers – evidenced by Microsoft making DeepSeek’s R1 available on GitHub and Azure AI Foundry despite its close partnership with OpenAI, and Amazon integrating DeepSeek R1 into its Bedrock and SageMaker platforms.

This evolution signals a broader shift in competitive advantage from raw model capabilities towards proprietary data assets, distribution channels, and specialised applications. Enterprise software businesses, which typically focus on building applications around models rather than developing models themselves, stand to benefit from the widespread availability of high-quality open-source foundation models. As these models improve and become more accessible, competitive advantage will increasingly derive from unique data assets and distribution channels. Enterprises with specialised data repositories, such as Salesforce (CRM data) or Bloomberg (financial data), could develop highly targeted AI agents that leverage their proprietary data advantages.

The platform landscape presents varying implications for different players. Meta appears well-positioned to benefit from LLM commoditisation (a strategy it has followed with its own Llama models), as it can deploy AI innovations to enhance content discovery and user engagement across its vast social networks. Alphabet presents a more complex case: while its Google search advertising model faces potential disruption from AI-powered “answer engines,” its YouTube platform and cloud business could benefit substantially from increased AI adoption and deployment.

Obviously, there is a question with respect to where one would undertake the inference task. DeepSeek’s approach to providing “distilled” models (1.5B–70B parameters) opens new possibilities for edge computing. These smaller models enable resource-constrained devices to leverage advanced AI capabilities while navigating practical constraints like battery life and thermal limitations. Apple’s current hybrid approach — running on-device LLMs for certain tasks while routing others to private cloud infrastructure built using Apple’s M-series silicon – could become the standard blueprint, particularly in consumer applications. This hybrid model effectively balances privacy considerations and response times with computational capabilities.

As the industry evolves, significant uncertainties remain regarding the distribution of economic value between frontier model developers, infrastructure providers, platform companies, and application developers. While investors will need to keep a close eye on these shifting value propositions, and the winners and losers are likely to emerge only in the fullness of time, one aspect appears increasingly clear: We are entering a fascinating phase of AI development. The improved efficiency and accessibility demonstrated by innovations like DeepSeek could democratise access to AI capabilities, potentially making businesses and consumers the ultimate beneficiaries of this technological revolution.

Conclusion

DeepSeek’s innovations are not just a technical achievement; they signal a potential restructuring of the AI industry’s competitive dynamics. By achieving frontier model performance at roughly 1/10th the traditional training cost and releasing the model under the MIT license, DeepSeek has challenged fundamental assumptions about AI development and deployment.

In this article, we have explored three key implications of this development. First, we have considered the balance between training and inference capex through the lens of Jevons paradox which suggests that lower barriers to entry could drive higher aggregate compute consumption over time. Second, we have considered the potential shift in value creation from raw model capabilities towards data assets, distribution platforms, and specialised applications. Finally, we have contemplated how the emergence of efficient “distilled” models enables new deployment paradigms, from edge computing to hybrid architectures, potentially expanding AI’s practical applications.

For investors, there are many nuances to consider including:

- The near-term risks versus medium to long-term opportunities for semiconductor businesses.

- The position of hyperscalers as model-agnostic compute and inference platforms.

- Democratisation of AI models and its effects on enterprise software businesses.

- The pros and cons for platform companies with access to unique data and/or strong distribution channels.

While the geopolitical implications of DeepSeek are still unfolding, the development clearly demonstrates that multiple paths to AI progress exist beyond simply scaling up computing resources and that a path to more democratised AI models is likely feasible. We believe organisations across the spectrum will be reassessing their AI strategies in light of these developments, with perhaps their lens focused on “value addition” and “Return on Investment” rather than raw model size or computing power. In a nutshell, DeepSeek is excellent news for the users of AI and by lowering both the training and inference costs, it has massively increased the Return on Investment (ROI) on AI.

