Autonomous driving technology is rapidly advancing, reshaping the landscape of transportation with its potential to enhance efficiency, convenience and safety on the roads.

The history of autonomous driving technology traces back to the mid-20th century, with early concepts appearing in the 1950s and 1960s. Initial developments were largely theoretical, but by the 1980s, more practical steps began to emerge. In 1986, Carnegie Mellon University's NavLab project demonstrated a vehicle that could drive autonomously on highways.

The 2000s marked a significant leap with the advent of DARPA's Grand Challenges, which spurred innovation by challenging teams to build autonomous vehicles capable of navigating complex environments. Google's entrance into the field in 2009, with its self-driving car project (now Waymo), accelerated advancements, leveraging advanced sensors and AI to enhance safety and functionality. The 2010s brought increased industry investment, with major automotive manufacturers and tech companies investing heavily in autonomous vehicle technology.

As of 2024, self-driving vehicles, powered by sophisticated sensors, artificial intelligence, and machine learning algorithms, are progressively becoming more reliable and integrated into everyday use.

Fully autonomous Level 4 vehicles are already on the road in select regions, marking a significant milestone in the industry's progress. Despite this achievement, technological hurdles, combined with regulatory and ethical challenges, continue to be obstacles on the road to large-scale deployment.

Levels of autonomy

The Society of Automotive Engineers (SAE) defines six levels of driving automation, from Level 0 to Level 5, each representing a different degree of autonomy in vehicles:

- SAE Level 1 (Driver Assistance): This level includes basic automation features such as adaptive cruise control or lane-keeping assistance. While the vehicle can assist with specific tasks, the driver is still responsible for most driving functions and must remain engaged.

- SAE Level 2 (Partial Automation): Vehicles at this level can control both steering and acceleration/deceleration simultaneously. However, the driver must remain actively involved, monitor the driving environment, and be prepared to take over if necessary. Tesla’s Autopilot and Full Self Driving (Supervised) are examples of Level 2 automation.

- SAE Level 3 (Conditional Automation): At this stage, the vehicle can handle all aspects of driving in certain conditions, such as highway driving, without driver intervention. The driver must be ready to take control if the system requests, but does not need to monitor the driving environment continuously.

- SAE Level 4 (High Automation): Vehicles at Level 4 can operate autonomously in their operational design domain (ODD) – specific conditions or areas where it is designed to operate such as campuses, dedicated routes within a city, or even an entire city. Within its ODD, no driver is required, and some Level 4 vehicles may not even have manual controls. Waymo operating in certain cities in the US is an example of Level 4 autonomy. Tesla’s Cybercab demonstrated within Warner Bros. Discovery’s Burbank California studio is another example of Level 4 autonomy.

- SAE Level 5 (Full Automation): At the highest level, the vehicle is fully autonomous in all conditions and environments. This represents autonomous driving with no ODD restrictions. As of 2024, there are no Level 5 autonomy solutions deployed anywhere in the world, and it remains (thus far) an elusive goal.

These levels represent a continuum of increasing automation, with Level 5 signifying the ultimate goal of fully autonomous driving.

Autonomous transport technology landscape

At the core of autonomous driving technology is artificial intelligence (AI) and machine learning (ML) which enable vehicles to perceive and navigate their surroundings without human intervention. These technologies process data from sensors to understand the vehicle's environment, make real-time decisions, and adapt to changing conditions. Typically, machine learning models are trained on diverse datasets to improve their ability to recognise patterns and make real-time decisions. Over time, these models learn from new scenarios and edge cases, enhancing their performance and reliability. AI and ML enable autonomous vehicles to adapt to changing conditions, such as varying weather or unexpected obstacles, and continuously refine their driving strategies based on experience. This dynamic learning capability is essential for achieving the high level of flexibility and safety required for autonomous driving. Reinforcement learning also plays a crucial role in improving decision-making over time by simulating real-world driving scenarios and continuously optimising vehicle behaviour. As AI continues to advance, its role in ensuring safety, improving driving efficiency, and handling edge cases will become even more essential, making it a key driver of both technological innovation and long-term investment in the autonomous vehicle sector

In addition to AI, autonomous driving hardware is crucial for enabling vehicles to perceive their surroundings and make informed decisions. Here is an overview of the key components:

Ultrasonic Sensors

- Function: These are used primarily for close-range detection, such as parking assistance and low-speed manoeuvring. They emit sound waves and measure the time it takes for the echoes to return, helping detect nearby objects.

