A vast array of investment options are available to investors, yet there can be no doubt that stocks are the best asset-class for long-term wealth creation. Whilst it is true that other asset-classes have their merits, history has shown that over the past century, stocks have significantly outperformed cash, corporate bonds, government bonds and gold.

Stocks represent part ownership stakes in real-world businesses (productive assets) and over the past century, thousands of world-changing businesses have invented invaluable products and/or services which have changed the way humans work, live and play. By enriching their customers’ lives, these businesses have not only benefited humanity, they have also created immense wealth for their owners or shareholders.

As businesses keep capturing new markets, introducing new innovative products and services, they will continue to generate ever increasing revenues, profits and free cash flows which will in turn make them more valuable over time.

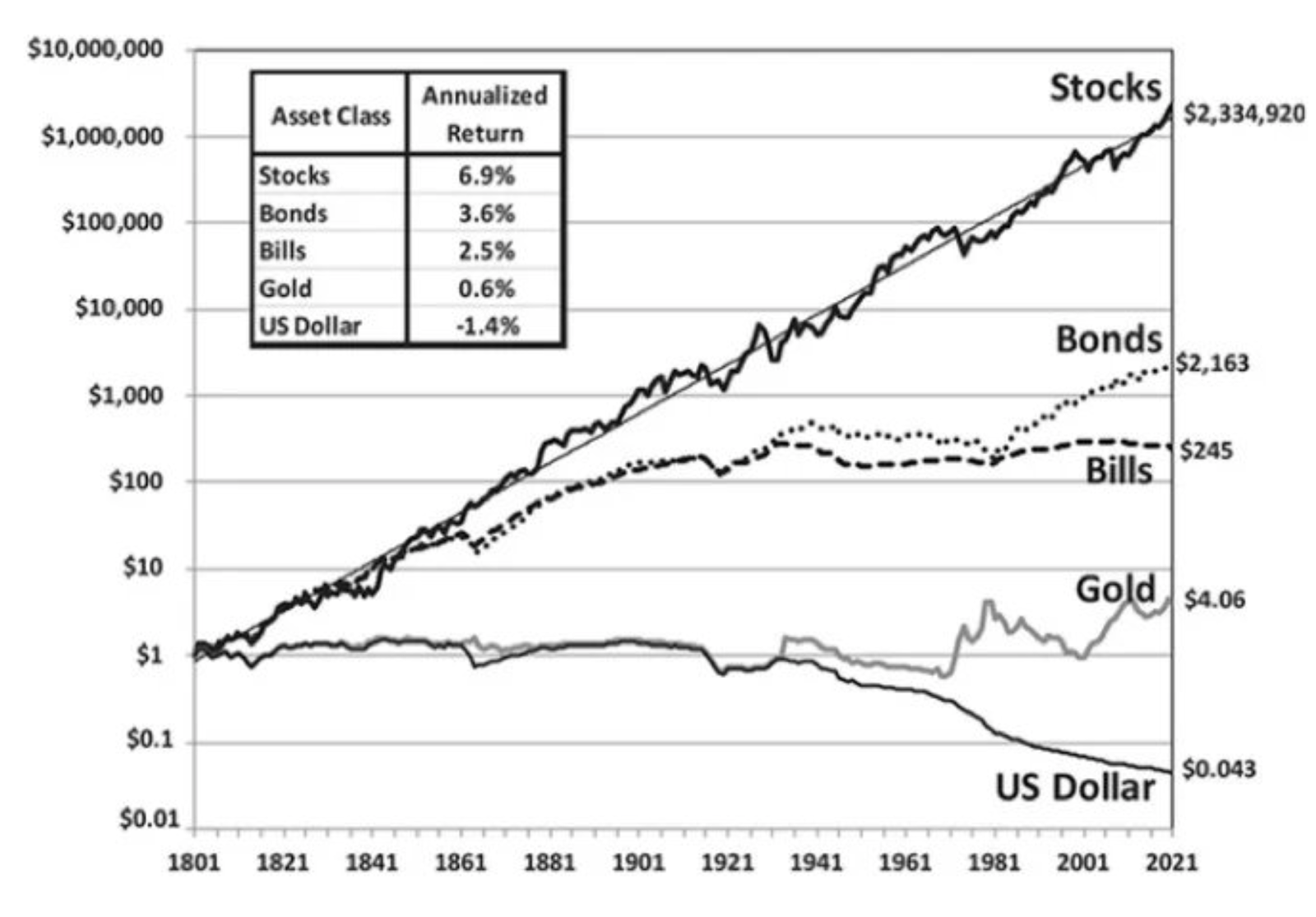

As you can see from Figure 1, over the past 200+ years, US stocks have significantly outperformed other major asset-classes and given the pace of ongoing innovation, expansion of the middle-class in the developing world and population growth, American businesses are likely to continue to prosper over the long-term.

Figure 1: US stocks’ outperformance is staggering!

Source: Stocks for the long run, Jeremy Siegel

Although US stocks have done well at an index-level, many dominant and disruptive businesses have done exceedingly well and compounded their revenues, profits and free cash flows at very high rates for very long periods of time! Consequently, the market capitalisations of such enterprises have grown at unbelievable rates; and handsomely rewarded their shareholders.

Before the advent of the internet, several businesses such as Adidas, American Express, Burger King, Coca-Cola, Colgate, Domino’s Pizza, IBM, KFC, Levi’s Strauss, McDonald’s, Mastercard, Nike, Philip Morris, Procter & Gamble, Unilever and Visa became household names and took over the world.

In the internet era, many disruptive businesses such as Airbnb, Amazon, Apple, Expedia, Facebook (now Meta), Priceline (now Booking.com), Google (now Alphabet), Netflix, Nvidia, Spotify, Tesla and Uber have captured the hearts and minds of billions of people.

Although the above businesses operate in different fields, they demonstrate the power of human ingenuity; and prove that if the sharpest minds in the world get together and there is no dearth of capital, the outcomes can be truly spectacular!

Since the start of the new millennium, many dominant businesses in enterprise software, online advertising, online gaming, online retail, online travel, payments, music and video streaming have done very well.

Turning to investment performance, although US stocks at the index-level (S&P 500 Index) have compounded at 10% per annum over several decades, the market capitalisations of the disruptive, dominant, rapidly growing businesses have compounded at very high rates (15/20/30% per annum)!