At AlphaTarget, we invest our capital in some of the most promising disruptive businesses at the forefront of secular trends; and utilise stage analysis and other technical tools to continuously monitor our holdings and manage our investment portfolio. AlphaTarget produces cutting edge research and our subscribers gain exclusive access to information such as the holdings in our investment portfolio, our in-depth fundamental and technical analysis of each company, our portfolio management moves and details of our proprietary systematic trend following hedging strategy to reduce portfolio drawdowns.

To learn more about our research service, please visit: https://alphatarget.com/subscriptions/.

Agentic artificial intelligence (AI) systems are fast-emerging as the next leap forward in AI systems development. Unlike traditional generative AI, which excels at creating content and responding to specific queries, agentic AI takes this capability further by enabling autonomous decision-making and proactive task execution within a given environment. This shift from passive content creation to active, decision-making AI has the potential to revolutionise how businesses operate. At a high level, while generative AI creates, agentic AI acts.

What is an AI agent?

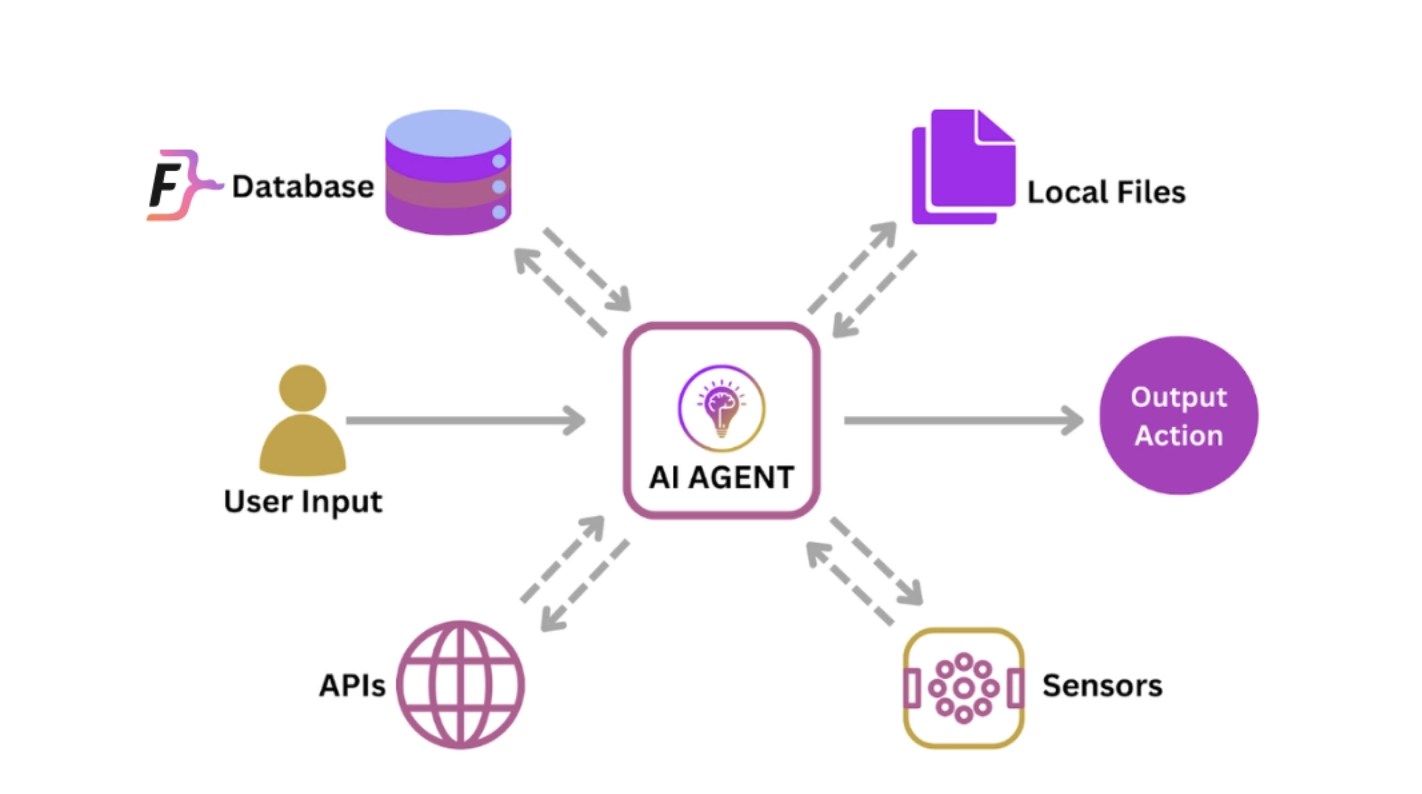

An AI agent is a software program (Figure A) designed to interact with its environment, gather data, and perform tasks autonomously to achieve predefined goals. While humans define these goals, the AI agent independently determines the best course of action to fulfill them.

For instance, in a contact centre, an AI agent can resolve customer queries by asking questions, retrieving information from internal resources, and providing solutions. Based on the customer’s responses, it decides whether to resolve the query itself or escalate it to a human representative.

AI agents function as rational agents that can analyse data and their environment to make informed, goal-oriented decisions. The following key capabilities set them apart from traditional software:

- Perception and Data Gathering: AI agents use interfaces to sense their environment. For instance, a robotic agent collects data through physical sensors, while a chatbot interprets text input from customer queries.

- Decision-Making: Using the collected data, AI agents predict the best outcomes and determine the next steps to achieve their objectives. For example, a self-driving car navigates obstacles using sensor inputs and pre-trained models.

- Collaboration: AI agents can collaborate with other agents and humans, in order to complete multi-step complex tasks.

Figure A: AI agent architecture

Source: Falkor DB

Benefits of AI

AI agents bring significant advantages to businesses and customers alike by streamlining operations and enhancing experiences. Key benefits include:

1. Enhanced Productivity

AI agents streamline operations by automating tasks, reducing inefficiencies, minimising human errors, and eliminating the need for manual effort, resulting in lower operational expenses. Their ability to adapt to evolving conditions ensures steady performance, further enhancing resource efficiency.

2. Cost Efficiency

AI agents automate workflows, cutting down inefficiencies, reducing human errors, and eliminating manual tasks, which lowers operational costs. Their flexibility allows them to maintain consistent performance, even in dynamic conditions, further enhancing resource utilisation.

3. Improved Decision-Making

Sophisticated AI agents utilise machine learning (ML) to process vast amounts of real-time data. This capability enables businesses to make accurate predictions and data-driven decisions swiftly. For example, AI agents can analyse market trends to optimise product positioning during an advertising campaign.

4. Superior Customer Experience

AI agents enhance customer engagement by delivering personalised interactions, prompt responses, and tailored recommendations. Businesses can boost customer satisfaction, conversion rates, and loyalty through these advanced, data-driven insights.

Given the unique capabilities of AI agents, the world’s transition to using active AI agents could prove to be an inflection point in how software is built and consumed. Currently, several major software businesses are evolving their technology stacks with an AI-first strategy.

For instance, enterprise giant Microsoft has integrated AI agents across its enterprise suite through its Copilot initiative, with capabilities ranging from automated coding, email summarisation, intelligent scheduling and improved search capabilities.

Similarly, IT workflow automation company ServiceNow is deploying specialised AI agents for IT service management, customer service, HR, and procurement workflows. These agents can handle everything from IT ticket resolution to employee onboarding, learning from each interaction to improve their performance while maintaining human oversight for critical decisions.

AI agents: A brief history

The concept of AI agents is not entirely new – it has roots in the “expert systems” of the 1960s and 1970s. These early attempts at AI used rule-based programming to mimic human decision-making in specific domains.

MYCIN, developed at Stanford in the 1970s, was one of the first expert systems. Its inference engine could diagnose blood infections and recommend antibiotics, using approximately 600 predefined rules. While groundbreaking for its time, these rule-based systems were inherently limited by their inability to learn from experience or handle novel situations.