- Limitations: Limited range (usually a few metres) and low resolution make them less suitable for high-speed or long-range scenarios.

Radar (Radio Detection and Ranging)

- Function: Radar systems transmit radio waves and detect objects by analysing the reflected signals. They are effective in various weather conditions and can measure the speed and distance of objects. Radar systems are often used in adaptive cruise control and collision avoidance systems.

- Limitations: Radar typically has lower resolution compared to cameras and LiDAR, making it less effective at identifying and classifying objects.

Cameras

- Function: Cameras capture high-resolution visual data, allowing the system to detect lane markings, traffic signs, and recognize objects such as pedestrians and vehicles. Cameras are critical for tasks like lane-keeping, traffic sign recognition, and object classification

- Limitations: Performance can be affected by poor lighting conditions, glare, and inclement weather conditions such as rain or fog. They also require sophisticated algorithms for processing and interpreting the visual data.

LiDAR (Light Detection and Ranging)

- Function: LiDAR systems emit laser beams and measure the time it takes for the light to return after hitting an object. This allows the creation of detailed 3D maps of the environment, which are crucial for precise localization, obstacle detection, and path planning.

- Limitations: LiDAR is typically more expensive and less effective in certain conditions (e.g., heavy rain or snow) compared to other sensors. The data processing requirements are also high.

In an autonomous driving system, these hardware components are often used in combination to complement each other’s strengths and mitigate their weaknesses. This sensor fusion approach enhances the vehicle's ability to perceive its environment accurately and operate safely under a wide range of conditions.

Autonomous driving technology often relies on a sophisticated integration of various systems to ensure safe and efficient navigation. Many current implementations use High-definition (HD) mapping in their solution. These maps provide detailed and precise representations of roadways, including lane markings, traffic signs, and topographical features. They offer a static reference against which real-time data from sensors can be compared, enabling vehicles to understand their precise location and navigate complex environments with high accuracy. The rich detail of HD maps enhances a vehicle’s ability to anticipate road conditions and obstacles, thereby improving decision-making and safety.

Vehicle-to-vehicle (V2V) and vehicle-to-everything (V2X) communication frameworks have also been proposed to further augment the capabilities of autonomous driving systems. V2V communication allows vehicles to exchange information about their speed, direction, and position, helping them coordinate movements and avoid collisions. For instance, if one vehicle suddenly brakes, nearby vehicles can receive this information in real-time and adjust their behaviour accordingly. V2X communication extends this concept to include interactions with infrastructure elements like traffic signals and road signs, as well as other entities such as pedestrians and cyclists. As of 2024, V2V/V2X technology is primarily limited to pilot projects and specific vehicle models, rather than being a standard feature across the automotive industry.

Hurdles on the road to Full Autonomy

The path to fully autonomous (“Level 5”) driving involves a complex and incremental journey, marked by technological advancements, rigorous testing, and gradual integration into everyday transportation.

One key concept in this progression is the "rollout," which refers to the phased introduction of autonomous driving features. Initially, these features are introduced in a limited scope, often focusing on specific driving environments such as highways or well-mapped urban areas. This phased approach allows for the refinement of technology and safety measures through real-world testing and user feedback.

The "March of Nines" is a framework used to describe the incremental safety improvements in autonomous driving technology. It measures safety levels using reliability metrics such as the number of accidents or incidents per billion miles driven. Each "nine" added to the reliability rate (e.g., 99% to 99.9%) represents a significant risk reduction, with the ultimate goal being near-zero accidents.This gradual approach helps ensure that each step forward is backed by rigorous testing and validation, mitigating risks as the technology progresses.

