The remarkable progress in healthcare and improvements in lifestyle has led to a significant increase in human life expectancy. Thanks to advancements in medical technology, improved access to healthcare and better awareness, people are now living longer than ever before.

The health and wellness secular trend has emerged as a powerful force and it has caught the attention of investors.. By and large, individuals all over the world are increasingly prioritising their physical and mental health. This shift has stirred up the business world, as companies that cater to this growing demand for “better for you” products and services are reaping substantial rewards, whereas businesses which sell harmful products are struggling.

This article aims to discuss the multifaceted dimensions of the health and wellness trend, exploring some of the underlying drivers and market dynamics.

Looking at the big picture, the consumer health and wellness industry represents an enormous and growing opportunity split into several core categories. Some of those categories are set out below:

Functional food, drink, and nutritional supplements

This category encompasses everything from vitamins and protein powders to healthier energy drinks and “functional foods” that are enhanced with specific nutrients or probiotics. These products aim to enhance overall health and performance, support exercise recovery and weight management, and prevent nutrition-related disease.

Over the years, there has been a significant increase in the availability of functional food and drink options not only in the grocery aisle (Beyond Meat, Celsius, Impossible Foods, Oatly, and Sprouts Farmers Market), but also through direct-to-consumer and restaurant channels (Cava, Chipotle Mexican Grill and Herbalife). More and more businesses are now trying to capitalise by offering “better for you” snacks and drinks; as well as plant based vitamins.

Fitness equipment and devices

This sector includes all types of physical fitness equipment, such as treadmills and stationary bikes from Peloton, as well as leading wearable devices such as Apple Watch and Fitbit that track physical activity, heart rate, sleep patterns and other useful health-related metrics. As people all over the world are pursuing more active lifestyles, businesses are developing more innovative products.

Health facilities and services

This closely related segment includes fitness memberships to gyms, wellness facilities, yoga studios and other health-related applications. Digital health apps today can provide everything from virtual fitness courses to personalised training sessions. This also encompasses digital mental health and telehealth solutions, such as those offered by still early stage leaders such as Teladoc and Hims & Hers Health.

Activewear – athletic apparel and footwear

The fitness apparel and footwear segment stands tall as a key driver of growth in the broader health and wellness industry. Growth in recent years has been driven by the popularity of so-called “athleisure” wear – that is, garments that are functional for exercise but also stylish enough for everyday wear.

Incumbent leaders in the fitness apparel and footwear spaces such as Nike and Adidas have found themselves challenged by more focused industry entrants like Lululemon, which has carved out its own niche over the past two decades in yoga apparel to take significant market share in the process. Several other companies such as Under Armour, Reebok, Hoka, Puma, New Balance are now competing in this space and meeting the growing demand for fitness apparel and footwear. Newer players have also entered this arena by leaning on technological and functional innovations, such as moisture-wicking fabrics, compression technology, and lighter, sturdier materials to enhance comfort and performance.

Beauty and personal care

The beauty and personal care segment focuses on products that enhance appearance and promote physical health – ranging from cosmetics, skin care to personal hygiene. This category intertwines with more than one core segment above, so the beauty and personal care segment has long been a staple within the broader health and wellness markets. Recent trends toward organic and natural ingredients have been integral in driving growth within this category over the last several years. Some of the major players in this segment are Avon, Estee Lauder, L‘Oreal, L’Occitane, Shiseido, Revlon and Unilever. Over the past few years, some innovative , rapidly growing companies have emerged in this space and they are trying to steal market share from the incumbents.