Arguably the biggest step change enabling modern AI agents came with two more recent significant advances in artificial intelligence. First, deep learning breakthroughs in the 2010s enabled systems to learn from vast amounts of data and improve their performance over time. Then, the development of large language models (LLMs) in the early 2020s provided the sophisticated reasoning and natural language capabilities that make today’s AI agents possible.

These foundation models dramatically improved natural language processing capabilities, enabling AI agents to understand nuanced instructions, generate contextually appropriate responses, and engage in more natural interactions. This advancement means agents can now interpret complex business requests and communicate their actions clearly to users.

Another crucial innovation is retrieval-augmented generation (RAG), which allows AI agents to combine their built-in knowledge with real-time access to enterprise data and documents. This technology enables agents to ground their responses in an organisation’s specific context, policies, and procedures while maintaining accuracy and relevance. RAG is a key tool in preventing LLMs from “hallucinating” – that is, generating misleading or inaccurate results.

Overall, this progression from simple rule-based systems to today’s sophisticated AI agents represents more than incremental improvement – it marks a fundamental shift in how organisations can deploy AI. Rather than following predetermined rules, modern agents can understand context, learn from experience, and autonomously pursue objectives while operating within appropriate business constraints.

AI agents in action

Major technology companies are making significant investments in agentic AI as the convergence of advanced language models, deep learning capabilities, and enterprise integration frameworks has created new opportunities for business transformation. In terms of the business case, there are opportunities with respect to cost efficiency, enhanced productivity, and improvements in outcomes, as demonstrated by a number of early deployments:-

Automating internal operations: At telecommunications giant Deutsche Telekom, an AI agent named “askT” is transforming the company’s internal operations. Serving approximately 10,000 employees weekly, askT not only answers questions about internal policies and benefits but is also actively managing administrative tasks like leave applications. In addition to cost efficiencies, the system provides consistent, 24/7 service availability while continuously learning from interactions to improve its responses.

Reimaging financial analysis: In the financial sector, organisations are leveraging AI agents’ sophisticated analytical capabilities. Moody’s, for instance, has implemented AI agents to analyze vast amounts of market data and company financials, enabling more comprehensive risk assessments. Moody’s system consists of a network of 35 specialized AI agents, each designed for specific analytical tasks and working within a coordinated multi-agent system. According to Nick Reed, Chief Product Officer at Moody’s, these agents have transformed how the company conducts crucial research tasks that were previously outsourced to lower-cost regions, such as industry benchmarking and SEC filing reviews.

Customer experience innovation: eBay’s implementation of AI agents is another illustration of the technology’s potential impact across multiple business functions. The company’s sophisticated “agent framework” orchestrates multiple LLMs for various tasks such as assisting with customer service inquiries, writing code, and creating marketing campaigns. The system learns from employee interactions to understand specific preferences and work styles, enabling increasingly autonomous operation. eBay is considering expanding this capability to help buyers find items and assist sellers with listings, showcasing how AI agents can enhance core business operations while improving the customer experience.

The SaaS disruption debate

Microsoft CEO Satya Nadella made a rather provocative claim during his appearance on the BG^2 podcast with hedge fund manager and venture capitalists Brad Gerstner and Bill Gurley. Nadella noted that “the business logic is all going to these AI agents” and suggested that they would fundamentally transform how organisations interact with their enterprise Software as a Service (SaaS) applications. This viewpoint challenges the traditional SaaS model that has dominated enterprise software for the past two decades.

Currently, business applications like CRM, ERP, HCM, and IT workflow systems primarily function as sophisticated data management tools, operating on a CRUD (Create, Read, Update, Delete) model with humans directing most operations. Nadella’s vision suggests a fundamental shift where the intelligence layer of these systems will migrate from isolated applications to a unified AI layer in the technology stack.