The bottom-line is that although investing in stocks via index investing is a lucrative endeavour over the long run, investing in disruptive, rapidly growing businesses with unique advantages has the potential to produce truly life changing returns.

At AlphaTarget, our team conducts in-depth research and invests its own capital in such disruptive businesses which are characterised by recurring revenues or frequent/repeat purchases by their customers, high gross margins, free cash flows and strong returns on invested capital (ROIC) at maturity.

Rationale for investing in disruptive companies

Innovation

Investing in disruptive businesses allows one to tap into the transformative power of innovation. Such companies challenge traditional norms, introduce ground-breaking products and services, or technologies that revolutionise entire industries. By identifying and investing in disruptive businesses early on, we seek to participate in the significant growth opportunities as these companies reshape markets and capture existing demand from competitors.

Rapid growth

Rapidly growing businesses possess the capacity to generate substantial returns over the long term. Disruptive companies either operate in nascent industries or have unique business models that enable them to expand quickly. By investing in such companies, investors can position themselves to ride the wave of growth and benefit from the compounding effect that can significantly enhance their investment returns over time.

High margins and scalability

At AlphaTarget, we primarily focus on the disruptive, online businesses because these enterprises tend to have high gross margins and also high net profit margins at scale. When it comes to the online economy, the cost of producing digital services is usually low (operating expenses are much lower than brick-and-mortar businesses).

Once they have established their infrastructure and systems, online businesses can serve a large number of customers without significant incremental costs. This allows them to generate higher revenue without a proportional increase in costs, resulting in higher margins.

Online businesses can often scale their operations more efficiently than traditional offline businesses. Digital products and services can be replicated and distributed at minimal or zero marginal cost, allowing online companies to reach a broader audience without incurring substantial expenses for each additional customer.

Free cash flows and high ROIC

Disruptive companies often have high free cash flow margins and return on invested capital (ROIC) due to their innovative business models. They operate with streamlined processes, lower costs, and efficient supply chains, allowing them to generate significant cash flows. In the online world, the nature of the offerings of the dominant businesses enables rapid cash flow generation without proportionate increases in capital spending, resulting in high free cash flows and high ROIC.