Current state of the industry

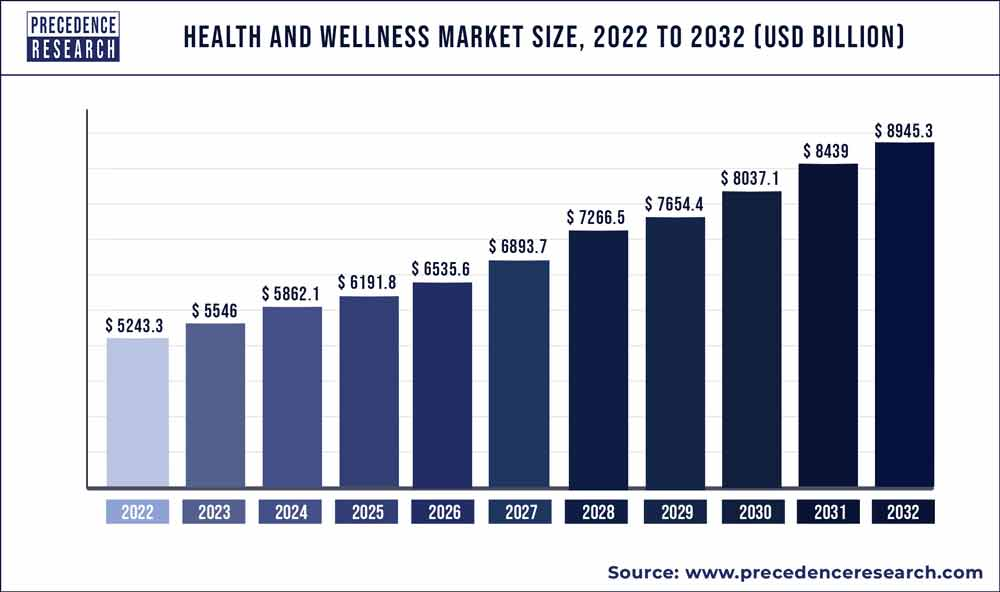

The global health and wellness market is currently worth nearly US$5.9 trillion and has expanded at a modest mid-single-digit percent rate for the past few years (Figure 1).