In addition to the technological hurdles towards achieving Level 5 autonomy, there are several other important considerations, which we discuss below.

Public Perception of Autonomous Driving: Public perception of autonomous driving is a mixed landscape of excitement and scepticism. Many people are enthusiastic about the potential benefits, such as reduced traffic accidents, increased mobility for the elderly and disabled, and the convenience of hands-free driving. However there are significant concerns about safety, reliability, and trust in the technology. High-profile accidents involving autonomous vehicles have fueled doubts and fears, leading to calls for more transparency and stringent testing before widespread adoption. Building public confidence involves not only demonstrating the technology's safety and effectiveness but also addressing these concerns through clear communication and ongoing education.

Security Considerations: Security is a critical concern for autonomous driving systems, given their reliance on complex software and data communications. Protecting vehicles from cyberattacks is paramount, as vulnerabilities could lead to unauthorised control or manipulation of the vehicle's systems, posing severe safety risks. Robust cybersecurity measures, including encryption, secure software updates, and regular vulnerability assessments, are essential to safeguard both the vehicle’s internal systems and the communication networks they rely on. Additionally, ensuring that data privacy is maintained is crucial to prevent misuse of sensitive information collected during vehicle operation.

Ethical/Societal Implications: The rise of autonomous driving technology raises significant ethical and societal questions. Key issues include the decision-making algorithms used in critical situations — such as how a vehicle should react in unavoidable accident scenarios — and the potential impact on employment, particularly for drivers in sectors like trucking and ride-hailing. There are also concerns about equity and accessibility, and we must consider whether the benefits of autonomous driving will be widely distributed or if they will exacerbate existing social inequalities? Addressing these ethical challenges involves creating transparent guidelines and engaging diverse stakeholders in discussions about the technology’s broader implications.

Regulatory and Legal Issues: Navigating the regulatory and legal landscape for autonomous driving is complex and evolving. Governments and regulatory bodies are tasked with developing standards and guidelines that ensure the safety and efficacy of autonomous vehicles while fostering innovation. This involves creating frameworks for testing and certification, defining liability in the event of accidents involving autonomous vehicles, and establishing data privacy regulations. The lack of uniformity in regulations across different regions can also create challenges for manufacturers and developers seeking to deploy autonomous vehicles on a global scale. Effective regulation requires collaboration between policymakers, industry leaders, and technology experts to create a balanced approach that supports technological advancement while protecting public safety and interests.

Sizing the opportunity

Autonomous vehicles will potentially impact multiple trillion-dollar markets including transportation, logistics, and urban infrastructure. This potential stems from fundamental changes to cost structures and asset utilisation across these sectors, although the early stage of the technology makes precise market sizing challenging.