Outperforming index investing

Investing in innovative businesses provides the potential to outperform index investing. These companies are able to rapidly grow their business for long periods of time, which enables them to outpace broader market indices over the long-term. By carefully evaluating and selecting disruptive businesses, investors can seek to outperform passive index strategies and potentially achieve superior returns.

Investing with the secular trends

Disruptive businesses usually operate at the forefront of new industries. At AlphaTarget, we observe the secular trends in the business world, study the dominant businesses and invest our capital in the most promising companies.

Over the past two decades, the below secular trends have transformed the business world:

E-commerce

E-commerce has witnessed extraordinary growth, transforming the retail landscape and creating immense investment opportunities. Companies like Amazon, Alibaba, Mercadolibre and Shopify have demonstrated unprecedented growth, reshaping consumer behaviour and capturing significant wealth for shareholders.

Dominant online travel agencies such as Expedia and Priceline (now Booking.com) have totally disrupted the industry, upended millions of traditional online agents and created immense value for their shareholders.

E-commerce penetration is still fairly low in many parts of the world, so the leading

businesses in this space are likely to continue to do well over the next few years.

Online payments

The rapid proliferation of online payments has revolutionised the financial industry, offering convenience, security, and efficiency. Companies like Adyen, PayPal, Mercadolibre, Square and Stripe have thrived in this space, providing seamless payment solutions that enable individuals and businesses to transact online. As digital payments become increasingly ubiquitous, investing in the leading online payment providers allows investors the opportunity to capitalise on the growth of cashless transactions and the expanding e-commerce ecosystem.

Music and video streaming

The advent of streaming services has disrupted traditional media consumption patterns, providing consumers with on-demand access to a vast array of content. Companies like Netflix and Spotify have emerged as pioneers in this space, experiencing exponential growth and reshaping the entertainment industry. Investing in the streaming sector has allowed investors to tap into the evolving consumer preferences and the shift towards digital content consumption.

Enterprise software

Enterprise software solutions have become integral to modern businesses, driving efficiency, productivity, and digital transformation. Due to cloud computing and “Software as a Service” (SaaS), enterprise software vendors now have sticky recurring revenues and they have become modern-day utilities.

The public hyperscalers have also spawned a new generation of software businesses which have experienced remarkable growth by providing cloud-based infrastructure services. Investing in leading enterprise software providers has offered investors exposure to the ongoing digitisation of businesses and the growth runway appears to be long.

Looking ahead

Long-term projections of any kind should be made with humility but at AlphaTarget, we have high conviction that the e-commerce, fintech/online payments, music/video streaming and software industries will continue to grow. Additionally, we believe that nascent industries such as autonomous driving, gene editing, robotics and space exploration will also transform the way humans live, work and play.

If our world-view is correct, the biggest transformation will be in Artificial Intelligence (AI). According to our research, AI is a major technological revolution and over the next decade, it will transform every industry.

Investing in AI-focused businesses will allow investors to participate in the next wave of technological advancements and potentially benefit from the transformative power of AI across various sectors, including education, finance, healthcare, professional services, robotics, transportation, and more.

Since the launch of ChatGPT (autumn 2022), due to the AI infrastructure (datacentres) build up, dominant “picks and shovels” plays in AI such as NVIDIA and Super Micro Computer have already made a small fortune and rewarded their shareholders.

Going forward, as businesses begin to monetise AI, we expect some companies at the application layer to prosper. Additionally, enterprise software companies which successfully deploy AI agents on top of their software platforms should also reward their shareholders.

At AlphaTarget, we invest our capital in some of the most promising disruptive businesses at the forefront of secular trends; and utilise stage analysis and other technical tools to continuously monitor our holdings and manage our investment portfolio. AlphaTarget produces cutting-edge research and those who subscribe to our research service gain exclusive access to information such as the holdings in our investment portfolio, our in-depth fundamental and technical analysis of each company, our portfolio management moves and details of our proprietary systematic trend following hedging strategy to reduce portfolio drawdowns. To learn more about our research service, please visit subscriptions.