Figure 1: Evolution of the worldwide health and wellness market

Source: Precedence Research

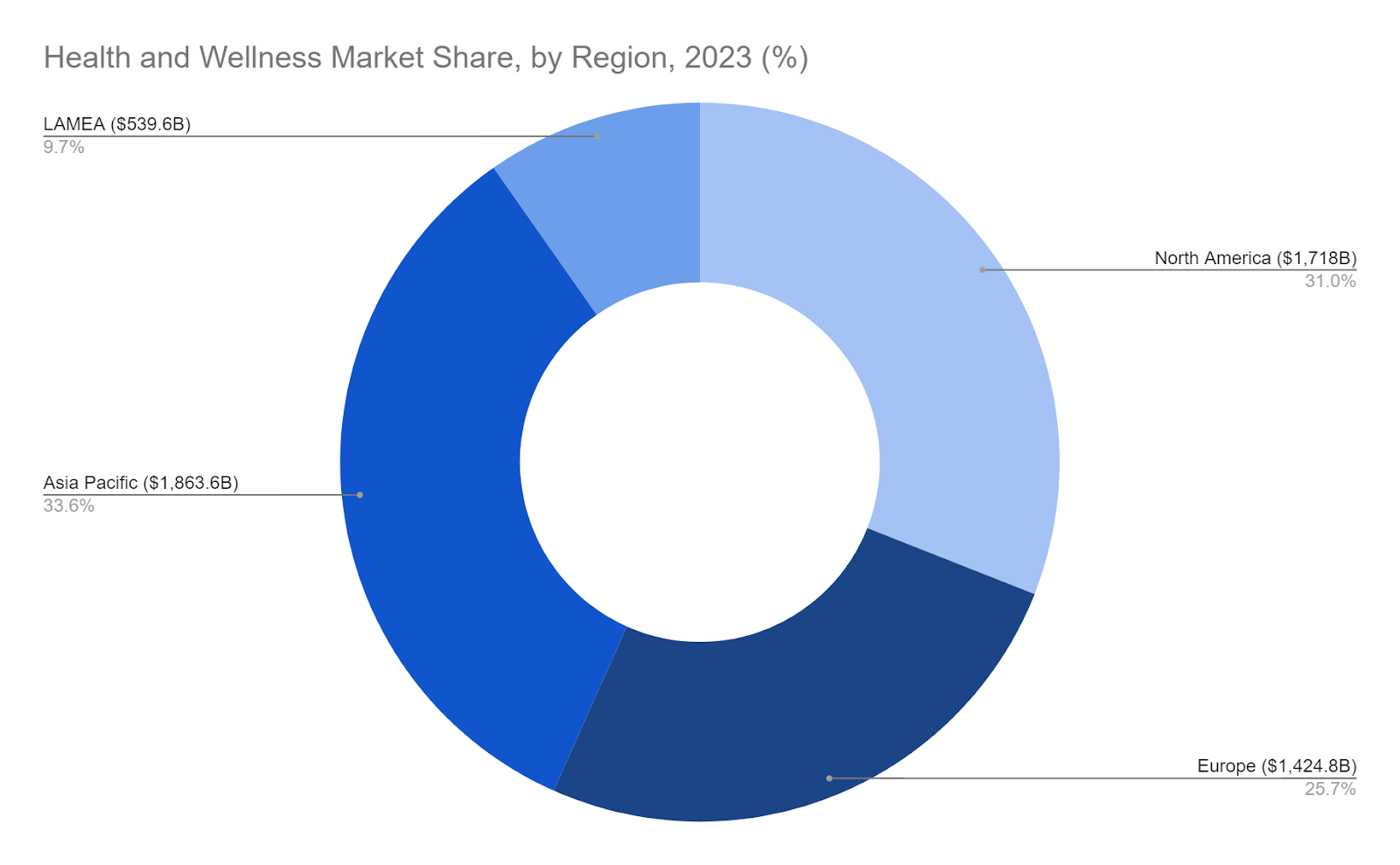

On a geographic basis, due to the massive population centres, rising urbanisation and industrialisation, the Asia Pacific region commands the largest slice of the health and wellness industry today, representing just over 33% of the industry’s total market share.. Interestingly, despite its significantly smaller population, North America is not far behind with a nearly 31% share, whilst Europe commands just under 26% of the market (Figure 2).

Figure 2: Health and Wellness geographic market share

Source: Precedence Research

Growth in the industry over the past several years has largely come about from consumers’ increased focus on holistic solutions for living healthier lives, while also being fuelled by a steady increase in personal disposable incomes that have given many health-focused consumers the resources to allocate to healthier living.

The rise of social media platforms has also helped proliferate health and wellness trends, particularly among younger generations who appear most concerned about physical appearance and prospective methods to improve longevity and quality of life.

Artificial Intelligence (AI) and Machine Learning (ML) are playing pivotal roles in personalising consumer health and fitness experiences.. These technologies are being used to tailor diet plans, fitness routines, and even wellness products to individual preferences and biological characteristics.

On the dietary front, there is a clear movement among consumers toward natural produce and healthier ingredients. Consumers are increasingly wary of processed foods and are turning toward organic and locally-sourced products. This trend appears to be fuelled by the public’s improved understanding of the health benefits associated with natural, minimally processed foods, as well as ageing populations and increasing preferences for more plant-based food options. We are also seeing growing demand for products with no added sugars and reduced sugar content, as awareness about the adverse health impacts of excessive sugar consumption becomes more widespread.

Consumers all over the world are demonstrating a noticeable reduction in their appetite for consuming harmful substances such as cigarettes and alcohol. Public health campaigns and increased awareness of the risks associated with smoking and excessive alcohol consumption have contributed to this trend. The market has responded with healthier alternatives, such as e-cigarettes (the actual relative benefit of which remains to be seen), and non-alcoholic beverages, which attempt to offer similar experiences without the same elevated health risks.

The non-alcoholic beverage industry continues to adapt as well. In particular, the leadership of traditional energy drinks, often criticised for their high sugar and caffeine content, is being usurped by healthier options infused with natural ingredients, reduced sugar, and additives that promote energy naturally. Furthermore, consumers all over the world are moving away from sugar-rich sodas and gravitating towards healthier alternatives such as juices and zero-sugar carbonated beverages.

Within the broader dining sector, the fast casual restaurant industry appears to be experiencing the most notable shift towards offering more wholesome food options. Restaurants like Cava, Panera Bread Company and Chipotle Mexican Grill are incorporating more health-forward menus to appeal to health-conscious consumers, featuring items like quinoa bowls, salads rich in superfoods, and lean protein options. This shift is not just about offering "lighter" options but also about integrating flavourful, nutrient-rich foods that cater to both taste and health.