In a utopian world with no accumulated technology debt, one could imagine a single AI layer seamlessly handling almost all business processes and functionalities. This scenario is not entirely theoretical; tech-savvy startups might build their systems around an AI-first architecture, potentially bypassing traditional business applications in favor of a more streamlined, AI-driven approach with simple database backends.

However, the reality is more complex. Enterprises have valuable data locked within various legacy systems and platforms, therefore realising a unified AI tier that can seamlessly orchestrate all business operations is extremely challenging. Furthermore, the incumbent leaders are not standing still. For instance, ServiceNow’s AI agents are being designed to work across previously siloed workflows, from IT service management to HR processes. Similarly, Microsoft is integrating Copilot capabilities throughout its enterprise suite, while Salesforce’s Einstein GPT and AI Cloud are reimagining customer relationship management and employee interactions through the lens of AI-driven automation.

Given the current state-of-play, predictions about the death of SaaS appear exaggerated and we expect many SaaS players to evolve by incorporating AI features. Companies that can effectively bridge the gap between legacy systems and AI-driven operations stand to capture significant value in the enterprise market. Infrastructure providers supporting AI operations, particularly those offering solutions for data integration and AI orchestration, could see increased demand. Additionally, new entrants might emerge with AI-first approaches that challenge traditional enterprise software categories entirely. The winners in this transition will likely be those who can effectively combine deep domain expertise with advanced AI capabilities while addressing the practical challenges of enterprise data integration.

