In the dynamic and ever-changing world of financial markets, investors and traders are constantly seeking strategies to gain an edge and generate consistent returns. One popular approach that has gained significant attention is trend following. Trend following is a strategy that aims to capitalise on the directional movements of various asset classes by identifying and riding trends.

Trend following is objective and instead of relying on complex analysis and forecasts, it focuses on the price reality i.e. what is actually happening in the financial markets. In the investment business, every market participant’s equity curve or profit & loss is fuelled by price action and by honing in on the price movement, trend following allows one to stay aligned with the major trends.

The reality is that money in the financial markets is made by following the trends and it is a whole lot easier to swim with the tide. Conversely, fighting the trends does not pay; in fact it is a sure-shot way of burning up a lot of emotional and financial capital.

This article explores the concept of trend following (its underlying principles), long-term performance, key components, benefits, and potential limitations.

Understanding Trend Following

Trend following is a systematic trading strategy that seeks to identify and profit from the momentum or trends in the price movements of financial assets. It operates on the belief that markets tend to exhibit persistent trends over time, and by aligning with these trends, traders can generate profits. Trend followers typically follow a set of rules and use technical analysis tools to identify and confirm trends before entering or exiting positions.

Unlike the “buy & hold” approach, which requires a market participant to remain fully invested at all times (and endure deep and lengthy drawdowns), trend following enables one to sell or hedge one’s portfolio at the start of downtrends. This means that a trend follower does not have to sit through large declines in the financial markets and suffer serious portfolio drawdowns. By either being in cash or hedged during downtrends, a trend follower is able to get out of harm’s way and/or reduce portfolio drawdowns.

As far as the stock market is concerned, “buy & hold” does well over the very long-term. However, the stock market is extremely volatile and the returns tend to be very lumpy. Put simply, the stock market does not go up every year and market participants have to contend with both secular bull-markets as well as secular bear-markets.