On the whole, these trends reflect a broader cultural shift toward health and wellness, where consumers are making more informed choices about their health, seeking quality and transparency in their food sources, and incorporating fitness into their daily routines as an essential part of their lifestyle. This holistic approach to health is reshaping the industry and forcing businesses to adapt to the evolving demands of today's health-conscious consumers.

Health & Wellness is an attractive industry

The health and wellness industry is home to strong consumer brands and companies in this space benefit from the following favourable business characteristics:

Brand loyalty: Consumer products are associated with strong brand loyalty. Most people are creatures of habit and when they get used to a product, they develop a strong affinity and loyalty towards the brand which creates repeat business.

Stable cash flows: Brand loyalty creates a stable customer base and frequent, repeat purchases or subscriptions/memberships generate consistent revenues and cash flows.

Pricing power: Strong consumer brands have pricing power and these businesses are able to charge a premium price, which boosts their profits and return on invested capital (ROIC).

Consistent demand: One of the key characteristics of businesses in the health and wellness category is their consistent demand (reduced cyclicality). Unlike some industries that are more vulnerable to economic downturns (energy, industrials, logistics, mining, real-estate and shipping), the majority of businesses in the health and wellness category benefit from relatively stable consumer demand. Whilst no industry is entirely protected from economic downturns, the health and wellness tends to demonstrate more resiliency and stability. This reduced cyclicality results in stable cash flows which makes these businesses more resilient.

Large, expanding market: The global health and fitness market is large and expanding at a relatively fast clip. This growth is not just in traditional areas like gym memberships, supplements, and healthier food and drink, but also in emerging fields such as digital health solutions, wearable technology, and personalised nutrition. The world’s middle-class is expanding rapidly and as hundreds of millions of people get lifted out of poverty, they are eating and living better; and this is translating into more revenues and profits for this industry.

Sizing the opportunity

The size of the global health and wellness market is expected to grow at a modest 5.5% compound annual rate over the next eight years, to more than US$8.94 trillion (see Figure 1 above). There are pockets of growth within the industry however, and certain segments are expected to grow at a much faster pace.

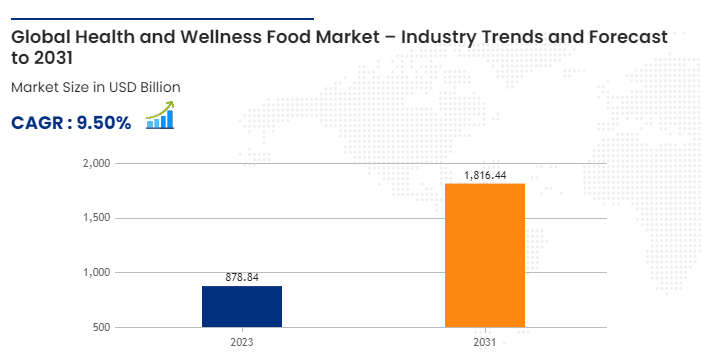

According to Data Bridge Market Research, the narrower wellness food and drink market is projected to reach approximately US$1.82 trillion by 2031, representing a stronger CAGR of 9.5% (Figure 3). There exist several up-and-coming health-centric beverage companies driving outsized growth within this niche and these opportunities are attracting growth-oriented investors.

Figure 3: Global health and wellness food / drink market

Source: Data Bridge Management

Even though segment-level growth is fairly modest within the industry, a few innovative companies are disrupting their markets and growing at a rapid pace. For instance, a few companies in the beverage, cosmetics and sports apparel/footwear space are growing their business rapidly and by doing so, they are handsomely rewarding their shareholders.

After conducting extensive research, we have invested our capital in one particular rapidly growing footwear business which is steadily improving its cash flows and profit margins.

In summary, health and wellness is more than a passing fad and the industry is home to some promising, disruptive businesses with long-term growth potential.

At AlphaTarget, we invest our capital in some of the most promising disruptive businesses at the forefront of secular trends; and utilise stage analysis and other technical tools to continuously monitor our holdings and manage our investment portfolio. AlphaTarget produces cutting-edge research and those who subscribe to our research service gain exclusive access to information such as the holdings in our investment portfolio, our in-depth fundamental and technical analysis of each company, our portfolio management moves and details of our proprietary systematic trend following hedging strategy to reduce portfolio drawdowns. To learn more about our research service, please visit subscriptions.