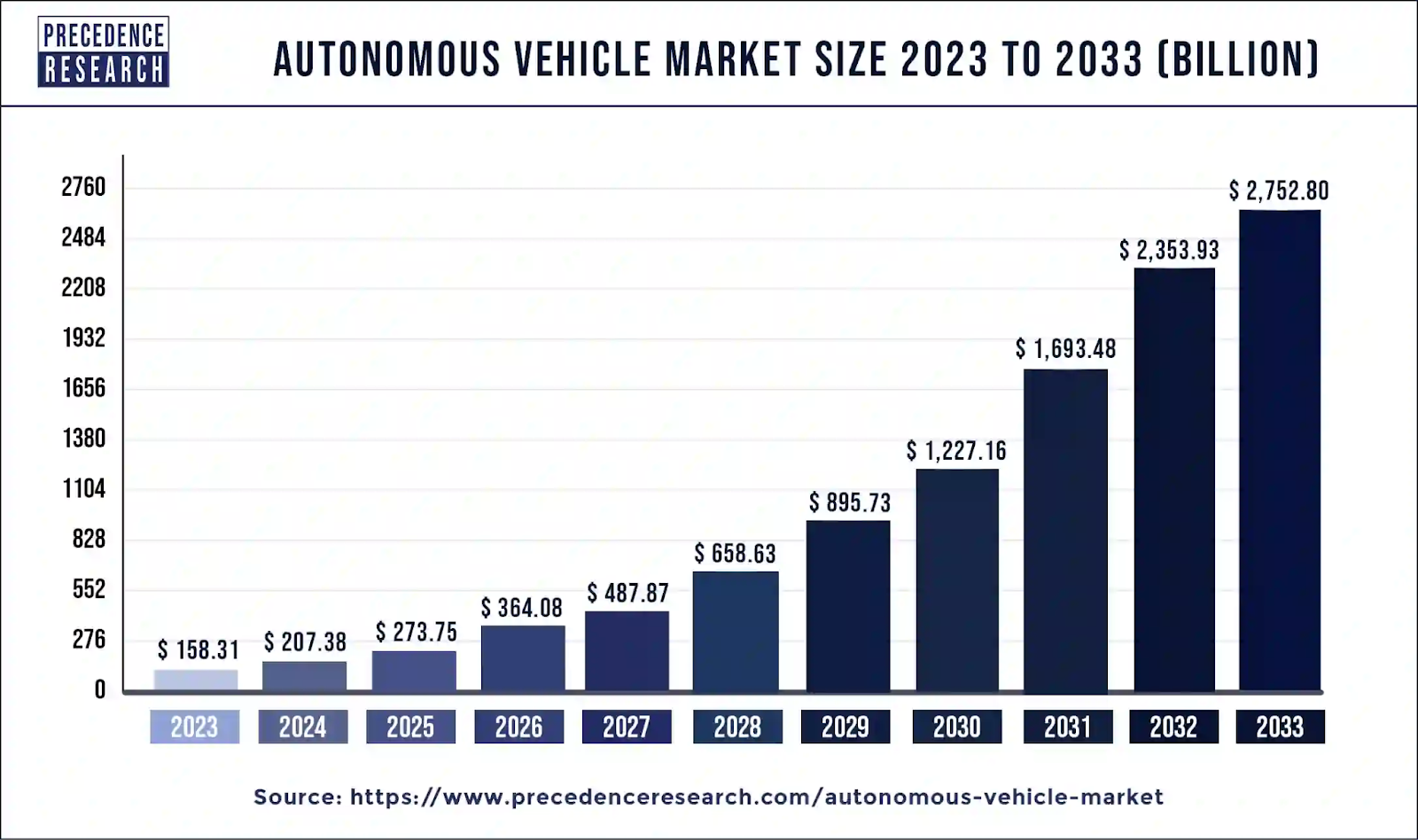

Since autonomous technologies are still in the very early stages of their rollout, the estimates for total addressable market (TAM) vary significantly across forecasts. For instance, according to Fortune Business Insights, the global autonomous vehicle market was valued at just over US$1.9 trillion in 2023 and is expected to grow to US$13.6 trillion by 2030 (representing a CAGR of 32.3%)! On the other end of the spectrum, Precedence Research has a relatively conservative estimate for the Autonomous Vehicle Market at US$158.3 billion in 2023, set to grow to US$2.75 trillion by 2033 (Figure A).

Figure A: Autonomous Vehicle Market Size, 2023 to 2033

Source: Precedence Research

Although the autonomous driving TAM forecasts vary depending on the source, our work suggests that this is indeed a very large opportunity encompassing both passenger and freight mobility.

In this regard, consider just the US trucking market. According to the American Trucking Association, in 2022 trucks moved 11.4 billion tons of freight and generated more than US$940 billion in freight revenue!