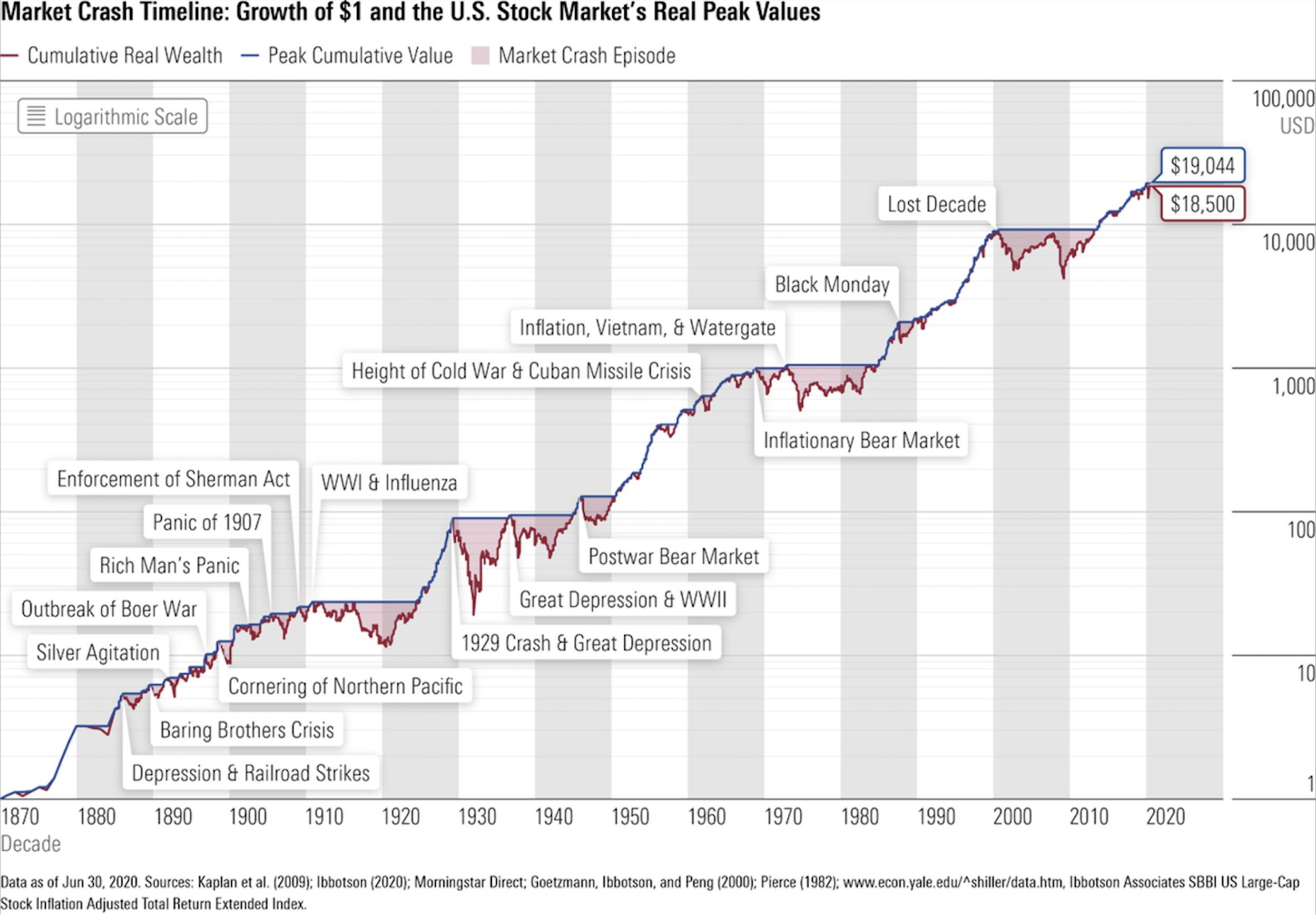

If you review the performance of the US stock market over the past 150 years (Figure 1), you will clearly see that the ride has been anything but smooth and there have been rewarding as well as frustrating passages of time. These rewarding long-term passages of time are called secular bull-markets and the frustrating ones are known as secular bear-markets.

Figure 1: The stock market is NOT a smooth ride

Source: Kaplan, Goetzmann, Ibbotson, Morningstar Direct, Shiller

Figure 1 shows that since 1870, on an inflation-adjusted basis, the US stock market has undergone four multi-year secular bear-markets (1910-1924, 1929-1954, 1969-1982, 2000-2013). It is worth noting that each secular bear-market not only brought about at least one 50%+ decline at the index-level, every single one lasted for a minimum of 10 years!

Unfortunately, secular bear-markets are not just a US phenomenon and they periodically occur in all the stock markets. Since 1950, there have been 25 secular bear-markets in the major world indices and each of them have lasted for a minimum of 15 years!

What about “buy & hold”?

“Buy & hold” works well over the very long-term at the index-level; however, it does not do so well for the majority of individual stocks. The reason why “buy & hold” with no risk management strategy in place works well over the very long-term at the index-level is because of the fact that stocks have an upward bias and the major stock indices are actively managed i.e. their underlying constituent companies are regularly replaced. Each year, larger and stronger companies are introduced in the major stock indices and the shrinking, weaker companies are replaced. For example, the annual churn rate of the S&P500 Index is around 4.5% and since 2015, ~40% of its constituent companies (~200 out of 500 companies!) have been replaced.

If one invests in individual stocks, then “buy & hold” with no exit strategy is not a good proposition. It is worth noting that the average company lifespan in the S&P500 Index has now shrunk to just 15 years and over the past 90 years, only 20% of the US listed companies both survived and outperformed the S&P500 Index! Furthermore, research reveals that over the past 90 years, only ~50% of US listed companies survived as standalone businesses at the 20-year mark. So, if one owns a portfolio of individual stocks, the odds are that many of the companies will underperform or not survive and this is why a risk management (exit) strategy is essential.

By utilising a trend following strategy, one can participate in the stock market’s uptrends whilst avoiding painful downtrends as well as the wrath of those destructive secular bear-markets. The main benefit of trend following is that it significantly reduces portfolio drawdowns and one ends up with a much smoother equity curve. Research indicates that for the S&P500 Index, trend following rules have reduced volatility by 33-50%, leading to higher Sharpe Ratios.