Sizing the opportunity

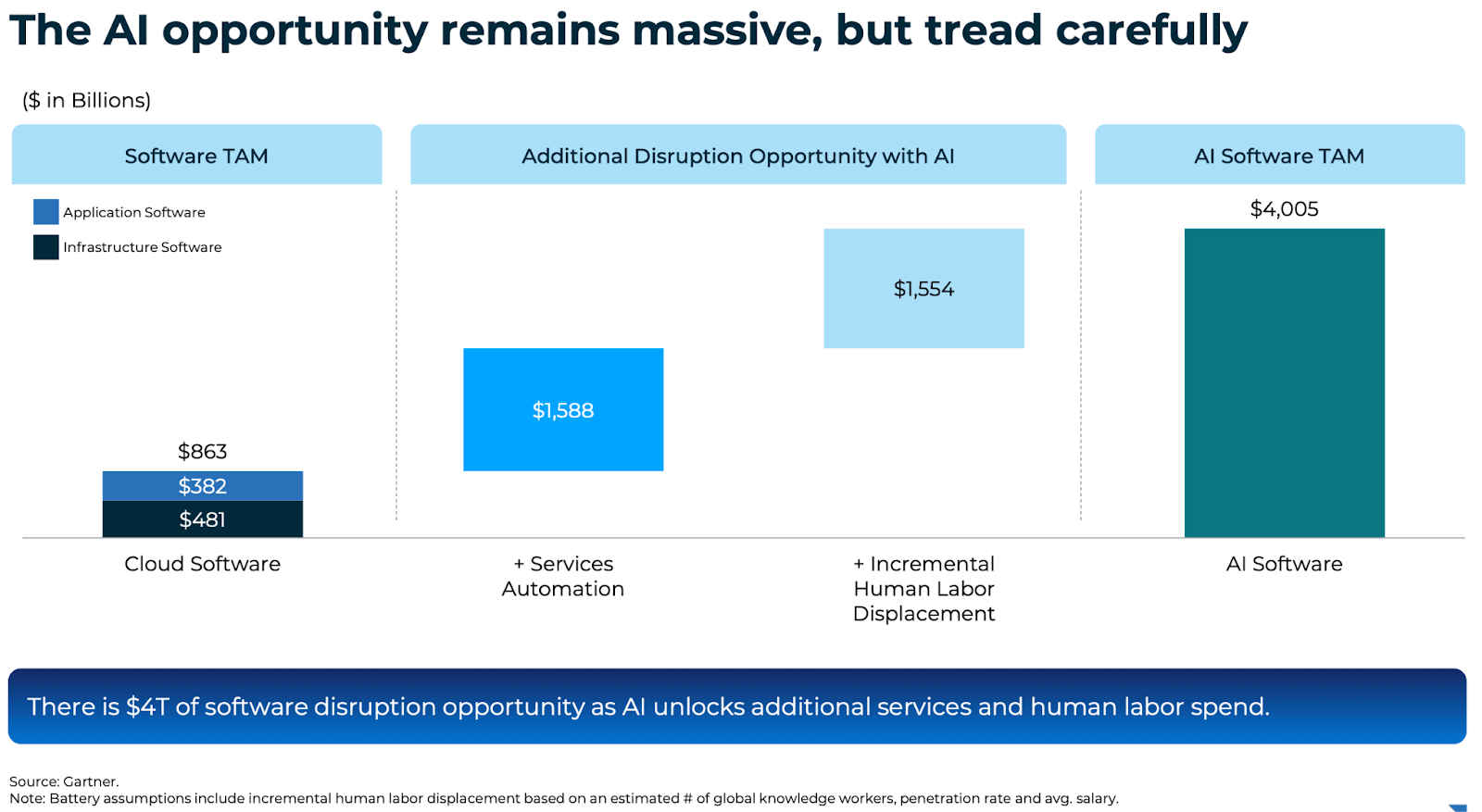

The emergence of AI agents represents part of a broader technological transformation that analysts believe could rival the mobile and cloud computing revolutions in scope and impact. According to Battery Ventures’ 2024 State of the OpenCloud report, the AI software TAM is worth ~US$4 trillion as it disrupts traditional software, services, and labour markets (Figure B).

Figure B: The Massive AI Market Opportunity

Source: Battery Ventures, State of the OpenCloud Nov 2024

The precise market sizing for agentic AI remains unclear due to the emergent nature of this technology. However, we note that the impact of AI agents extends beyond direct market size. Cloud providers are making unprecedented investments in AI infrastructure to support these emerging technologies. This infrastructure buildout provides the foundation for widespread adoption of AI agents across industries.

Going forward, it will be important to watch the pace of agentic AI technology adoption within enterprises as well as regulatory developments. While some regulations may stifle deployment, ultimately regulation developed in conjunction with industry leaders and other key stakeholders will likely create a more stable environment for long-term investment.

Conclusion

Agentic AI is a fundamental shift in enterprise technology moving beyond simple automation to create systems capable of autonomous, complex decision-making. While early adoption shows promising results, success will depend on several critical factors.

For investors evaluating opportunities in this space, key considerations include:

- The pace of enterprise adoption and deployment success rates

- Regulatory developments, particularly around autonomous decision-making

- Competition between incumbent SaaS providers and AI-first startups

- Infrastructure requirements and associated investment opportunities

The winners in this transition will likely be companies that can effectively bridge the gap between legacy systems and AI-driven operations, while addressing the practical challenges of enterprise data integration. We believe both established players as well as new AI-first players can win in this market. The opportunity also extends beyond direct AI agent providers to the broader ecosystem of companies providing essential infrastructure, security, and integration services. For investors, agentic AI represents a potentially transformative opportunity – but one that requires careful analysis of technological capabilities, business models, and go-to-market strategies.

At AlphaTarget, we invest our capital in some of the most promising disruptive businesses at the forefront of secular trends; and utilise stage analysis and other technical tools to continuously monitor our holdings and manage our investment portfolio. AlphaTarget produces cutting edge research and our subscribers gain exclusive access to information such as the holdings in our investment portfolio, our in-depth fundamental and technical analysis of each company, our portfolio management moves and details of our proprietary systematic trend following hedging strategy to reduce portfolio drawdowns. To learn more about our research service, please visit https://alphatarget.com/subscriptions/.

Autonomous driving technology is rapidly advancing, reshaping the landscape of transportation with its potential to enhance efficiency, convenience and safety on the roads.