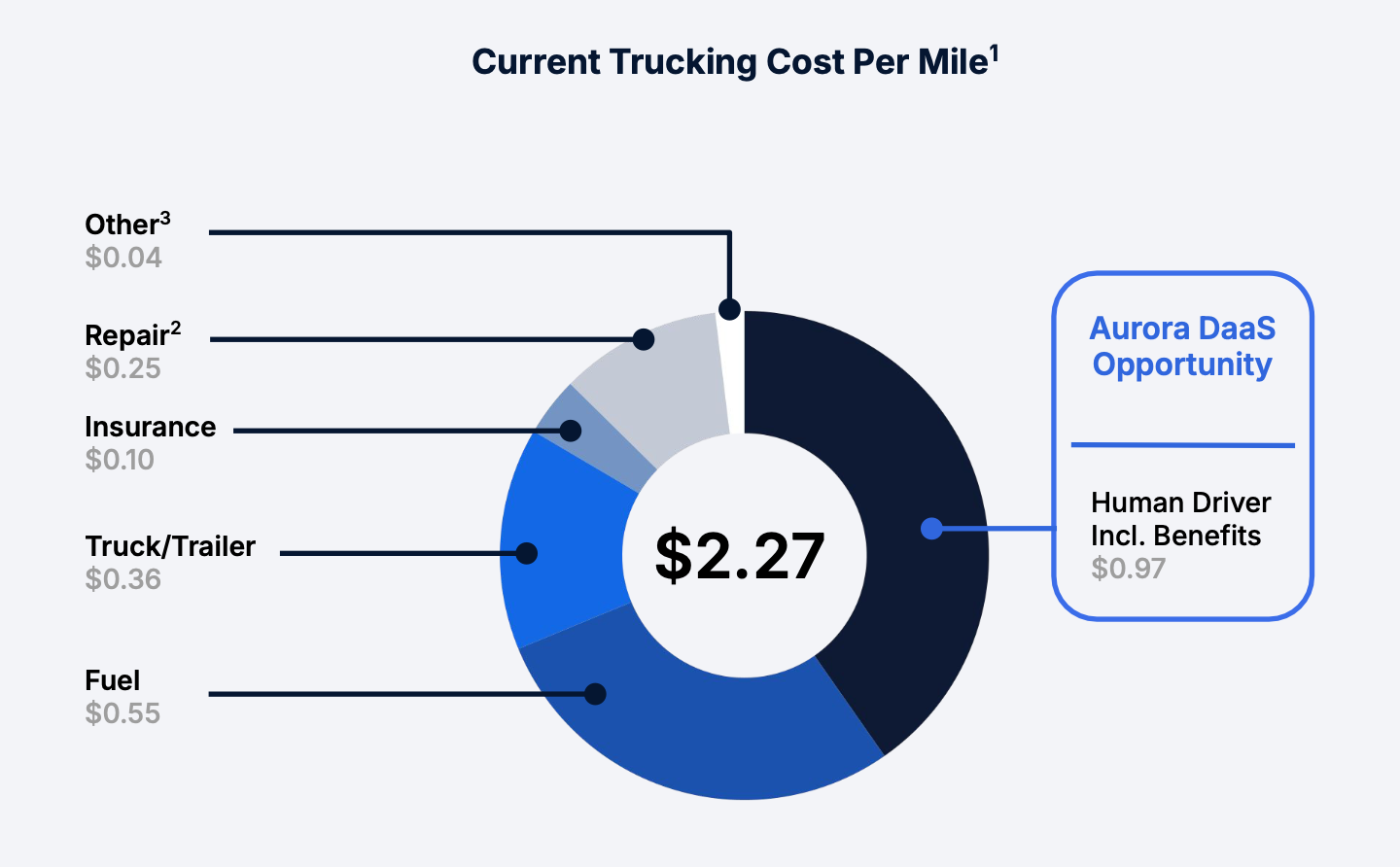

Autonomous trucking software developer Aurora pegs the current cost per mile at ~US$2.27, with the human driver component being the single largest cost at US$0.97 (Figure B). The potential for autonomous technology to eliminate this cost while potentially increasing fleet utilisation through 24/7 operation capability presents a clear economic incentive for widespread adoption.

Figure B: Cost Per Mile for Trucking in the US

Source: Aurora July 2024 Investor Presentation

Similarly, ride-hailing giant Uber’s financials also demonstrate the latent potential of autonomy. In Q3 2024, Uber’s mobility gross bookings were US$21 billion. After paying drivers, the company’s revenue for the quarter was US$6.4 billion. In other words, approximately 70% of the gross bookings were for driver-related costs (i.e., wages, vehicle costs, fuel etc). Similar to the trucking statistics above, the single largest cost factor in ride hailing was driver related.