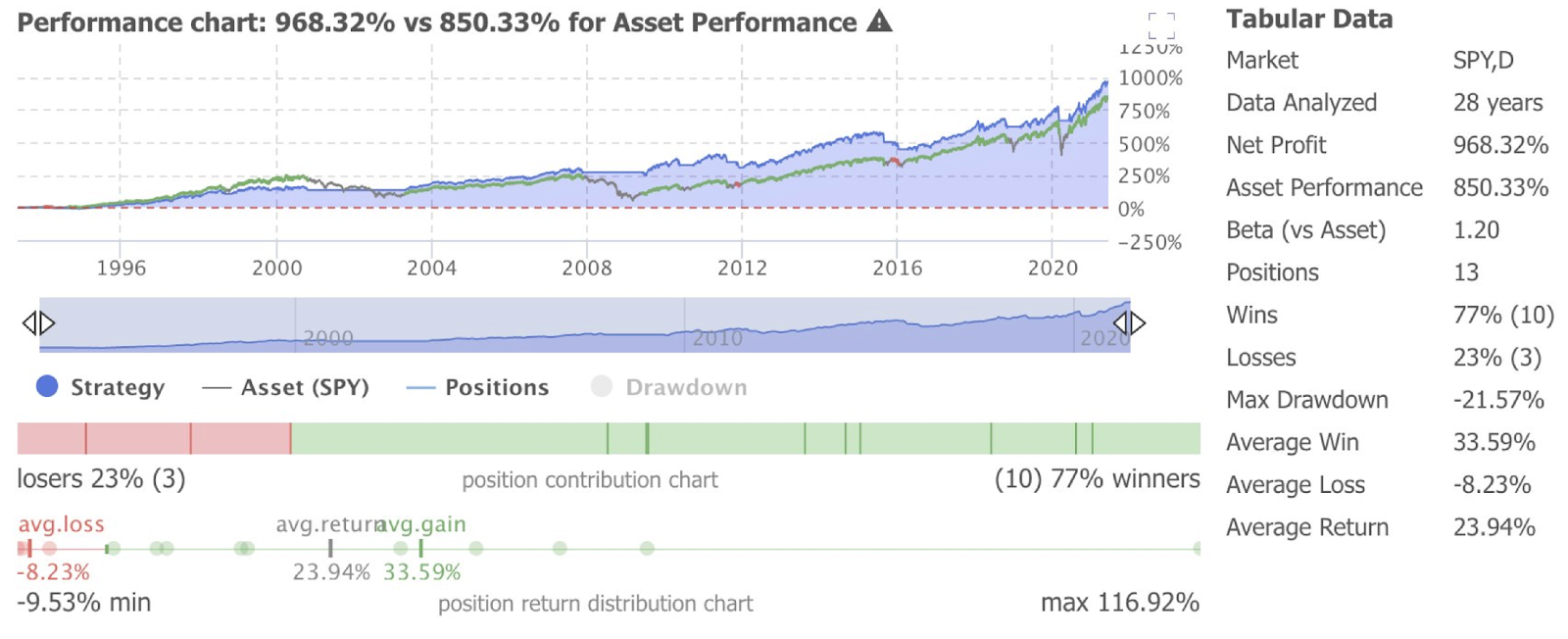

Figure 2 illustrates how trend following reduces portfolio drawdowns when compared to “buy & hold”. This is a backtest we performed on the S&P500 Index a few years ago and the lookback period was 28 years. This backtest utilised the 150-day moving average with additional rules to minimise whipsaws and as you can see, this strategy not only outperformed “buy & hold”, it also significantly reduced the drawdown to just 21.57% (vs. two 50%+ drawdowns for the S&P500 Index during the lookback period)!

Figure 2: Trend following vs S&P500 “buy & hold”

Source: Trendspider

For the sake of full transparency, we must point out that trend following strategies underperform “buy & hold” when the S&P500 Index is in a secular bull-market but they really shine and reduce portfolio drawdowns during secular bear-markets.

Finally, trend following can be utilised on all financial markets (bonds, commodities, currencies and stocks).