The history of autonomous driving technology traces back to the mid-20th century, with early concepts appearing in the 1950s and 1960s. Initial developments were largely theoretical, but by the 1980s, more practical steps began to emerge. In 1986, Carnegie Mellon University’s NavLab project demonstrated a vehicle that could drive autonomously on highways.

The 2000s marked a significant leap with the advent of DARPA’s Grand Challenges, which spurred innovation by challenging teams to build autonomous vehicles capable of navigating complex environments. Google’s entrance into the field in 2009, with its self-driving car project (now Waymo), accelerated advancements, leveraging advanced sensors and AI to enhance safety and functionality. The 2010s brought increased industry investment, with major automotive manufacturers and tech companies investing heavily in autonomous vehicle technology.

As of 2024, self-driving vehicles, powered by sophisticated sensors, artificial intelligence, and machine learning algorithms, are progressively becoming more reliable and integrated into everyday use.

Fully autonomous Level 4 vehicles are already on the road in select regions, marking a significant milestone in the industry’s progress. Despite this achievement, technological hurdles, combined with regulatory and ethical challenges, continue to be obstacles on the road to large-scale deployment.

Levels of autonomy

The Society of Automotive Engineers (SAE) defines six levels of driving automation, from Level 0 to Level 5, each representing a different degree of autonomy in vehicles:

- SAE Level 1 (Driver Assistance): This level includes basic automation features such as adaptive cruise control or lane-keeping assistance. While the vehicle can assist with specific tasks, the driver is still responsible for most driving functions and must remain engaged.

- SAE Level 2 (Partial Automation): Vehicles at this level can control both steering and acceleration/deceleration simultaneously. However, the driver must remain actively involved, monitor the driving environment, and be prepared to take over if necessary. Tesla’s Autopilot and Full Self Driving (Supervised) are examples of Level 2 automation.

- SAE Level 3 (Conditional Automation): At this stage, the vehicle can handle all aspects of driving in certain conditions, such as highway driving, without driver intervention. The driver must be ready to take control if the system requests, but does not need to monitor the driving environment continuously.

- SAE Level 4 (High Automation): Vehicles at Level 4 can operate autonomously in their operational design domain (ODD) – specific conditions or areas where it is designed to operate such as campuses, dedicated routes within a city, or even an entire city. Within its ODD, no driver is required, and some Level 4 vehicles may not even have manual controls. Waymo operating in certain cities in the US is an example of Level 4 autonomy. Tesla’s Cybercab demonstrated within Warner Bros. Discovery’s Burbank California studio is another example of Level 4 autonomy.

- SAE Level 5 (Full Automation): At the highest level, the vehicle is fully autonomous in all conditions and environments. This represents autonomous driving with no ODD restrictions. As of 2024, there are no Level 5 autonomy solutions deployed anywhere in the world, and it remains (thus far) an elusive goal.

These levels represent a continuum of increasing automation, with Level 5 signifying the ultimate goal of fully autonomous driving.

Autonomous transport technology landscape

At the core of autonomous driving technology is artificial intelligence (AI) and machine learning (ML) which enable vehicles to perceive and navigate their surroundings without human intervention. These technologies process data from sensors to understand the vehicle’s environment, make real-time decisions, and adapt to changing conditions. Typically, machine learning models are trained on diverse datasets to improve their ability to recognise patterns and make real-time decisions. Over time, these models learn from new scenarios and edge cases, enhancing their performance and reliability. AI and ML enable autonomous vehicles to adapt to changing conditions, such as varying weather or unexpected obstacles, and continuously refine their driving strategies based on experience. This dynamic learning capability is essential for achieving the high level of flexibility and safety required for autonomous driving. Reinforcement learning also plays a crucial role in improving decision-making over time by simulating real-world driving scenarios and continuously optimising vehicle behaviour. As AI continues to advance, its role in ensuring safety, improving driving efficiency, and handling edge cases will become even more essential, making it a key driver of both technological innovation and long-term investment in the autonomous vehicle sector

In addition to AI, autonomous driving hardware is crucial for enabling vehicles to perceive their surroundings and make informed decisions. Here is an overview of the key components:

Ultrasonic Sensors

- Function: These are used primarily for close-range detection, such as parking assistance and low-speed manoeuvring. They emit sound waves and measure the time it takes for the echoes to return, helping detect nearby objects.