According to various estimates, the average cost (paid by riders) per mile is in the US$1 to US$3 range. Currently, autonomous vehicle attempts are targeting costs in the sub US$1 per mile range. At the unveiling of Tesla’s Cybercab (the no-pedal 2-seat specialised robotaxi), Musk indicated that Cybercab at scale will probably cost US$0.30 to US$0.40 per mile (inclusive of taxes), which is well under the US$1 cost for a city bus.

Given the glaring cost advantages, it is no surprise that this is a race that is attracting so much interest. Furthermore, beyond impacting the transportation and freight markets, we expect autonomy to have broader implications, including on personal vehicle ownership, insurance, and urban planning. For instance, as autonomous vehicles become more common, consumers may rely less on personal car ownership, favouring shared autonomous vehicles instead. This could impact vehicle sales, especially in urban areas.

Infrastructure may need to adapt to accommodate autonomous vehicles, including the integration of smart roads, sensors, and traffic systems. This could lead to new investments in highway systems and urban design to ensure safe interaction between human-driven and autonomous vehicles. Autonomous vehicles could reduce the need for parking spaces, particularly in urban areas, leading to repurposing of land previously allocated for parking lots and garages. This could also affect real estate values and urban density.

Autonomous driving will shift the focus of liability from human drivers to manufacturers and software providers. Insurance companies may need to develop new products to cover the risks associated with software failures, cybersecurity breaches, and product liability claims.

As autonomous vehicles are expected to reduce human error, the number of accidents could decrease, which may lower overall premiums but also reduce the volume of claims handled by insurers.

Insurers will likely need to adjust to new regulations and policies governing autonomous vehicle operation, while pricing models may shift towards covering technology-related risks rather than individual driver behaviour.

In summary, although the rise of autonomous driving will create opportunities for innovation, it will also force industries to adapt, as traditional models of transportation, logistics, infrastructure, and insurance get disrupted.

Conclusion

The autonomous vehicle market is rapidly evolving, fueled by significant investments and technological advancements that have sparked growing consumer and investor interest. Yet, substantial challenges remain, including regulatory hurdles, insurance complexities, and safety concerns, especially in regions with limited infrastructure or minimal traffic laws. These barriers are particularly pronounced in developing markets, where the absence of consistent road infrastructure and traffic regulations may slow adoption.

Despite these obstacles, the potential benefits of autonomous vehicles—from enhanced safety and cost savings to reduced congestion—continue to drive the industry forward. Key players in automotive, technology, and mobility sectors are actively shaping the future of transportation, creating fresh opportunities for innovation, growth, and investment in this high-risk, high-reward space. While this remains a nascent industry, we believe autonomous driving presents a major opportunity.

The autonomous driving industry offers a highly attractive, high-margin, recurring revenue model. Providers of autonomous driving technologies are likely to licence their software to automotive OEMs and fleet operators, creating a lucrative business through ongoing royalties and partnerships. In addition to licensing, companies are expected to own and operate their own robotaxi fleets, which will also bring in high-margin, recurring revenue. By directly managing these fleets, these companies will capture a significant share of the growing mobility-as-a-service market, generating income through ride-hailing services while minimising operational costs. This combination of technology licensing and fleet ownership positions autonomous driving companies for long-term, scalable growth and significant profitability. Following extensive research, we have invested in what we see as the most promising companies positioned to lead this transformative shift.

At AlphaTarget, we invest our capital in some of the most promising disruptive businesses at the forefront of secular trends; and utilise stage analysis and other technical tools to continuously monitor our holdings and manage our investment portfolio. AlphaTarget produces cutting-edge research and subscribers to our research gain exclusive access to information such as the holdings in our investment portfolio, our in-depth fundamental and technical analysis of each company, our portfolio management moves and details of our proprietary systematic trend following hedging strategy to reduce portfolio drawdowns.

To learn more about our research service, please visit https://alphatarget.com/subscriptions/.