Key components of Trend Following

A trend following strategy utilises the following key components -

a) Trend identification: Trend followers utilise various technical indicators such as moving averages, momentum channels or volatility bands to identify the direction and strength of a trend. They aim to differentiate between bullish, bearish, or sideways market conditions.

b) Entry and exit signals: Once a trend is identified, trend followers establish specific rules for entering and exiting positions. This may involve using breakouts, moving average crossovers, or other technical signals to initiate trades. Similarly, predetermined exit rules, such as trailing stops or trend reversals, help manage risk and lock in profits.

c) Position sizing and risk management: Proper risk management is crucial in trend following. Traders determine the size of each position based on factors like volatility, account size, and risk tolerance. They often employ techniques like the use of stop-loss orders to limit potential losses and protect capital.

Benefits of Trend Following

Here are some of the benefits of the trend following approach -

a) Diversification: Trend following strategies can provide diversification benefits to an investment portfolio. They have the potential to perform well in various market environments, including bull, bear, or volatile conditions, as they do not rely on predicting market tops or bottoms.

b) Capturing large market moves: Trend following aims to capture substantial market moves by staying in positions for the duration of the trend. By riding these trends, investors and traders can potentially benefit from significant price movements and generate attractive returns.

c) Risk management: Trend following strategies often incorporate risk management techniques that help control downside risk. By setting predefined exit rules and managing position sizes, trend followers aim to limit losses and protect capital during adverse market conditions.

d) Emotional discipline: Trend following strategies are rule-based, which helps eliminate emotional biases and impulsive decision-making. Traders follow their predefined rules and signals, reducing the influence of emotions like fear or greed, which can negatively impact trading outcomes.

Potential limitations

Trend following is not a perfect approach (there is no perfect strategy or system!) and its limitations are set out below -

a) Whipsaw and false signals: Trend following strategies are not foolproof and they are susceptible to false signals, especially during choppy or range-bound markets. Rapid reversals or market noise can result in whipsaw trades, where positions are entered and exited quickly, leading to potential losses.

b) Late entries and exits: Trend following strategies may not capture the entire duration of a trend. One may enter positions after a trend has already been established and exit relatively late, potentially missing some profit potential.

c) Periods of drawdown: Like any trading strategy, trend following can experience periods of drawdown, where consecutive losing trades occur. These drawdowns can test the one’s discipline and patience, requiring a long-term perspective and confidence in the strategy.

d) Underperformance: When a stock index is in a secular bull-market, trend following strategies underperform “buy & hold”.

Summary

Trend following is a popular trading strategy that aims to profit from the directional movements of financial assets. By identifying and riding trends, trend followers seek to generate consistent returns. While there are potential drawbacks and challenges associated with trend following, its benefits, such as diversification, capturing large market moves, and disciplined risk management, make it an attractive approach for many traders and investors. As with any investment strategy, it is essential to thoroughly understand the principles, develop a robust framework, and continuously adapt to changing market dynamics. Trend following can provide a powerful tool for navigating the complexities of financial markets and potentially achieving long-term trading success.

At AlphaTarget, in order to properly time our entries and exits in our preferred growth stocks, we utilise “Stage Analysis” which is a long-term trend following strategy. We initiate new positions during Stage 1 (base building phase) and Stage 2 (rally phase) and book our gains/sell over-extended stocks during Stage 3 (distribution phase).

We also utilise a systematic trend following strategy to hedge our growth stock portfolio during stock market downtrends. If you would like to learn more about “Stage Analysis” or portfolio hedging, please read our related articles “Stage Analysis: an overview” and “Hedging: umbrella for a rainy day” on the “Resources” subpage of our website www.alphatarget.com

At AlphaTarget, we invest our capital in some of the most promising disruptive businesses at the forefront of secular trends; and utilise stage analysis and other technical tools to continuously monitor our holdings and manage our investment portfolio. AlphaTarget produces cutting-edge research and those who subscribe to our research service gain exclusive access to information such as the holdings in our investment portfolio, our in-depth fundamental and technical analysis of each company, our portfolio management moves and details of our proprietary systematic trend following hedging strategy to reduce portfolio drawdowns. To learn more about our research service, please visit subscriptions