- Limitations: Limited range (usually a few metres) and low resolution make them less suitable for high-speed or long-range scenarios.

Radar (Radio Detection and Ranging)

- Function: Radar systems transmit radio waves and detect objects by analysing the reflected signals. They are effective in various weather conditions and can measure the speed and distance of objects. Radar systems are often used in adaptive cruise control and collision avoidance systems.

- Limitations: Radar typically has lower resolution compared to cameras and LiDAR, making it less effective at identifying and classifying objects.

Cameras

- Function: Cameras capture high-resolution visual data, allowing the system to detect lane markings, traffic signs, and recognize objects such as pedestrians and vehicles. Cameras are critical for tasks like lane-keeping, traffic sign recognition, and object classification

- Limitations: Performance can be affected by poor lighting conditions, glare, and inclement weather conditions such as rain or fog. They also require sophisticated algorithms for processing and interpreting the visual data.

LiDAR (Light Detection and Ranging)

- Function: LiDAR systems emit laser beams and measure the time it takes for the light to return after hitting an object. This allows the creation of detailed 3D maps of the environment, which are crucial for precise localization, obstacle detection, and path planning.

- Limitations: LiDAR is typically more expensive and less effective in certain conditions (e.g., heavy rain or snow) compared to other sensors. The data processing requirements are also high.

In an autonomous driving system, these hardware components are often used in combination to complement each other’s strengths and mitigate their weaknesses. This sensor fusion approach enhances the vehicle’s ability to perceive its environment accurately and operate safely under a wide range of conditions.

Autonomous driving technology often relies on a sophisticated integration of various systems to ensure safe and efficient navigation. Many current implementations use High-definition (HD) mapping in their solution. These maps provide detailed and precise representations of roadways, including lane markings, traffic signs, and topographical features. They offer a static reference against which real-time data from sensors can be compared, enabling vehicles to understand their precise location and navigate complex environments with high accuracy. The rich detail of HD maps enhances a vehicle’s ability to anticipate road conditions and obstacles, thereby improving decision-making and safety.

Vehicle-to-vehicle (V2V) and vehicle-to-everything (V2X) communication frameworks have also been proposed to further augment the capabilities of autonomous driving systems. V2V communication allows vehicles to exchange information about their speed, direction, and position, helping them coordinate movements and avoid collisions. For instance, if one vehicle suddenly brakes, nearby vehicles can receive this information in real-time and adjust their behaviour accordingly. V2X communication extends this concept to include interactions with infrastructure elements like traffic signals and road signs, as well as other entities such as pedestrians and cyclists. As of 2024, V2V/V2X technology is primarily limited to pilot projects and specific vehicle models, rather than being a standard feature across the automotive industry.

Hurdles on the road to Full Autonomy

The path to fully autonomous (“Level 5”) driving involves a complex and incremental journey, marked by technological advancements, rigorous testing, and gradual integration into everyday transportation.

One key concept in this progression is the “rollout,” which refers to the phased introduction of autonomous driving features. Initially, these features are introduced in a limited scope, often focusing on specific driving environments such as highways or well-mapped urban areas. This phased approach allows for the refinement of technology and safety measures through real-world testing and user feedback.

The “March of Nines” is a framework used to describe the incremental safety improvements in autonomous driving technology. It measures safety levels using reliability metrics such as the number of accidents or incidents per billion miles driven. Each “nine” added to the reliability rate (e.g., 99% to 99.9%) represents a significant risk reduction, with the ultimate goal being near-zero accidents.This gradual approach helps ensure that each step forward is backed by rigorous testing and validation, mitigating risks as the technology progresses.

In addition to the technological hurdles towards achieving Level 5 autonomy, there are several other important considerations, which we discuss below.